Scalping is an approach to trading whereby traders seek to profit from daily price fluctuations that are as small as a few cents. Over time, little profits from each trade might build up to a significant amount.

The volatile nature of the crypto market makes this strategy quite popular. In order to open more trades, you may need to employ leverage. Tight stop losses are necessary to reduce your risk exposure.

How it works in the crypto market

The use of technical analysis is more common among scalpers as compared to day traders, who put equal importance on fundamental analysis. As a result, indicators are invaluable to scalpers, and you must learn how to read them correctly and fast to succeed with this strategy.

Scalpers trade as frequently as they can in short periods of time. The goal is to build a sizable profit by combining several little ones.

Crypto scalping strategies

Choose the right time frame

In order to increase the number of setups, you can spot and use an appropriate time frame. Most successful scalpers use a time frame of 5 to 20 minutes. As the time frame shrinks, the number of potential trade setups increases. It’s important to keep in mind that this will all depend on the approach you use.

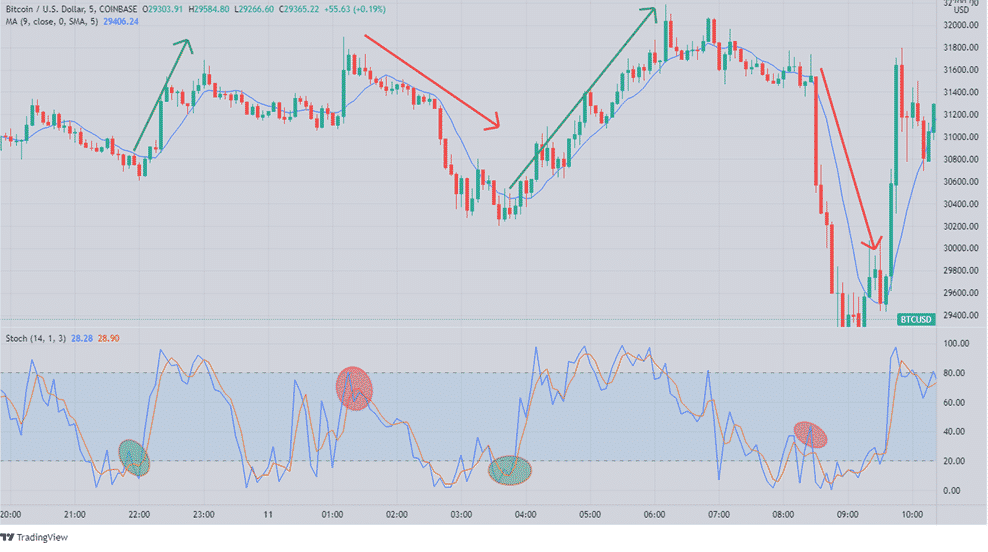

Using the BTCUSD currency pair, here is an example. We’ve utilized the Moving Average indicator to identify a trend. Also, we’ve employed the stochastic oscillator to tell us whether or not the trend is continuing.

With four trades, all done within 12 hours, and each taking under two hours, a trader can make a decent profit, as seen in this example.

When it comes to cryptocurrency, it is possible to make a considerable amount of money from a number of trades throughout the course of a single day.

But even while this can return quite a significant profit margin, it comes with some drawbacks, the most significant of which is a high commission to pay per trade. Crypto trading is infamous for its high trading costs, which can dramatically limit overall profits.

Also, you need the mental fortitude to deal with the fast-paced and high-stress nature of their work. As a result, they must adhere to their strategy and take their emotions out of the equation in order to succeed.

Using range trading

Scalpers that use range trading wait for prices to move inside a certain range before entering a trade. In addition, some traders employ a stop-limit order in which the trade is made when the asset reaches the minimum or at the exact price indicated in the order.

