The cryptocurrency market is booming in the post-pandemic era, where traders rush to participate in the bull run. New strategies are surfacing to beat the digital instruments for a potential earning. In the current race, algorithms are one of the vital elements in the financial sector that are aimed at automating your trading.

Several crypto trading bots are available via online platforms to connect with your exchange via API keys. Traders can access them for a specific fee and configure their internal strategy without any coding experience.

What is a grid trading bot?

Grid trading algorithms are based on the fact that the market will revert to its mean point. To understand better, let us consider an example of a trader who sells Bitcoin at $50000. The current bullish trend pushes the market upward up to $55000. According to the grid strategy, our investor sells the same lot size whenever the price increases by $1000. When the asset returns to its initial value, the positions are closed, and the profits are withdrawn.

Image 1. The hourly chart of Bitcoin shows how the grid trading bot works. Subsequent short trades are placed as the market trends upwards. After it turns to the original sell point, all the executions are closed with an overall profit.

Such expert advisors are available within exchanges or third-party websites. Traders can connect them to their accounts via API keys.

The installation process can differ according to the platform. For example, the MT 4 and 5 software would require you to place the file in the experts’ folder and drag it onto the charts to start trading.

What should you know about grid trading?

Grid bot crypto can generate a valuable chunk of passive income when the assets range between particular support and resistance levels. It can be based on any technical indicator. The distance between two sell/buy trades can depend on the volatility of the digital instrument and the risk appetite of a trader. Generally, shorter pip steps will allow you to earn faster but can increase the overall drawdown rapidly. Currently, almost all major centralized and decentralized exchanges support the use of averaging algorithms.

Why should you use grid trading bots?

In a market like crypto, which is full of ranging pairs, it is quite easy to generate profits while keeping a check on the drawdown. By splitting your overall trade size into smaller portions, you avoid risking all of your account balance on one single trade.

The use of averaging is justified by many as there are little to no strategies that can provide a good winning rate couple with a good risk-reward ratio. High frequency or self-learning systems require professional monitoring and are only accessible by big institutions or hedge funds. With such an environment, retail traders have to resort to averaging, which can match the performance of the best systems in crypto-bot trading.

How much can you earn with a crypto grid trading bot?

Your potential earnings can depend on the strategy and the position value. Risking a high percentage of your account will provide a better return at the expense of a large drawdown. As mentioned earlier, the value of the pip step can also affect the profits and risk value.

Given the correct implementation of strategy and pairs, generating a stable return of 1-3% on your portfolio via a crypto trading bot is quite easy. Before going live, it is recommended to run your expert advisor on a virtual portfolio.

How does a grid bot work in different markets?

There are two types of movements in markets that govern the performance of the grid bot:

- Volatile. The instruments are trending significantly in one direction without any pullbacks. Here, the grid bot will continue to open positions on the initial buy/sell side, leading to a high drawdown.

- Ranging. This condition is perfect for any grid bot to function. When the market is trapped between two points, the crypto trading bot will open buys on the downtrend and sells on an uptrend. The recovery in the value of the asset would then lead to profits.

What are the risks of using a grid bot?

While the profitability and winning rate are high, there is a chance of a high drawdown when the asset moves significantly in one direction. This can wipe out months or years of profits in a short time. If supported, it is possible to set the max percentage value you can afford to lose in the grid bot. While the loss may be painful, it can save your portfolio from a potential margin call.

How to start trading with a crypto grid bot?

Traders can start using the grid bot in the following steps:

- Sign up on one of the exchanges and obtain the API key

- Register on a grid trading bot of your choice or use one that is available within the exchange

- Customize the bot’s strategy. Adjust the available parameters and backtest it if possible.

- Connect your bot with the exchange by entering the API key

Are crypto grid trading bots legal?

Crypto trading bots are legal to use on all exchanges where supported. Traders should note if the crypto broker has jurisdiction to offer its services to the residents of their country.

