A quick Google search of the term ‘cryptocurrency exchange’ brings up immensely established names in the space like Luno, Binance, Gemini, Coinbase, and Kraken, to name a few.

Although cryptocurrencies have radically changed the way people do financial transactions, some may not know we have different marketplaces for achieving these activities.

While exchanges like Binance and Gemini perform an exceptional job at handling the billions of daily trading volume, most traders believe they don’t stay true to one of the cores of cryptocurrencies; decentralization.

Decentralized exchange (DEX) proponents dislike the somewhat corporate nature of centralized exchanges (CEXs), which is why decentralized exchanges have become increasingly popular in the industry. NXT became the first of this kind in 2014.

CoinMarketCap has listed at least 105 of these at present. Decentralized exchanges are one of the burgeoning elements in the field of DeFi (decentralized finance). Yet, DExs have a steeper learning curve to navigate and understand since they function differently from their centralized counterparts.

Hence, we’ve created this guide covering what they are, how they work, the differences compared to CEXs, the advantages/disadvantages, and the top decentralized exchanges to consider for your trading.

What is a decentralized exchange?

Although the term ‘decentralized exchange’ may seem daunting, it undoubtedly helps to break it down. An exchange is just a business providing a marketplace for traders to buy and sell different digital currencies.

Like any market, there always needs to be buyers and sellers. For any financial instrument to function efficiently, traders must be able to trade a large number of markets without causing any delays or erratic price changes (liquidity).

Liquidity is provided by market makers (also referred to as liquidity providers), typically third-party companies or even the exchanges themselves who essentially offer the traded pairs by keeping an ‘inventory’ of all the markets through an order book.

For instance, if someone wants to buy BTC by selling USD, the market maker will always have a substantial number of BTC at hand ready for exchange (and vice versa). This concept applies to all instruments on the platform.

The efforts of market makers are compensated through fees on every order. A DEX flips this model on its head where this liquidity is entirely exchanged peer-to-peer without any third party or middleman facilitating the transactions.

Swapping different tokens is not the only activity taking place on a decentralized exchange. Some platforms in this niche are dedicated to borrowing/lending, margin trading, and yield farming, while others do a bit of everything.

How do decentralized crypto exchanges work?

We’ve just established decentralized exchanges that do not rely on an intermediary to create the markets for traders. Now we need to understand how a DEX provides liquidity autonomously.

Presently, DEXs achieve this objective in three ways. The first still relies on a traditional order book of a typical exchange where a record is kept by market makers of all the buy and sell orders.

For their efforts, such organizations make money primarily from the spreads between the different prices. These entities are technically semi-decentralized and aren’t as favored as exchanges like Uniswap with total decentralization. Yet, some of the infrastructure is still non-centralized.

Examples of these DEXs include Loopring, ViteX, dYdX, Binance DEX, etc. The two other liquidity-providing models, which are more prominent, are swaps and aggregators. For the former, the exchange doesn’t rely on an order book but rather user-created liquidity pools (known as automated market makers or AMMs) using smart contracts.

Essentially, trading occurs between users’ wallets on the platform via a deterministic algorithm setting prices based on a specified changing ratio of supplied tokens. Ordinary users are incentivized to provide this liquidity through trading fees, similar to the compensation model of conventional market makers.

Platforms utilizing the swap method include Uniswap, PancakeSwap, SushiSwap, Curve, Balancer, Kyber, and many more.

The issue with the swaps model is DEXs cannot provide substantial liquidity, causing problems such as price slippage. Aggregators are the third method for creating liquidity and aim to solve this challenge.

As the term suggests, such exchanges aggregate liquidity from several other decentralized exchanges and private providers on one interface, ensuring better prices than entities using swaps. ZeroSwap, 1inch, Matcha, and DeversiFi are some of the popular platforms employing this model.

Another distinction with DEXs over regular exchanges is that there is no sign-up process because decentralized exchanges foster complete anonymity in keeping with the ethos of cryptocurrencies, which experts frequently cite as one of the most significant advantages.

Hence, users can start trading right away without delay. Furthermore, traders keep custody of their private keys, unlike centralized entities.

