Whether someone is a casual user or a serious investor, they will need to understand the best crypto wallets to store cryptocurrencies. Unlike fiat money, keeping digital coins is a little more complex because of their decentralized nature.

The main concern with any wallet is security. With so many stories of ordinary users and exchanges losing substantial amounts of coins from cybercriminals, it becomes imperative to understand coin storage and using the best online crypto wallets.

This article will look at a decent selection of the best hardware and online wallets on the market, although most of this guide is educational.

Storing cryptocurrencies means understanding the different kinds of existing wallets, how they work, their pros and cons, what to look for when choosing a wallet, all of which will be sufficiently explored in this article.

Best hardware crypto wallets

Trezor

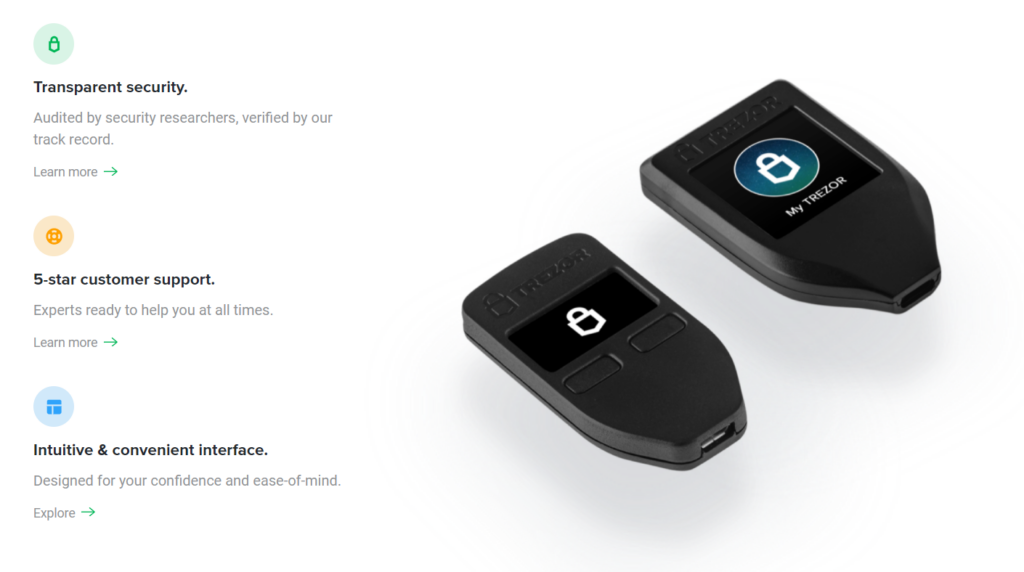

Trezor is one of the leading products in cold coin storage and one of the first invented hardware wallets. Created by the Czech Republic-based, aptly named SatoshiLabs, the wallet was initially released in 2014.

Since then, the brand has been renowned for its sophisticated wallet security features. Trezor supports hundreds of coins and is pluggable in both computers and smartphones. Their wallets come in solid, portable, lightweight devices with screen displays.

Trezor’s two current product lines are the One and the Model T. Both versions share many similar features, except the Model T boasts a full-color touchscreen, supports more coins, and costs about $120 more.

Pros

- Offers top-notch offline storage

- Has constant firmware updates

- Supports more than 1000 cryptocurrencies

Cons

- Offers the Model T at a high price

- Not compatible with as many online wallets/exchanges as Ledger

- Not as physically durable as Ledger

Ledger Nano

Ledger is another prominent name for hardware wallets, affording users complete security and control over their digital assets. It was first released in 2016 by a computer and network security company of the same name and is considered the leading cold wallets, along with Trezor.

The current product lines for Ledger are the Nano S and Nano X, costing $59 and $119, respectively. Both wallets boast much of the same features, except the Nano X has a slightly larger screen, allows users to install 100 apps at once, comes with 8-hour battery power, and is Bluetooth-compatible with Ledger Live Mobile.

Pros

- One of the cheaper wallets

- Highly secure

- Supports over 1800 coins

- Compatible with more than 50 software wallets/exchanges

- Durable as each wallet comes with stainless steel cover

Cons

- Difficult to set up and navigate initially

KeepKey

KeepKey is another old and trusted brand in hardware wallets, created in 2014 by the Swiss-based exchange ShapeShift. The wallet supports a limited selection of the most popular cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, XRP, etc.

