As with virtually all traded financial markets, we classify traders into four camps: scalpers, day traders, position traders, and, of course, swing traders. The latter approach is generally the happy medium between day trading and position trading.

As a crypto swing trader, you don’t expect to be frequently trading as a typical trader; but at the same time, one also doesn’t execute as seldom as a position trader. Thus, many experts have recommended this methodology as one of the best ways of speculating on cryptocurrencies.

Thus, this article will explore more swing trading and the most popular strategies around it.

What is swing trading?

If you look at the chart of any coin, you’ll immediately notice it moving between different swing highs and swing lows. A swing trader is simply someone looking to capture these wave-like motions over several days, weeks, or longer.

One defining characteristic of swing trading is the study of higher time frames, more specifically from the 4HR and above. You generally only find opportunities to hold your positions for weeks or longer by analyzing these charts.

The second attribute is the reduced execution frequency. It’s pretty standard for the average swing trader only to take a few positions weekly or monthly. Therefore, employing a ‘quality over quantity’ mindset becomes natural and essential.

Swing trading also thrives on strong-trending markets. Yet, you can also take advantage of reversals and range-bound conditions through this method with the right experience and analytical skills.

Regardless of the situation, swing trading is quite versatile because you are only hoping for a ‘big move’ which you can ride for several days or more. Lastly, a crypto swing trader may combine technical and fundamental analysis or either of the two exclusively in their decision-making.

Popular crypto swing trading strategies

Although there are practically a gazillion swing trading strategies, we can simply classify them into a trend, reversal/counter-trend, and breakout trading.

Regardless of how many indicators, patterns, and drawing tools you employ, one is either entering into an existing trend, trading a reversal, or trading a breakout. Knowing this information offers one a blueprint of their intentions in the markets.

Trend trading strategies

Most literature suggests strategies thrive the most in existing trends. The idea is looking for a correction or retracement to a particular area of value. This is usually defined by a mean-reverting tool, most commonly a Moving Average (MA).

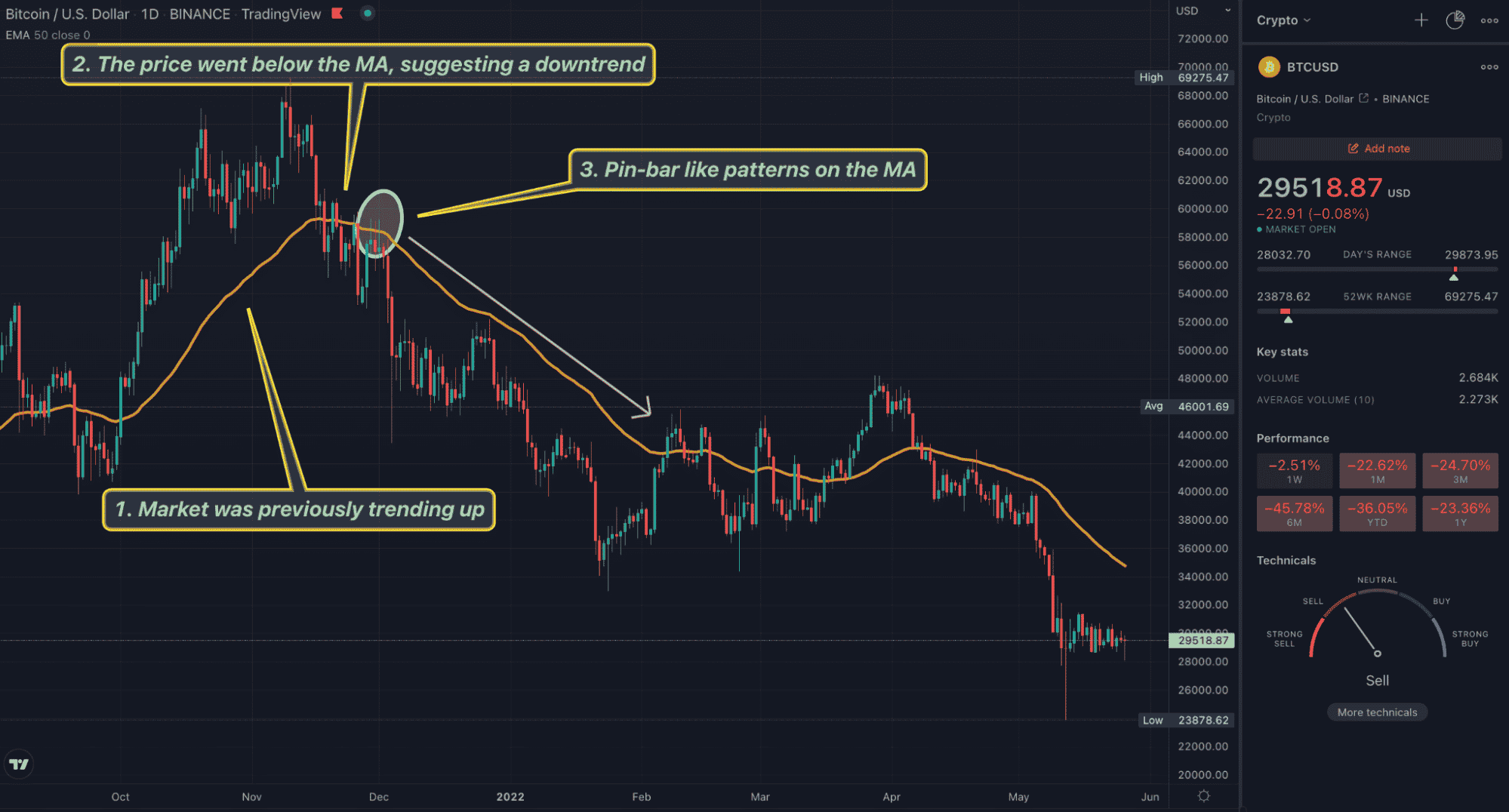

Crypto swing traders should use a minimum of 50 days as their period setting (but depending on the time frame and individual preferences, some may use 100 or 200). A simple popular strategy is combining price action with the 50-period Moving Average.