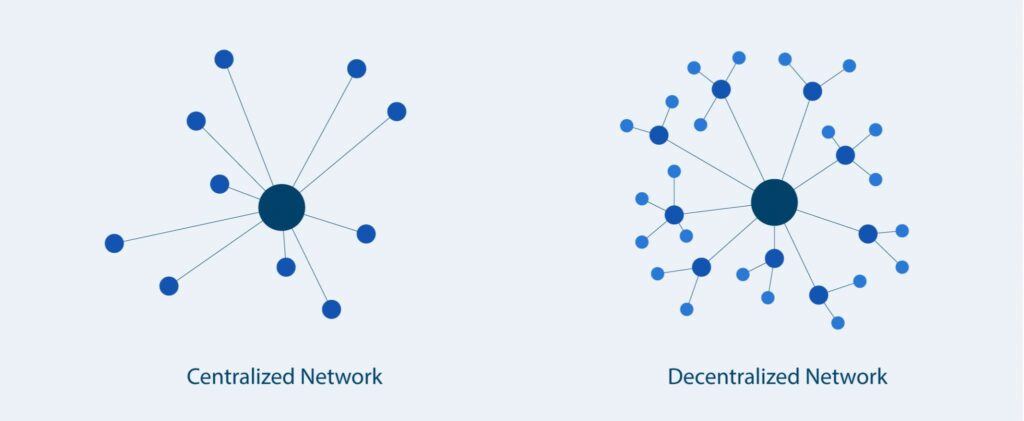

Differences between a centralized and decentralized exchange

The table below summarizes the key differences between CEXs and DEXs.

| Centralized exchanges | Decentralized exchanges | |

|---|---|---|

| Liquidity-sourcing mechanism | Order books and market makers without using any blockchain | Mostly peer-to-peer liquidity pools/swaps and aggregators using the blockchain |

| Identity verification/anonymity | KYC is necessary | No KYC is necessary |

| Funds control | Up to the exchange | Up to the users |

| Withdrawal limits | Yes | No |

| Custody of private keys | Held with the exchange | Held with the user |

| Hacking chances | Higher | Lower |

| Deposit currencies | Fiat-to-crypto or crypto-to-crypto | Crypto-to-crypto |

| Magnitude of fees | Higher | Lower |

| Depth of liquidity | Higher | Lower |

| Hosting | Centralized servers | Distributed network |

Pros and cons of decentralized exchanges

Let’s briefly observe some of the pertinent advantages and disadvantages of decentralized cryptocurrency exchanges.

Pros

- Control of the funds remain with users, meaning no third-party trust is necessary

- Privacy-enhanced

- Generally lower trading fees and incentives to providing liquidity

- Lower hacking and counterparty risks

- No sign-up process involved

- More efficient trading and fewer chances of downtime

- No transaction limits

- Fewer risks of government intervention or regulation crackdown

Cons

- The responsibility of wallets and private keys is up to the user

- Not the most user-friendly interfaces at times, making it confusing initially

- Not as much liquidity available compared to centralized exchanges

- Range of markets is typically limited to a single or few blockchains

- No fiat deposits are accepted

- Limited customer support

What to consider when choosing a decentralized exchange

Your research over which decentralized exchange to use is the same as with any other. Below are some of the main criterion points to consider in your quest.

User-friendliness

As briefly mentioned, the user interfaces of many DEXs aren’t straightforward to navigate initially, particularly if you’re new to the trading world. To their credit, these exchanges have gotten better over time.

Nonetheless, when looking at a decentralized platform, you should spend some time on their website or mobile application mastering the navigation. The interface should be as simple and as stripped-down as possible while serving the main functions of the exchange, whether it is borrowing/lending, yield farming, margin trading, swapping, etc.

For instance, swaps-focused DEXs such as Uniswap have effortless menu setups where traders can see where to swap tokens, join liquidity pools, connect their wallets, browse charts, and so on.

Number of available coins

Several decentralized exchanges tend to focus on tokens created from a particular blockchain. Yet, it’s fair to assume most traders prefer those offering the highest number of available coins. Hence, you would need to see which markets can be traded and when new coins would be listed.

Trading volume

You can compare the trading volume of your desired tokens through applications such as CoinMarketCap. For instance, if you’re looking to trade Ethereum-based tokens, you would filter all the decentralized crypto exchanges over the last 24 hours, day, seven days, etc., and see which has the highest volume.

As previously mentioned, the volume with many DEXs isn’t as substantial compared to entities like Binance. For the best trading experience with minimal irregularities, you would want to stick with decentralized exchanges with the highest liquidity for your chosen markets.

Trading costs

Of course, while trading fees among DEXs tend to be lower, you still need to check the fine print of these along with any other possible transaction charges. Trading costs in cryptocurrencies have been notoriously high over the last few years, particularly with Ethereum-based tokens.

Through a process of elimination, you should be able to find the cheapest exchange based on the respective markets you wish to trade or employ other means to lower the fees where possible.

Wallet compatibility

A DEX user will need to have an existing wallet beforehand. Nowadays, decentralized crypto exchanges are compatible with several options like MetaMask, WalletConnect, Coinbase Wallet, Fortmatic, Trezor, Ledger, etc. So, traders should opt for exchanges with the highest number of these compatible on their platform.

Which are the top decentralized exchanges for 2022?

Now that we’ve covered valuable and helpful information about the landscape of decentralized exchanges, let’s look at the top options in this sphere.