Grid trading bots: quick summary

Crypto trading bots are a great way to set up a passive income with proper strategy and drawdown control. Traders with zero market experience can select ready-made EAs and run them on their portfolios. The whole process is simple, with little interference required from the investor.

Professional traders and developers can use their programming skills alongside market experience to produce complex neural systems. They can be sold to the general public or kept for self-usage. Novice investors should check out the performance statistics of the grid bot before running them on the live portfolios. The records should cover an extensive period of both volatile and ranging markets.

Python is one of the common languages used to develop grid bots on exchanges. Other than this some forex brokers also support crypto trading on MT 4/5 platforms where MQL 4/5 are the primary coding languages.

Best crypto grid bots in 2022

Crypto bot trading is available across a wide variety of exchanges. Each comes with its own set of unique features. The best trading bots are developed by the general community of traders using the available set of tools at the brokerage.

| Name of the bot | Prominent features | Price | Fee |

| Bitsgap | Backtesting is available to check the performance of the algorithms. | $29/$69/$149/month | No. |

| KuCoin | EAs are at hand with recommended or manual settings, copying experts’ configurations. | Free | 0.10% |

| Pionex | No skills are required from traders. The setup is beginner-friendly. | Free | 0.05% |

| Quadency | A variety of prebuilt strategies are available. | Free | Network fee. |

| 3Commas Grid Bot | Traders can manage all exchange accounts from a single platforms. | Free/$14.5/$24.5/$49.5 | No. |

| Gate.io | It supports around 50 fiat currencies. | Free | 0.2% |

| Binance | The platform supports over 600+ cryptocurrencies. | Free | 0.10% |

Bitsgap

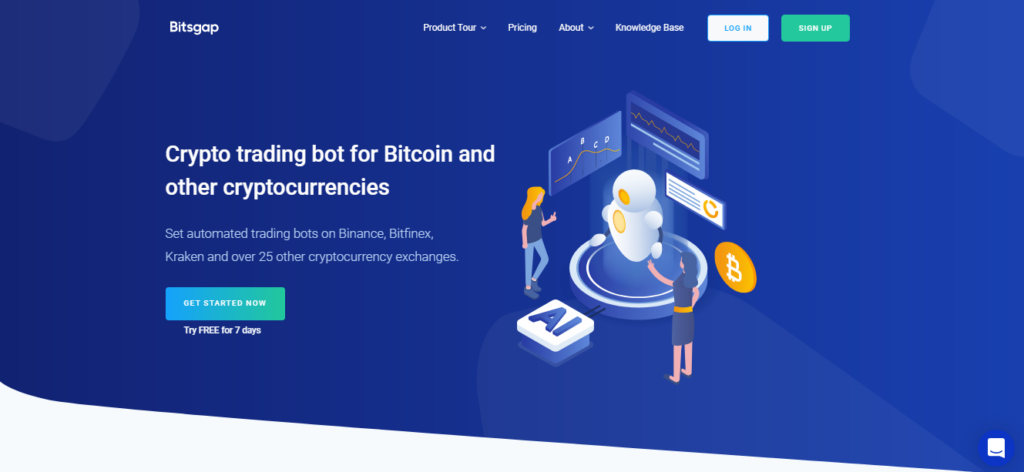

Bitsgap is a trading platform that offers portfolio tracking and automated bots. Investors can use all the cryptocurrency exchanges from one interface, including Binance, Coinbase, Kraken, Bitfinex, etc. It can be purchased in 3 subscription plans: $29/month, $69, and $149 monthly with no hidden fees.

About Bitsgap

Bitsgap is an Estonia-based company with a full-stacking marketing team and ten full-time developers. Maxim Kalmykov is the Chief executive offer, and other members include Dmitri Laush as Chief strategist, Sergei Verbitsky as COO, Jevgeni Avdeev as CTO, and Anatoli Girenko as CFO. It claims to be supported by Cointraffic and Admiral markets.

