Cryptocurrency acceptance and adoption have been on the rise in recent years. The result has been a spike in investment opportunities as people look to take advantage of the heightened volatility in the sector.

The volatile nature of cryptocurrencies has made it possible for investors and traders to speculate on the prices of various virtual currencies. While most people try to profit from the price of underlying assets increasing, it is also possible to profit from the price dropping.

Can you short crypto?

Shorting cryptocurrencies is an emerging trend and a spectacle that has allowed people to generate significant returns trading Bitcoin, Ethereum, and other digital currencies. Going short or selling comes into being whenever a trader or an investor believes the cryptocurrency’s price will fall.

Therefore, instead of buying the coin, one enters a sell position to profit from the price tanking due to a number of factors. Profit is generated as soon as the cryptocurrency’s price falls from where one entered a short position to a much lower level.

The best platforms for shorting cryptos

The opening up and development of the crypto market has seen an increase in the number of platforms offering support to cryptocurrencies. The platforms have also made it possible for people to profit from cryptocurrency prices tanking rather than just going up, as is the case in the stock market.

Futures market

The CME and CBOE are some of the best platforms known to cater to the needs of institutional investors looking to short cryptocurrencies. Known for the futures market, the CME and CBOE allow investors to sell, say, Bitcoin or Ethereum at a predefined price and day in the future. In this case, the markets allow the investors to bet on the price of cryptocurrencies going down without owning the assets.

Retail brokers

Retail brokerage firms have also added support for cryptocurrencies making it possible to short Bitcoin and Ethereum. Some of the best brokers that allow traders to short cryptocurrencies using financial derivatives such as CFDs include eToro, AvaTrade, and Plus 500.

Tracker funds

It’s also possible to short Bitcoin and Ethereum using Bitcoin exchange trade notes. In Europe, for instance, traders can short Bitcoin using the Nasdaq QMX exchange. In the US, traders can also short Bitcoin using the Grayscale Bitcoin Trust.

Crypto exchanges

Crypto exchanges offer one of the best routes of profiting from a decline in cryptocurrency prices. Poloniex, GDAX, Bitfinex, Binance, and Kraken are some popular exchanges that allow users to short Ether and Bitcoin.

Shorting in exchanges functions the same way as shorting in retail brokerages using the Contract for Difference option in the platform menu. The only difference is that one gets to receive the profits in the underlying crypto rather than the US dollar.

Shorting Bitcoin

Shorting Bitcoin works the same as shorting stocks or any other financial asset. The process entails borrowing Bitcoin prior to a drop happening. As soon as one receives the coins, a sell position is triggered.

Once the price dips to the desired level, one can repurchase Bitcoin with the original sale funds. Given that the price drop results in Bitcoin being cheaper, one can repay the initial loan used to enter the short position and keep the difference as profit.

Example

Consider a trader who borrows 5 Bitcoins at $12,000 each. The trader can sell the coins for $60,000. If, after a few days, the price was to drop to $10,000, the trader can use the $60,000 borrowed to repurchase the coins held from the initial sale.

In this case, the trader will receive 6 Bitcoins, given that the price has dropped to $10,000. In return, the trader will return the 5 BTC coins borrowed and keep the extra 1 BTC as profit. Selling the one BTC at $10,000, the trader will end with a $10,000 profit.

How to short Bitcoin – process

The process of shorting Bitcoin is straightforward. It starts with locating a reliable platform that supports margin or leverage trading. Leveraged trading is essential as it makes it possible to borrow money that can be used to buy or sell a highly-priced asset such as Bitcoin.

Normally, it is extremely difficult, especially for retail traders, to sell an asset such as Bitcoin priced at $52,000 a coin with their own capital. Consequently, brokers offer loans, often referred to as leverage that allows people to deposit only a small amount of capital to be able to buy or sell such highly-priced assets.

However, the amount borrowed to sell Bitcoin must be paid back plus fees once the trade is closed. For instance, if you were to borrow five coins, as is the case in the example above, you will have to repay the total amount once the trade is closed, with the profit being the difference after the loan repayment.