Uniswap: Best Overall

By trading volume, according to CoinMarketCap, Uniswap is the largest amongst all DEXs and regularly processes several billion daily. The exchange was launched in 2018, now with over 1.5 million users, controlling about 20% of the DEX market share.

Uniswap is a swaps-driven decentralized exchange for trading or swapping Ethereum-based or ERC20 tokens, with added earning functionality through providing liquidity, building, and listing new coins. The project launched its version 3.0 in May 2021 with some significant improvements over v2.

Users pay 0.3% per trade, which is generally on par with the industry average of crypto exchanges. For withdrawing, traders are only charged the network fees, with research suggesting these are 15-20% of the global industry standard of 0.000812 BTC per withdrawal.

Uniswap launched its own cryptocurrency in September 2020, UNI, a governance token among the top 15-20 traded coins in the space. Overall, Uniswap is the best overall and offers everything you need from a decentralized crypto exchange.

Pros

- Largest DEX by trading volume presently

- Liquidity-providing incentives available through trading fees

- Wide selection of compatible wallets supported

Cons

- Only supports ERC20 tokens

- Rug pulls and scam tokens have been commonly reported

- Transaction failures may occur because of fee, liquidity, or pricing issues

dYdX: Best For Margin And Perpetuals Trading

dYdX is the second-largest DEX by trading volume after Uniswap, according to CoinMarketCap.

Launched in 2017, it is also an Ethereum-based platform dealing primarily with isolated and cross-margin trading and perpetuals trading with 1:25 maximum leverage on popular markets like Bitcoin, Ethereum, Bitcoin Cash, Cardano, and many more.

dYdX provides the best of both worlds in the security of a DEX and the usability of a CEX. Additionally, dYdX is also a lending and borrowing platform for cryptocurrencies on several wallets. Over 15 000 traders rely on dYdX’s lightning-quick trade execution thanks to blockchain and smart contracts technology.

The exchange has recently added a ‘layer 2 protocol’ powered by StarkWare to offer reduced fees, zero gas costs, lower trade sizes, faster withdrawals, faster execution, and better security.

All in all, dYdX is an excellent alternative for those looking to trade crypto on margin and perpetuals while still benefiting from the advantages of a decentralized exchange.

Pros

- Biggest DEX for margin and perpetuals trading

- The layer 2 protocol allows for zero gas costs and lower trading fees

- Decent selection of markets for perpetuals trading (23)

- Allows for borrowing and lending of tokens

Cons

- Minimal range of pairs for the margin trading (3)

- Not so easy to navigate initially compared to centralized exchanges

PancakeSwap: Best For Providing Several Earning Mechanisms

Closely behind the tail of Uniswap is PancakeSwap, a food-themed and anonymously-developed decentralized exchange launched in September 2020, which allows for the swapping of BEP20 or Binance Smart Chain-based tokens. PancakeSwap is pretty similar to Uniswap in several ways.

The exchange also uses the AMM model, where you swap various BEP20 tokens (about 290 of them) in many ‘SYRUP’ pools with incentives in the form of trading fees for providing liquidity.

PancakeSwap has its utility token, CAKE, used for trading fees. Users can earn in several other ways aside from swapping BEP20 coins and providing liquidity to earn fees. Costs-wise, you can expect to pay 0.25% for every trade. Most DEXs typically don’t have a standard withdrawal fee but rather a blockchain network fee.

In this regard, Binance’s costs are, on average, $0.05 per transaction, much lower than most. The liquidity-providing tokens are called FLIP, which users can ‘farm’ or stake to receive even more CAKE. Moreover, traders can stake CAKE for more CAKE and receive tokens of other projects.

Lastly, lotteries are held every six hours, where each ticket costs 10 CAKE for entry. Here, users stand to win a ‘jackpot,’ which equals half of the lottery pool. Overall, PancakeSwap is another superb decentralized exchange.

Pros

- One of the largest decentralized exchanges by trading volume

- Offers numerous earning mechanisms

- Lower trading fees and faster transactions compared to Ethereum-based DEXs

- Secured and audited by CertiK, presently ranked #1 for most secure DEX

- Plenty of supported wallets for trading purposes

Cons

- Only supports BEP20 tokens

- Less range of available coins

SushiSwap: Best For Wide Range Of Supported Blockchains

SushiSwap keeps with the strange theme of exchanges named after food like PancakeSwap. Some of the exchange’s taglines are ‘be a DeFi chef with sushi’ and ‘Michelin star-worthy DeFi innovations crafted by our master chefs.’ SushiSwap ranks fourth for the highest volume in the DEX market.

