Cryptocurrencies have become a major asset class worth over $2 trillion. It has achieved this spectacular growth in less than 15 years, and analysts expect its growth to continue in the coming years. This article will look at some of the top strategies for making money in cryptocurrencies in a passive manner.

Passive vs. active

There are two main ways of making money in cryptocurrencies and other assets: active and passive. An active strategy is one where you are buying and selling assets to make a profit. This involves trading, where you open and close trades within a short time. Investing, on the other hand, is a long-term approach.

Passive, on the other hand, is a strategy where people seek to make money without doing a lot of work on a daily basis. Instead, their goal is to possibly set aside some capital and let it work for you, creating an income stream. A good example of this is an investor who buys several dividend-earning stocks. Such investors will always receive dividends as long as the company is healthy financially. Other popular passive-income strategies are real estate, published books, and music.

So, with that in mind, let us look at some of the best passive income strategies for cryptocurrencies. As you will find out, these processes are not without risks.

Cryptocurrency mining

There are two main ways in which cryptocurrencies are generated: proof-of-stake (PoS) and proof-of-work (PoW). Other approaches are proof-of-authority (PoA) and proof-of-history (PoH).

Proof-of-work is a process that uses complex computers to generate new cryptocurrencies. Some of the most popular coins that are generated using this proof-of-work approach are Bitcoin, Litecoin, Bitcoin Cash, Ravencoin, and Kadena.

After buying a computer and running the software, you will earn cryptocurrencies as they are mined. You can then sell these coins in the open market and make money.

It is a passive way of making money simply because you won’t need to do much work after running the software. However, there are several disadvantages of this approach. First, it can be an expensive process because of the high initial capital needed to buy computers. Second, the cost of energy can be high.

Third, at times, the cost of producing new coins can be higher than the price you will sell your coins for. Most importantly, there could be liquidity challenges depending on your mining cryptocurrencies.

Cryptocurrency HODLling

HODL is a term that is popular in the cryptocurrency industry. It refers to the process where you buy one or more cryptocurrencies and hold them for a long time. People who do this are usually not interested in the short-term profits digital currencies can produce. Instead, they have a long-term view.

While cryptocurrencies are highly volatile, Hodlers have generated substantial profits over time. For example, hodlers who bought Bitcoin in 2010 have seen the price rise from less than $5 to the current $40,000. Similarly, people who bought a cryptocurrency like Ethereum in 2015 have seen its price rise from below $1 to over $3,000.

While hodling is a strategy that works, the biggest risk is that digital coins are incredibly volatile. As shown above, Ethereum’s price tumbled by about 40% from its all-time high of $4,860 from November 2021 to April 2022.

Cryptocurrency copy trading

Another way to generate passive income in cryptocurrencies is known as copytrading. Copytrading is when an experienced or inexperienced individual uses technology to copy trades from professionals. This process has been made possible by the technology offered by leading exchanges and brokers.