Brokers ensure people can repay the loan used to buy and sell Bitcoin by requiring an initial deposit, on top of which a loan is added in the form of margin. The deposit, in this case, acts as collateral or security.

Ways to short Bitcoin

Short Bitcoin with contracts for difference (CFD)

One of the most popular ways to short Bitcoin is with the help of contract for difference. These derivative instruments allow one to sell without assuming ownership of the Bitcoin coins. One only gets to profit from the price difference, from when the short position is triggered and the final price after the price has dropped.

Contracts for difference stand out partly because they are convenient and cost-efficient. Additionally, they do not involve the actual coin; thus no need to look for wallets for BTC storage.

With CFDs, traders only have to open a sell position on the BTCUSD instrument on a brokerage account. As long as the instrument depreciates in value, one gets to accrue a profit.

Shorting via Bitcoin exchange

Cryptocurrency exchanges also allow traders to short Bitcoin using leverage. For instance, with $1,000 deposited, an exchange can offer a 1:3 leverage which allows one to short sell up to 3 times the amount deposited.

Shorting BTC on exchanges functions the same way as trading CFDs. The key difference is that profits in exchanges come in BTC and not dollars.

In this case, one can enter a short position on BTCUSD and profit as the price of BTCUSD instrument tanks. Leverage, in this case, will magnify the profit in the same proportion. Some of the exchanges that allow leverage trading include Kraken, Bitfinex, and Bitmex.

Short Bitcoin with options

Some Bitcoin exchanges such as BitMEX allow traders to short Bitcoin using options.

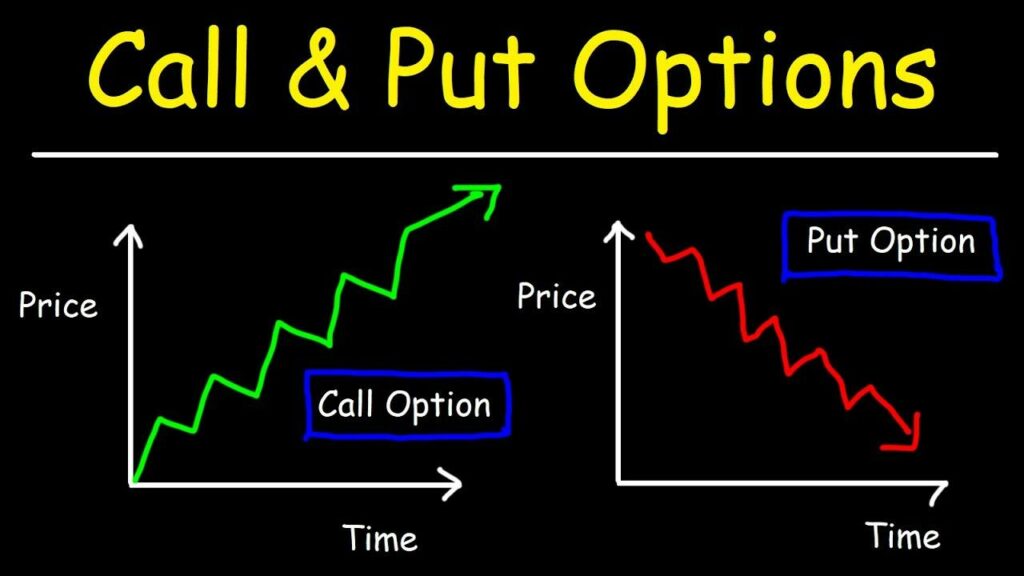

Options are financial instruments that give one the right but not an obligation to purchase the underlying asset at a predefined price. While the call option gives one the right to buy Bitcoin, the put option offers the right to sell.

If a trader believes Bitcoin price will collapse, they can enter a put option on LedgerX exchange with, say, a $40,000 strike price for, say, three months. Should Bitcoin price collapse below $40,000 upon maturity, the trader will be in the money and make a profit. However, should the price be above $40,000, the trader will only lose the option premium, which is the fee paid for the put contract.

When to short Bitcoin

Given the volatile nature of Bitcoin, it is important to be cautious when selling. Sell positions should never be triggered against the long-term trend. Bitcoin has proved to be tricky in recent months, rising in value to all-time-highs of $64,000 as of writing.