A fork or clone of Uniswap, SushiSwap is an all-in-one ecosystem for swapping, liquidity-providing, yield farming, lending, and borrowing. The exchange was co-created in 2020 by a pseudonymous person or group named ‘Chef Nomi’ and ‘0xMaki.’ SushiSwap now boasts 1975 pairs, supports 20+ wallets, and 14 blockchains.

Like other DEXs, SushiSwap has its own governance token, SUSHI, also usable for staking rewards. 0.3% is the trading charge for all trades performed on the platform, along with the network fees of the respective traded tokens.

SushiSwap is a competitive DEX with similar capabilities to the likes of Uniswap and PancakeSwap, except it does support a few more blockchains.

Pros

- Provides a substantial number of trading pairs from various blockchains

- No scandals have been reported yet

- Offers several incentivized DeFi products

Cons

- Network fees may be high as with other exchanges

- Still fairly new in the market

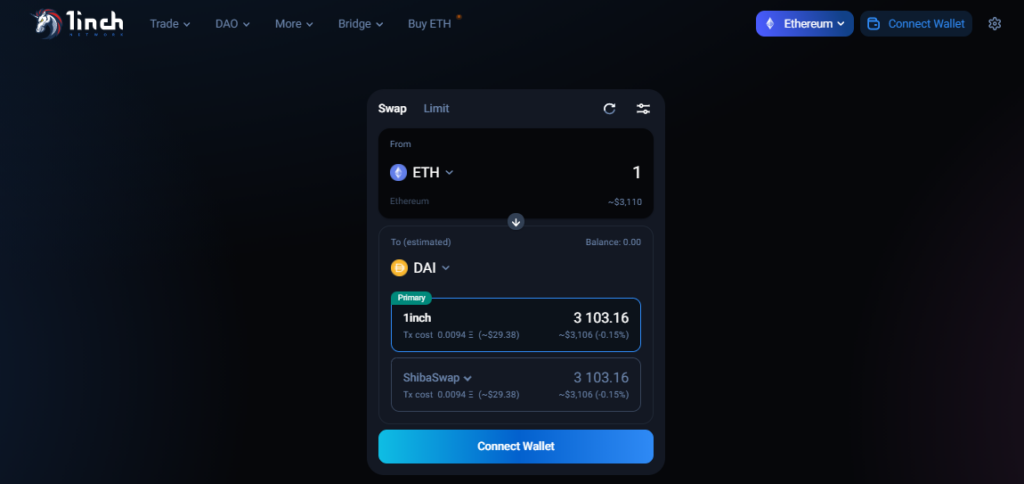

1inch: Best For DEX Aggregation

Released in May 2019, 1inch is the largest DEX aggregator presently and ranks 8th in DEXs with the highest trading volume overall, according to CoinMarketCap. The exchange aggregates the best prices from hundreds of tokens from the Binance Smart Chain, Polygon, and Optimism blockchains, trading on 21 different DEXs.

Aside from swapping, users can purchase 1inch’s own token of the same name for yield farming and governance purposes. As a DEX aggregator, 1inch doesn’t charge any deposit or withdrawal fees, only those coming from the respective exchanges.

For traders looking to lower the gas fees from the various tokens, 1inch has the Chi Gastoken. 1inch is compatible with 12 different wallets. Ultimately, 1inch is a worthy choice if you’re looking for the leading DEX aggregator offering better pricing and a broader range of markets under one roof.

Pros

- The leading DEX aggregator presently by trading volume

- Better pricing rates as an aggregator while limiting transaction costs where possible

- Provides a yield farming option

- Transaction costs can be lowered further with Chi Gastoken

Cons

- The ‘Infinity Unlock’ feature has been viewed as a security threat

- Slightly less user-friendly for beginners

FAQs about decentralized exchanges

Do decentralized exchanges charge fees?

Yes, DEXs charge fees like any other exchange, although the models are distinct. Traders should expect to pay trading fees between swapping different cryptocurrencies and note the miners’ network fees of the respective blockchains.

Are decentralized exchanges safe?

No exchange is entirely safe. Despite reduced hacking and counterparty risks compared to centralized exchanges, users still have the responsibility to ensure the highest possible security, particularly in handling wallets and private keys.

How does a decentralized exchange make money?

The business models vary from exchange to exchange, which you can learn about beforehand in the documentation. ETH-based platforms typically have a fee on the smart contracts, and others have their own tokens as a payment method where traders are charged regular fees. Some exchanges may even be purely not-for-profit.

Can decentralized exchanges be hacked?

While hacking reports with such exchanges have been much lower than CEXs, they are still hackable. The point is DEXs pose fewer possibilities of these unfortunate events because of being non-custodial and not relying on a single point of failure.

Are decentralized exchanges regulated?

Technically, no, due to the unregulated nature of cryptocurrencies themselves. Yet, DEXs are perfectly legal if they do not cross the line of shady financial practices that particular regulatory authorities may discover.