The key features

The key aspects of Bitsgap are as follows:

- The demo trading allows the trader to practice without the risk of losing funds.

- The portfolio shows the real-time performance of digital assets.

- It offers automated trading bots that trade 24/7.

- The safety and security of the platform are up to the mark.

Pros & cons

Evaluating the system, we can write the pros and cons as the following:

Pros

- Bitsgap has 100+ popular indicators.

- Traders can test strategies and check bots’ performance from the dashboard.

- A wide range of cryptocurrencies is available to trade.

Cons

- It is integrated with a few crypto exchanges.

- They do not offer refunds.

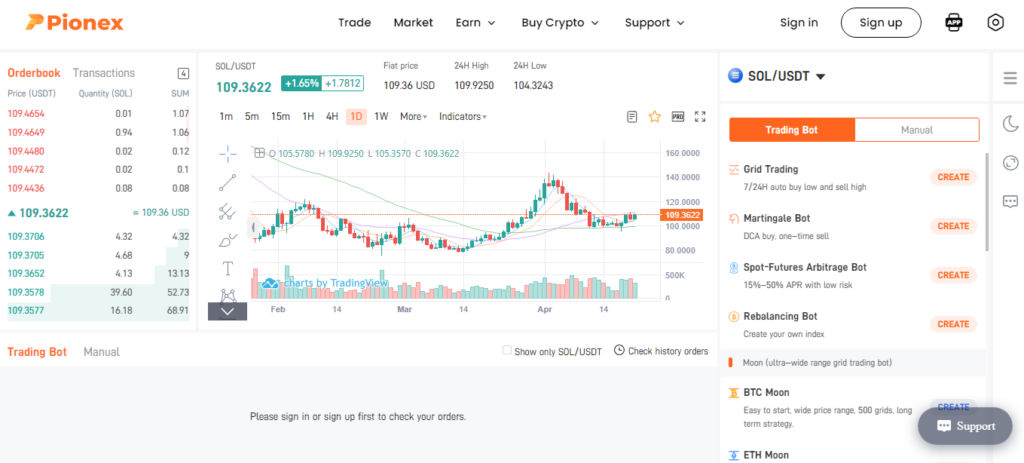

Pionex

Pionex is a cryptocurrency exchange that offers 346 tokens with 0.05% market/taker fees. The platform claims to have performed 100million+ trades with $5B+ monthly trading volume. Users can access 16 built-in bots, including, Grid trading bot, DCA, rebalancing, etc. It is completely free to use and can be downloaded on the trader’s mobile phone.

About Pionex

Pionex has been in business for almost three years with traders from 100 countries. They aggregate liquidity from Binance and Huobi. The company headquarters are located in Singapore with a team of developers including Jiawei Ai (Head of compliance operations), Robert Morris (Global chief of compliance), and Larry Toh, the chief compliance officer at Pionex.

The key features

The highlights of Pionex are as follows:

- It is free to download from the app or play store.

- The platform offers several crypto trading bots that scan the market 24/7.

- The algorithms are cloud-based. There is no need to run a computer for it to work.

- It has a relatively low trading fee when compared to other exchanges.

Pros & cons

The benefits and drawbacks are given in the table below:

Pros

- Easily configurable bots.

- It offers a variety of crypto trading algorithms and several strategies.

- Beginner-friendly platform.

Cons

- Possible loss of funds in an unstable market.

- The withdrawals are time-consuming.