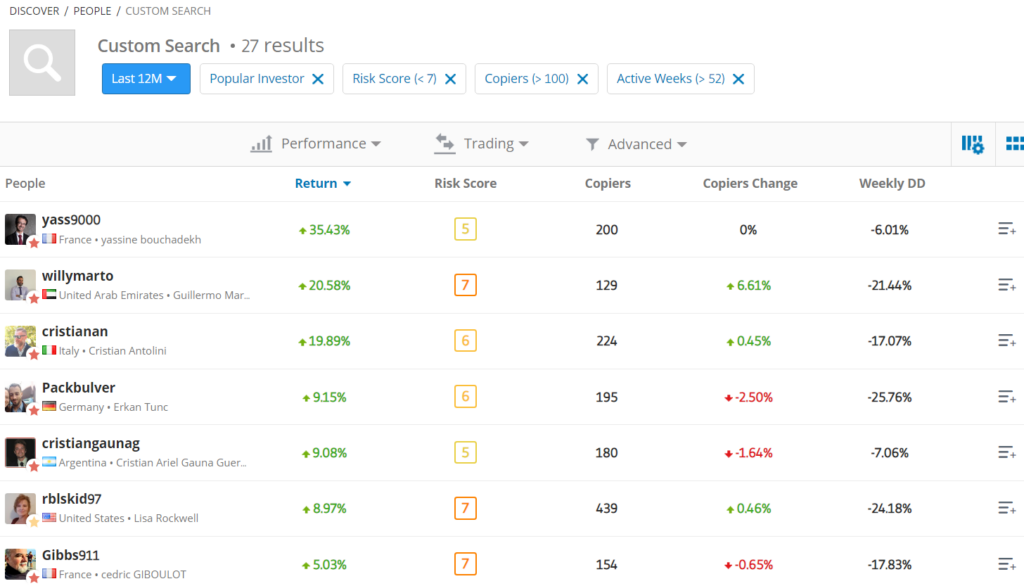

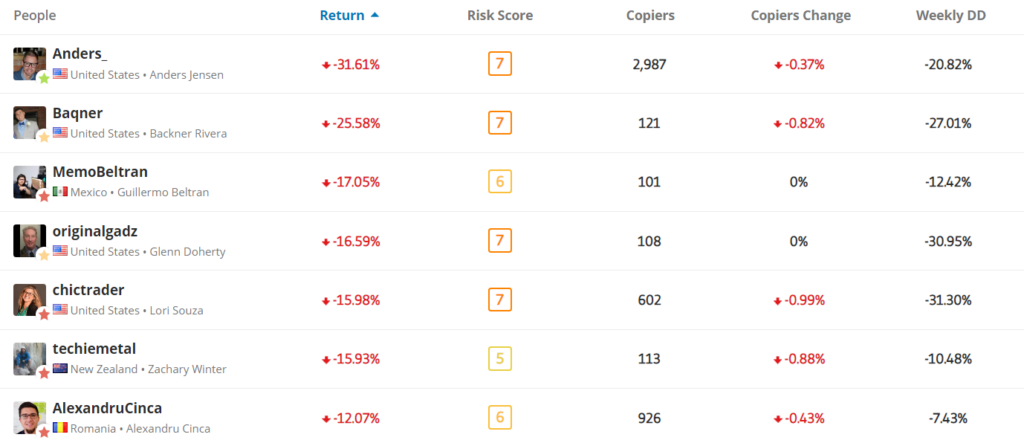

The idea is simple. You create an account with a broker and then select the copytrading feature. After this, the company will show you some of the most profitable traders on its platform. Finally, you can select the individual and start mirroring their trades. In this case, their trades will be implemented in your account. The chart below shows some of the best-performing traders on eToro’s platform.

Experienced traders can embrace copytrading as a way of diversifying their income. In this case, they will continue making money in their account while generating income from the other professionals.

While copytrading is a good way to make money, there is a risk that the professionals will stop performing well. As shown above, some of the best-rated professionals have not performed well.

Staking

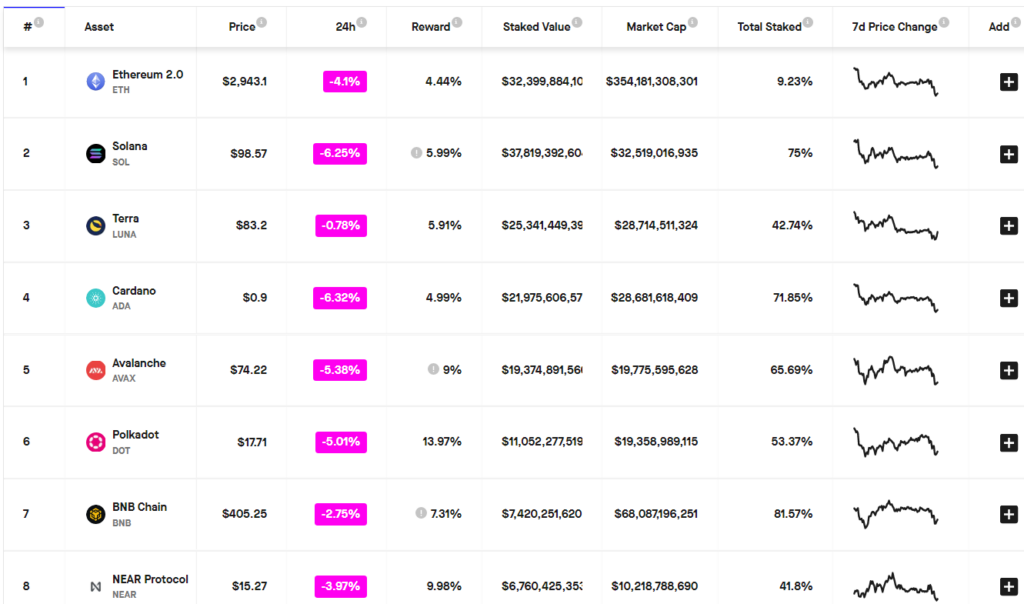

Another way of making passive returns in cryptocurrencies is known as staking. Here you buy proof-of-stake cryptocurrencies and then generate returns monthly. These returns come from several sources depending on how the cryptocurrency is designed.

At times, these staking rewards come from the fees that the network charges to handle these transactions. For example, a cryptocurrency like UNI usually rewards its holders using the fees that Uniswap charges its users. Some cryptocurrencies provide rewards using newly-minted tokens.

Cardano, Solana, Terra, and Fantom are the top cryptocurrencies you can stake. The chart above shows some of their staking rewards. Still, a major risk when staking is that cryptocurrency prices movements will affect your total returns.

Liquidity providing

Another way of making passive income in cryptocurrencies is to provide liquidity to DeFi platforms. For the Lending DeFi platforms like Aave and Anchor Protocol to work, they need liquidity in their networks.

Therefore, you will provide your cryptocurrency, and then the protocol will pay you a fee to do that. Some of the most popular DeFi protocols that allow you to make money by providing liquidity are Uniswap, Anchor Protocol, Lido, and Aave.

Summary

There are several approaches to making money passively in cryptocurrencies; we have looked at some of them. As you have seen, each of these strategies has its risks, which you need to be aware of and mitigate.