The most fundamental trading strategy in most financial markets is buying low, selling high, and profiting from the difference. However, in crypto, prices will not always manifest an upward trend. Most of the time, especially in lower timeframe charts, prices will fluctuate wildly with no discernible trend. This may seem discouraging, but what if we told you there was a way to profit from this seemingly sideways movement? Enter grid trading.

Grid trading defined

Essentially, this is a trading strategy that involves placing strategic limit buy and sell orders. First, the trader identifies the upper and lower limits within which prices are fluctuating. The area enclosed by the two limits is called the grid. The trader then places strategic limit buy orders below the current market price, and limit sell orders above this price.

It goes without saying that the wider apart the buy and sell orders are placed, the higher the profit potential from the trade. For instance, if the buy order is placed at $30,000, a sell order at $35,000 would yield more profit than one at $31,000.

How it works

First off, grid trading is best suited for short-term trading. Therefore, the best timeframe to use this strategy is anywhere between the 1-minute to the hourly chart. This is because lower timeframe charts tend to display numerous whipsaws, which constitute the volatility that grid traders aim to take advantage of. On higher timeframe charts, price charts may appear smooth and stable and in a consistent trend.

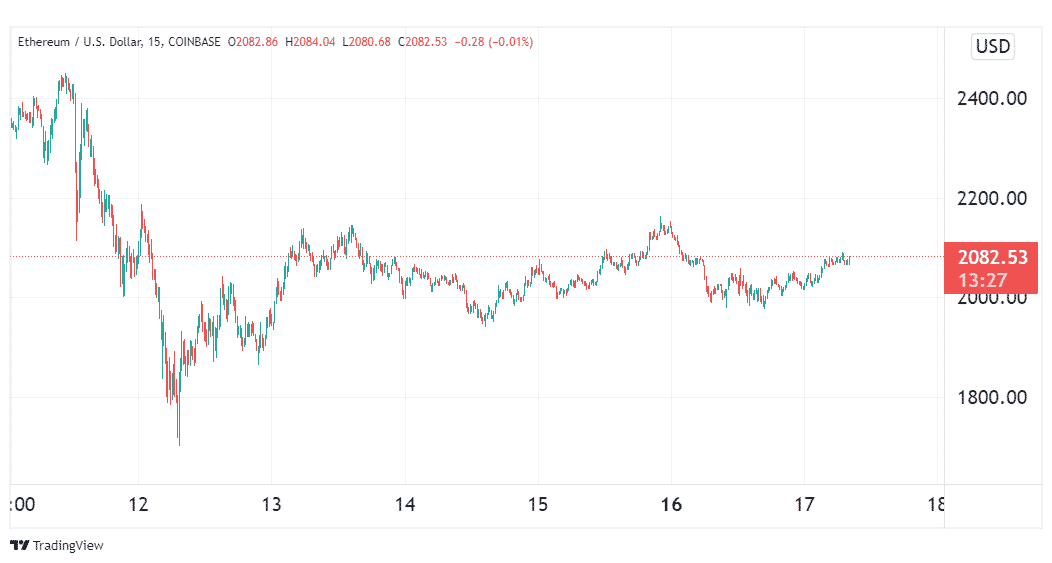

For instance, if you look at the ETH daily chart in the image above, ETH seems to be in a consistent downtrend since the beginning of April. However, on doubling down to a lower timeframe, we can see its price has been fluctuating wildly in a range, making it an ideal candidate for grid trading. This is illustrated in the 15-minute chart below.

For the last several days, ETH’s price has been fluctuating between $1940 and $2140. To trade this, a grid trader could place a lower limit of $1900 and an upper limit of $2200, with the assumption that prices will be stuck in this range for the foreseeable future.

The good news is, on platforms such as Bitsgap, you can create a grid trading bot with just a few mouse clicks without needing to write a single line of code. But first, there are some vital parameters to consider.

- Take profit – This is the maximum price you set for your trades. When prices reach this point, your bot will automatically close all open positions.