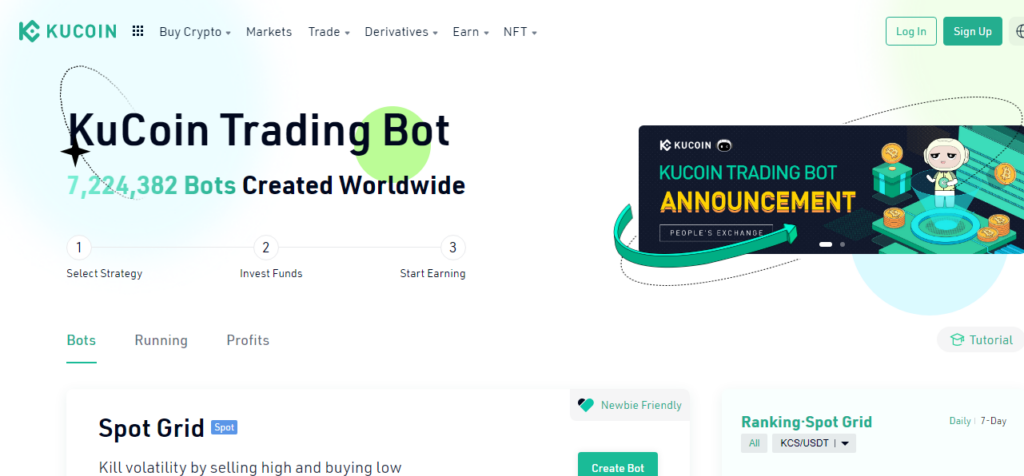

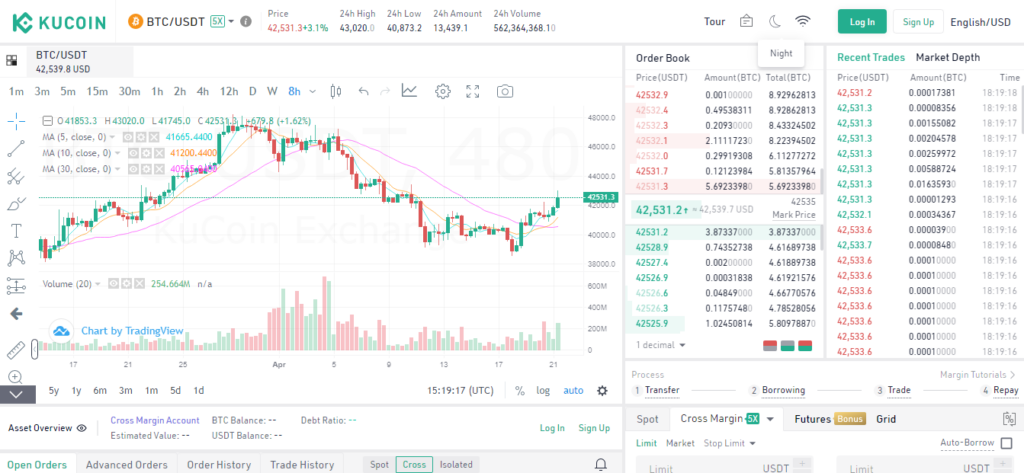

KuCoin

Kucoin claims to be the best crypto exchange offering 600+ tokens on the platform. The service is completely free to use, where traders are only charged a trading fee of 0.10%. Investors can trade with five available bots: Spot grid, Futures, smart rebalance, DCA, and infinity grid. The mobile application can be installed from the app store or Google play, making it easy for investors to monitor their activity.

About KuCoin

Kucoin was founded by Michael and Eric (developers), who wrote the first code for the platform in 2013. The exchange claims to have 10M+ users from around 205 countries with billions in trading volume. They have their governance token called KuCoin token (KCS).

The key features

The most notable characteristics of KuCoin are as follows:

- Users can trade for as low as $1.

- The exchange supports over 50 fiat currencies through the P2P market and credit/debit card channel.

- It offers preset trading strategies with free built-in bots.

- KuCoin has a mobile app for iOS and Android.

Pros & cons

The pros and cons of trading with KuCoin include:

Pros

- Traders can access a vast library of altcoins.

- They provide support in over 19 languages.

- A mobile application is available.

Cons

- The customer reviews on TrustPilot are poor.

- Users experienced problems with withdrawal/deposits.