KeepKey is known for its sleek and simplistic user interface with a slightly larger screen than other wallets for more clarity on transferred assets on the device. However, where KeepKey shines above its competitors is value for money, with the wallet costing only $49, making it one of the most cost-effective wallets on the market.

Pros

- Upholds all the industry-standard security measures

- Is one of the most affordable hardware wallets

- Comes in a robust aluminum case

- Is very user-friendly

- Boasts a much wider screen than Trezor and Ledger

Cons

- Only supports 40 cryptocurrencies

- Slightly heavier than Trezor and Ledger

Best Online Crypto Wallets

Binance

Binance has been the largest cryptocurrency exchange in trading volume for several years, making it a trusted and reputable name in the industry. So naturally, this has made them a place where millions of traders keep their tokens for performing transfers and withdrawals.

Also, we could consider Binance a jack-of-all-trades as they keep innovating and offering new crypto products catering to as many niches as possible. It’s important to note this wallet is exchange-based, unlike Binance’s other wallet, Trust, which is not.

Nonetheless, Binance wallet owners enjoy an unmatched selection of popular and obscure coins, supreme security, and highly liquid markets.

Pros

- One of the biggest exchanges globally

- Offers the highest security technology

- Provides access to a substantial number of digital currencies

- Trading fees lower than the average

- Emergency insurance fund available (SAFU)

Cons

- Hacking risks exist with online wallets

- Platform not particularly beginner-friendly

Coinbase

Coinbase is one of the world’s most popular and reputable cryptocurrency exchanges based out of America. It has a dedicated and separate wallet that allows users to buy, store and send Bitcoin, Bitcoin Cash, XRP, Litecoin, Ethereum, Ethereum Classic, Dogecoin, Stellar, and all ERC-20 or Ethereum-based tokens.

Furthermore, the wallet permits traders to participate in occasional ICOs (initial coin offerings) and airdrops, collect NFTs (non-fungible tokens), shop at selected stores, and browse decentralized applications.

Although Coinbase, the exchange, is centralized or custodial, the wallet is user-controlled and non-custodial. As a result, traders need to keep their seed recovery phrases securely in case they lose access to their wallets through ordinary means.

Pros

- Created by a trusted and well-known exchange

- Has several industry-standard security features

- Requires a Coinbase account to be used

- Offers $250k insurance on USD deposits

Cons

- Has high fees

- Has no phone support

- Is vulnerable to hacks

Gemini

Along with Coinbase, Gemini is another prominent, regulated USA-based exchange. Gemini is known as the invention of the famous Winklevoss twins.

Aside from storing a decently wide range of the most popular digital currencies, Gemini’s wallet allows users to make retail purchases with selected retailers and earn above-average interest on some of their coins with the Gemini Earn program.

Unlike Coinbase, Gemini’s wallet is not separate from the exchange itself, meaning users need to open a Gemini account and access it there. Regardless, users can buy, sell and store around 40 cryptos in a simple yet elegant platform, and enjoy plenty of other perks for Gemini clients.

Pros

- Adheres to the highest possible safety precautions

- Is a reputable brand

- Insures funds in the wallet

- Is user-friendly

- Offers good customer support

Cons

- Supports a limited number of cryptocurrencies

- Known for high fees

- Restricted in many countries

- Online wallets are vulnerable to hacks

What is a crypto wallet?

A crypto wallet is nothing more than an application allowing users to retrieve their cryptocurrencies. Before exploring how these wallets work, it’s important to note that a crypto wallet doesn’t technically store any coins as a physical one would.

A wallet simply stores certain information, primarily keys or addresses, directing a holder to a specific location on a blockchain where their actual tokens exist. Then, when someone wants to send money to another user, they can either scan their QR code or use their public address (covered more in the next section).

How do crypto wallets work?

We’ve just established that digital wallets merely interact with a plethora of blockchains enabling holders to perform various operations rather than keeping the actual coins. As the term suggests, a public address, typically composed of a long, random alphanumeric sequence, is used by the receiver to receive crypto from senders.

The public key is assigned to a user for a particular cryptocurrency, like an account on a specific distributed ledger. It is shareable to anyone who wants to send some crypto to the address.

On the other hand, a private key is more like a password necessary to access the funds in a designated wallet. It’s usually a complex 256-character binary or similar code, mnemonic phrase, or QR code.

As the name suggests, this key must remain confidential at all times as any security compromise poses a risk of substantial and unrecoverable theft of funds from bad actors. The private key generates the public key through some perplexing math, meaning both work in synergy.