However, there are times when the cryptocurrency corrects after a massive price swing to the upside. When such corrections come into play, they present an attractive opportunity to enter a short position.

Additionally, some scenarios occur that make Bitcoin an attractive prospect for shorting. For instance, whenever major cryptocurrency exchanges are hacked, Bitcoin prices tend to tank, presenting an opportunity to enter a short position.

When Mt. Goxx, the largest cryptocurrency exchange at the time, was hacked, Bitcoin price spiraled downwards, presenting an opportunity for traders to generate returns on short positions.

Additionally, Bitcoin experiences intense selling pressure whenever the community behind the project is split on an upgrade. The impasse which often triggers a fork also results in a significant drop in BTC price, acting as an ideal time to enter a short trade.

Waning institutional interest is also known to have a significant impact on Bitcoin price. For instance, Bitcoin’s price significantly tanked when Tesla confirmed it would no longer accept BTC payments. Therefore it is important to watch developments on the institution front as they tend to have a significant say on price fluctuations.

How to short Ethereum

While many people are enthusiastic about Ethereum prospects, not everyone shares the same outlook, given its increasing use cases. Consequently, the price of the blockchain native currency, Ether, experiences swings from time to time.

Concerns around scaling, obscure use cases, and security vulnerabilities mean the price of Ether does not always trend up. Ether price also tanks occasionally, presenting an opportunity for people to profit from short positions.

Shorting Ether amounts to borrowing and selling ETH at today’s price on the expectation that the price will decline in the future to buy back at a much lower price.

Shorting Ethereum on exchanges

As is the case with Bitcoin, it is also possible to short Ethereum on crypto exchanges. Shorting Ethereum on Kraken has never been easy for anyone looking to profit from margin trading. In this case, one only needs to deposit a small amount on the exchange, which will be magnified by leverage of, say, 1:3 offered by the exchange.

With sufficient capital, thanks to the leverage, a sell position can be triggered on the ETHUSD pair to profit on the price tanking. The profit will be the difference between the opening price and the price at which the trade is closed.

For instance, if ETHUSD is priced at $3200 and one enters a short position in the exchange, a profit will be accrued on the price tanking to $3100.

Shorting Ether using Contract for Difference

Contract for Difference is a derivative instrument that also makes it possible to profit from price fluctuations. In this case, one can enter a short position on ETHUSD without assuming ownership of the Ether coins.

The ETHUSD price tanking would allow one to generate a profit on the difference between when the short was placed and the final price, which should be lower. Price increasing after one has entered a short position would only amount to a loss.

Put options

Put options are low-risk financial instruments that one can also leverage to profit from a potential decline in Ether price. While it is a more complex product, it provides an ideal way of shorting Ether at low risk.

A put option essentially accords one the opportunity to sell Ether but not an obligation upon maturity of the contract. For instance, if one expects Ether price to the tank below $3,000 after one month. They can trigger a put option.

If, after one month, the price of Ether would have tanked to say $2,700, the trader will be in the money, thus accrue some profit. However, if the price is above $3,000, the trader can forgo the contract opting just to pay the fee of triggering the put option.

How to short one crypto against another

Cryptocurrency exchanges pair cryptocurrencies with fiat currencies as well as other cryptocurrencies. While most people are used to cryptos being paired with the US dollar, there are also instances whereby crypto is paired with another crypto.

BTCETH is one such pairing that shows the relationship between Bitcoin and Ethereum price. While shorting this pair on an exchange, a trader would essentially be bullish about Ethereum expecting its value to increase relative to Bitcoin’s.

Consequently, as the BTCETH price drops, a trader in a short position would generate a profit on the price difference. For instance, if the price of BTCETH is 13.42 and a trader triggers a short position on an exchange, he will gain 2 on the price tanking to 11.42.

Bottom line

The opening up of the cryptocurrency market has given rise to unique investment opportunities. While most people focus on profiting from price appreciation of various virtual currencies, short selling is also possible, allowing people to profit from price drops. Cryptocurrency exchanges, retail brokerage firms as well as futures markets offer some of the best ways to short Bitcoin and Ethereum.