- Stop-loss – This is the lowest price you set for your trades. At this point, the bot will automatically close all open positions, albeit at a loss.

- Upper limit – This is the upper boundary of your grid. There will be no more sell orders above this level.

- Lower limit – This is the bottom boundary of your grid. Your bot will not place any buy orders below this price point.

- Grid number – This is the total number of buy and sell orders within your grid. This number is usually evenly distributed. Therefore, if you set a grid number of 6 for example, you’ll have three buy orders and three sell orders.

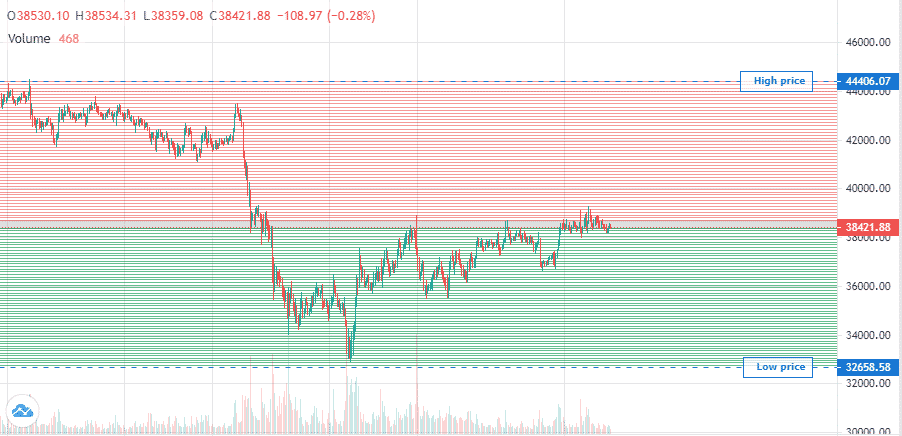

The chart above shows an example of a grid trading setup. The green horizontal lines represent the buy orders, while the red horizontal lines represent the sell orders. The total number of buy and sell orders is the grid step.

Moving back to our Ethereum example, we placed a lower limit of $1900 and an upper limit of $2200. From the current price of $2082, and assuming a grid step of 6, we can place buy orders at:

- $2,000

- $1,950

- $1,900

Similarly, sell orders can be placed at:

- $2,100

- $2,150

- $2,200.

These figures are obtained relative to the volatility characteristic in question. Since the crypto market is ever-changing, you would need to adjust these parameters regularly to match the prevailing market conditions. What’s more, this strategy should only be used when the coin fluctuates 2-3% daily. This is because a sudden spike to the upside would trigger the take-profit early, while a quick drop would trigger the stop loss.

Benefits of using a grid trading bot

- Grid trading is a reliable strategy – Grid trading has been around for ages and has been in use in several financial markets, with a proven record of success. It has proved especially useful in crypto due to the market’s characteristic high volatility.

- It is easy to use – the strategy does not involve any complex calculations, indicators, or measurements. This makes it suitable for traders with little experience in crypto.

- It is highly adaptable – Since it is based on the concept of buying low and selling high, it can be applied to a variety of markets. What’s more, it can be set up for the short term with a narrow grid or long term by selecting a wide grid and letting it run for months to gather profits from any major trend changes.

- Enhances risk management – Due to a large number of trades, it inherently incorporates hedging as losses from some could be offset by profits from other trades. What’s more, by using stop-losses and take-profit orders, one can minimize the amount of risk they are exposed to.

Points to note before running a grid bot

Usually, most platforms will charge fees for every transaction. Due to a large number of trades, these fees may significantly eat into your profits. Therefore, you should choose an exchange with low transaction fees. Additionally, do your due diligence before choosing an asset to trade to ensure that no fundamental events will cause significant price spikes or downturns in the near future.

Conclusion

Grid trading is a popular strategy used to profit from range-bound markets. It involves placing several limit buy and sell orders within a range. Due to the simplicity of its logic, it can easily be incorporated into a bot, allowing you to profit from numerous trades in a day. However, you should beware of transaction charges, and you should choose an asset that fluctuates around 2-3% daily.