When someone receives crypto in their wallet using their public address, the sender is essentially signing off ownership to the receiver. For the recipient to retrieve the funds, their private key should match the public address assigned to a specific cryptocurrency.

Once this process is finalized, the blockchain will keep a record of the transaction and update the balances of the wallets accordingly.

Cold vs. hot crypto wallets

The main types of crypto wallets are ‘hot’ and ‘cold.’ These distinctions have to do with whether the wallet in question is linked to the internet or not. A hot wallet is connected to the internet and is very common with exchanges.

It allows for quick access to one’s holdings, swift peer-to-peer transfer of coins, and holding multiple cryptocurrencies in one location. In addition, hot wallets are the easiest to set up with no upfront cost, typically only requiring creating an account online.

They also come in a few forms aside from web interfaces, namely mobile and desktop applications. However, while hot wallets are highly convenient, the biggest disadvantage is their susceptibility to cyberattacks since they are connected to the internet.

This can cause hackers to steal a substantial number of tokens which are near impossible to recover in many cases. Moreover, the exchange or wallet provider keeps the private keys for their clients, which some might perceive as counterparty risk and susceptible to hacking incidents.

A cold wallet seeks to circumvent many of these challenges by keeping coins in offline storage or off the net. It achieves this goal using a physical device which is most commonly a USB, but a compact disc and hard drive are sometimes used.

Traders use the device on their computers to read their keys through an interface provided by the exchange or wallet service to perform transactions. Furthermore, users gain control of their private keys, although this does come with additional responsibility.

Cold wallets are best for long-term storage of coins since they are a little tedious for frequent transfers, unlike hot wallets. Also, they come at an upfront cost as well. Traders who own massive amounts of cryptocurrencies often choose this option as well for the protection it provides.

However, the biggest drawcard for cold wallets is they are shielded from cyber attackers, making them much safer for storing cryptocurrencies.

What to look at while choosing the best crypto wallet

Below are the main key things to observe when choosing the best hot or cold wallet. Similarities do exist between the two though some factors are also unique.

It’s worthwhile to note many traders use both online and hardware wallets, keeping a small portion of their funds in the former while the rest in the latter. Therefore, someone’s usage will affect which type of wallet they would choose.

Hot wallet

- Security: Security with a hot or online wallet is even more crucial than with cold storage. The standard features users must look for are U2F authentication, other authentication measures, and PIN codes. As much of the hot wallets presently are provided by exchanges, they must keep most of their users’ holdings in separate cold storage with multi-signature private keys.

- Widest cryptocurrency range: The more coins supported by a hot wallet, the more convenient as it prevents the need to open more than one wallet.

- Fees: A potential client needs to compare transaction and trading fees across exchanges in ensuring they get the most cost-effective deal.

Cold wallet

- Security: The sophisticated technology used by the most popular hardware wallets is more or less the same, e.g., two-factor authentication, PIN codes, multi signatures, etc. However, the wallet must provide a straightforward back-up process using recovery or seed phrases that users must safely store and remember if their devices are lost or broken.

- Price: This really comes down to someone’s affordability and how much crypto they have to store. Although Trezor is the pricier option compared to the others, it’s only about $100 difference.

- Extensive cryptocurrency range: Users will need a wallet supporting the storage of tens of different coins to eliminate the need for having multiple wallets.

- Purchasing at the right place: To ensure users don’t receive possibly tampered devices, they should always buy the wallet directly from the brand that created it instead of third-party retailers.

Conclusion

Although cryptocurrencies have revolutionized the way we interact with money, they’ve also presented some challenges largely absent with fiat currencies. The most significant of these is security.

While cold or hardware wallets are technically more protected, users must still take extra precautions never to lose their devices and that they interact in a safe online environment when conducting transactions.

Online wallets are still a prevalent option due to their convenience. Many owners who don’t own a lot of crypto and perform frequent transactions still opt for this storage. Still, it’s critical to choose a reputable exchange adhering to the highest possible security standards to minimize the chances of hacks.

Alternatively, natural ‘HODLers’ who own substantial amounts of coins might prefer the tactile and secure storage of hardware wallets. Regardless of which wallet is chosen, PIN codes and other access data should always be kept private and stored in a few different locations.

When creating this guide, we used a specific methodology looking at security, costs, user-friendliness, features, and anything else that would benefit the modern cryptocurrency user.