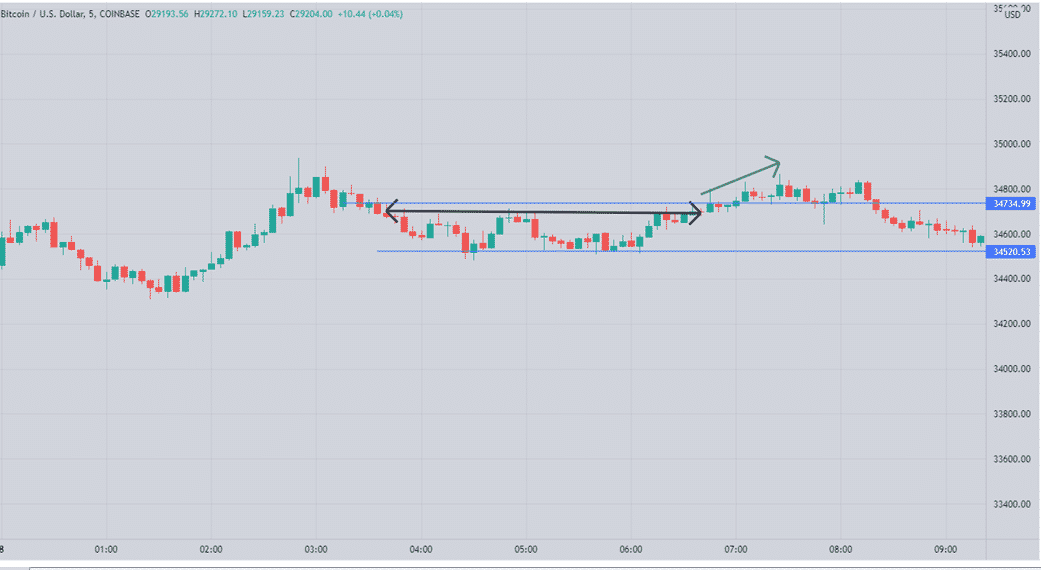

As long as the range remains intact, the bottom and top of the range will act as support and resistance, respectively. In order to enter a position manually, a trader will look to purchase at the support and sell at resistance. The likelihood of a level break increases in direct proportion to the frequency with which a price touches either level. On the chart below, BTCUSD is stuck in a range between $3,4520 and $34,734.

A breakout in the image above, shown by the green arrow, marks the end of scalping based on this range.

Leveraging bid-ask spread

The gap between the asking and the bid price is known as the spread. In order to make money, traders can enter at either price and quickly close at a lower or higher price.

An unusually big distance between ask and bid price is common when this occurs. The most likely explanation for this situation is that the buyers and sellers are few or indecisive. If bids start building up, the market may rise. If asks try to close the spread, the decline is likely.

Price action

This is a more established approach to trading, one that does not make use of any technical indicators. As long as you know where to look for resistance and support levels, you can benefit if your forecast is true. For a signal generation, many chartists rely on price action and trade volumes.

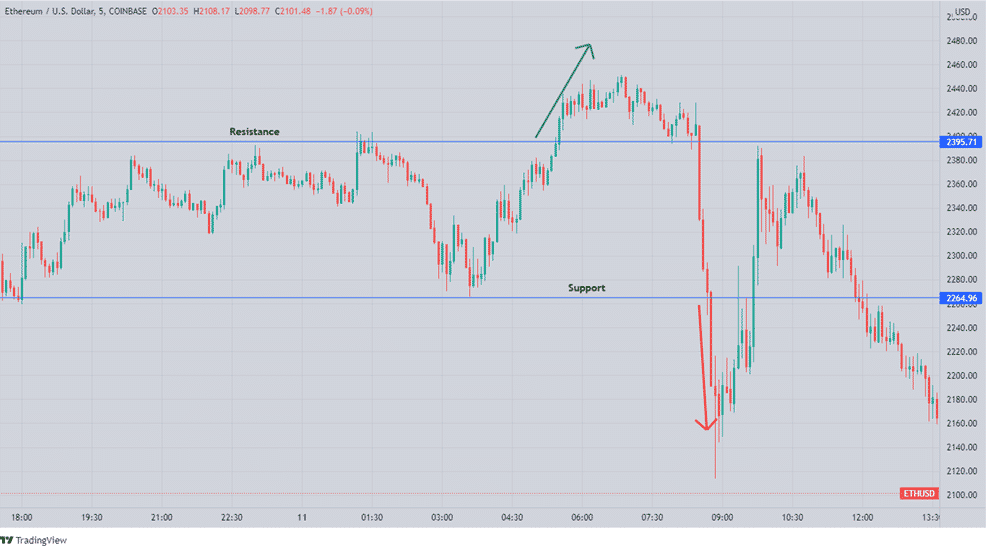

As an example, look at the ETHUSD chart below. The levels $2,395 and $2,264 serve as resistance and support, respectively. Trading volumes rose sharply after the breakout and confirmed that bulls were on the scene.

Smart traders would hold off on buying until the bull bar had closed above the barrier, which it did. It is preferable that you place the stop loss near the lows of the preceding bar.

Using robots

There are a variety of programming languages that you can use to create bots, depending on the platform. Binance, Bitfinex, and Kraken are some of the most popular exchanges for trading with bots. Through well-written instructions, bots undertake automatic trading based on established criteria. When a trader continues using a reputable bot, the chances of success increase, and the likelihood of making mistakes decreases. In trading, two well-known scalping-friendly bots are 3Commas and Haasbot.

In summary

Scalping is a low-risk, high-reward approach if you have the correct tools and information. If you don’t have the proper training, it might be much more demanding than day trading. Therefore, newbie traders should first experiment with alternative strategies like swing trading or medium-term investing before attempting this form of trading. It’s also possible to go in headfirst and enjoy the fast-paced nature of crypto trading manually or with the help of automated bots.