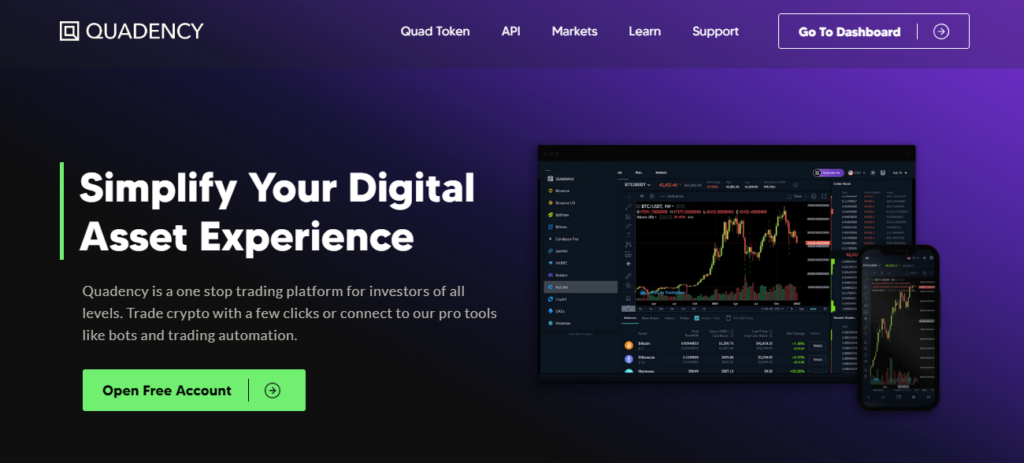

Quadency

Quadencyy is suitable for both beginners and experts as they offer prebuilt configurable strategies. It is free software that comes with a mobile application available on Google Play and the App Store.

About Quadency

Quadency was launched in 2018, with Rosh Singh as the CEO. It is a trading terminal that securely connects to all major cryptocurrency exchanges, allowing users to trade from a single unified interface. API keys are used for connection purposes.

The key features

The most significant characteristics of Quadency include:

- It offers over 1500 cryptocurrency assets.

- The bots perform 200 backtests per day to get the best-optimized set files.

- They include premium bot power where traders can choose preset strategies.

- The platform offers charts with extensive data for market analysis.

Pros & cons

The advantages and disadvantages of trading with Quadency are as follows:

Pros

- Traders can access a variety of trading pairs.

- An all-in-one platform to trade on several exchanges like Binance, Kucoin, OKEx, etc.

- It has a user-friendly interface.

Cons

- The exchange is still in the launch phase.

- It only supports spot trading.

3Commas Grid Bot

3commas is an automated trading terminal that offers cryptocurrency bots that operate on several crypto exchanges and provide many strategies for different market conditions. Investors can configure the system based on the specified triggers.

About 3Commas Grid Bot

3commas was founded in 2017, with its company headquarters located in Estonia and a representative office in Canada. It can be purchased for free with one grid bot and other monthly subscription plans: $14.5/$24.5/$49.5.

The key features

The highlights of the 3commas grid bot are listed below:

- The bots automatically analyze the 7-day price volatility of tokens.

- Traders can choose to go with AI settings or use a manual approach.

- 24/7 trading with single and multi-pair algorithms.

- Ready-made presets are available to choose from.

Pros & cons

The strengths and weaknesses of trading with the 3commas grid bot are listed below.

Pros

- The platform has excellent customer reviews on a trusted third-party platform like TrustPilot.

- A mobile application is available.

- Trading signals are present for copy trading.

Cons

- It is compatible with a few cryptocurrency exchanges.

- Constant monitoring is necessary during periods of high market volatility.

Gate.io

Gate.io is a free cryptocurrency exchange where traders can buy/sell over 1300 tokens. It supports spot trading, Margin, Futures, ETF, and loans. The platform secures investor funds with centralized and decentralized methods providing extra protection for the assets. A maker/taker fee of 0.2% is charged on transactions. The service is available to download on the Apple store, Google Play, Android, macOS, and Windows.

About Gate.io

Gate.io was founded in 2013, and it has been in business for eight years. It has over 80M+ users worldwide with a $12B daily trading volume and provides services in more than 224 countries. Tower research capital is the official partner that provides liquidity to the exchange.

The key features

The critical characteristics of Gate.io include:

- The platform uses real-time asset sending/receiving technology for fast deposits and withdrawals.

- Trades can exchange cryptos with leverage and ETFs.

- The exchange provides earning opportunities with HODL and lending features.

- It provides several trading strategies and also allows users to copy the setting of expert traders.

Pros & cons

The table below shows the benefits and flaws of Gate.io.

Pros

- Gate.io supports over 1300 tokens.

- The assets can be restored in case of a damaged server.

- Comprehensive security measures

Cons

- The platform has poor customer reviews on notable forums like TrustPilot.

- It has a complex user interface, and it is not beginner-friendly.

Binance

Binance is one of the most famous crypto exchanges available globally in supported countries. The platform offers a variety of automated bots and strategies like spot, futures, swap farming, etc. It supports a mobile and web version that allows traders to create portfolios, manage executions and analyze digital instruments. Binance provides an extra layer of security for the safety of funds with data encryption.

About Binance

Binance was launched in 2017, with the company headquarters located in the Cayman Islands, Mahé, Seychelles. The management team includes Changpeng Zhao (CEO) and Richard Teng (Chief Executive Officer, Singapore).

The key features

The most notable features of Binance are listed below:

- The platform is free without any subscription plans.

- They have their governance token called BNB that powers its ecosystem.

- Binance can be used on Android, IOS, macOS, and Windows.

- Traders can pay with several payment options such as Bank deposit, P2P, credit/debit card, cash, and third party balance.

Pros & cons

After evaluating the system’s working and features, we found the following strengths and flaws.

Pros

- They have an easy-to-use mobile application.

- The platform supports several fiat currencies.

- P2P trading to easily add or remove your cryptocurrency from the platform.

Cons

- There can be issues in account verification.

- It is not available in all US states.

What are the upsides and downsides of using grid bots?

The working methodology of a grid trading bot is the same as that of the Dollar Cost Averaging system. It will place a market or pending orders as the price moves away from the initial entry. A fully automated grid EA with perfect coding should support the custom configuration of the strategy.

Upsides

Grid trading bots have the following advantages for traders:

- Passive income. Grid bots are a good source of passive income for traders. They can generate slow and steady returns while maintaining the drawdown with proper risk management.

- Automation. There is no need for manual interventions as the trading bot handles all the executions. The expert advisor can perform thousands of calculations within a split second which is impossible for a manual trader.

- Emotions. Trading algorithms have no emotions such as fear, greed, etc. They trade solely based on their coding. As psychology plays an essential role in trading success, eliminating a bad mindset gives grid trading bots a definite edge over markets.

- Market experience. Traders with little or no trading expertise can use grid bots. A detailed user manual and backtesting/live records are available for setting up the systems.

Downsides

While the demerits are as follows:

- Swaps. To recover from losing trades, a grid trading bot may hold positions over an extensive duration which can last for weeks or months. This may incur rollover fees that may eat up profits.

- Application. A classic grid trading bot is suitable mainly when the market is ranging. As soon as it trends in one direction with the momentum, the account can suffer a high drawdown.

- Fundamental analysis. It may not be possible for a grid bot to analyze important market news incoming from central banks or social media platforms such as Twitter. Manual intervention may be necessary in such cases.

Best crypto grid bots summary

Are crypto trading bots profitable?. The answer to this question is a bit tricky. The market is filled with tons of grid trading bots. Before going with any online grid averaging platform, it is vital to understand how the crypto industry operates. See if the algorithm is compatible with your exchange to avoid any issues post-purchase. Live or backtesting records can help gauge the true performance of the EAs.