Firstly, you’d identify a correction where the market ‘pulls back’ towards the MA. Secondly, one would look at whether the price is below the Moving Average (downtrend) or above it (uptrend).

Then, the swing trader observes any striking price action patterns, typically some ‘rejection’ candle setups like the pin-bar or similar formations with small bodies and long wicks. These should form on the Moving Average to signify strong support or resistance level.

The chart above of BTC on the daily time frame is an example of this strategy in action.

Reversal trading strategies

As you might have guessed, trading reversals are going against the predominant trend. These strategies tend to be the riskiest since countering the present momentum is difficult for the average retail trader whose orders are just a drop in the ocean.

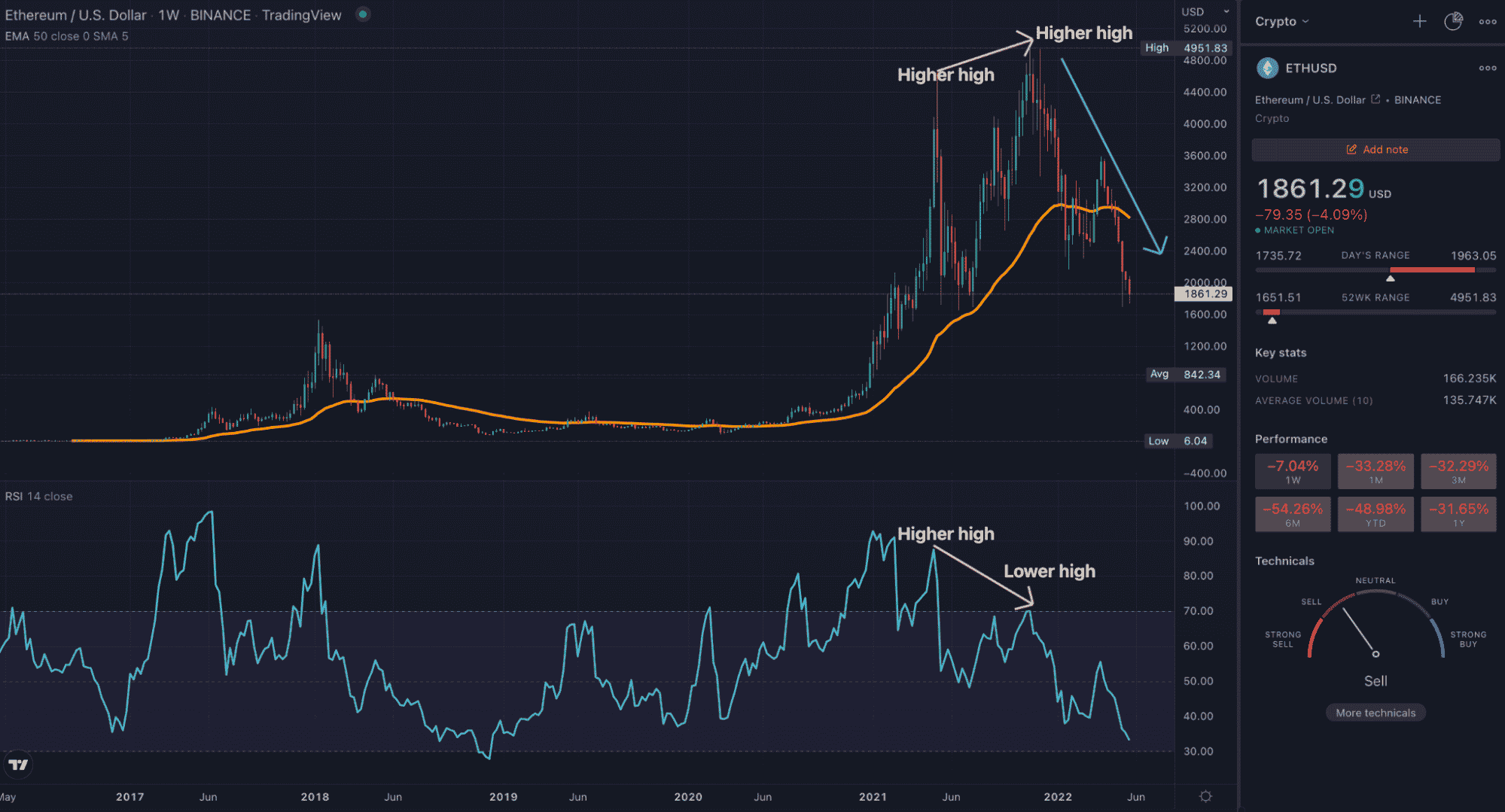

However, in certain situations, reversals can be quite profitable. Yet, this way of trading needs an experienced and skilled chartist. Most reversal analysts will use a momentum indicator, most notably the Relative Strength Index (RSI).

Reversal traders look for periods of ‘fading’ momentum or where the momentum is at its lowest, which is where the RSI can be useful. A staple of this tool is divergence. This shows a potential for reversal through a mismatch between the highs and lows on the indicator against those on the actual price.

The chart shows a classic example of bearish divergence on Ethereum’s weekly chart.

Breakout trading strategies

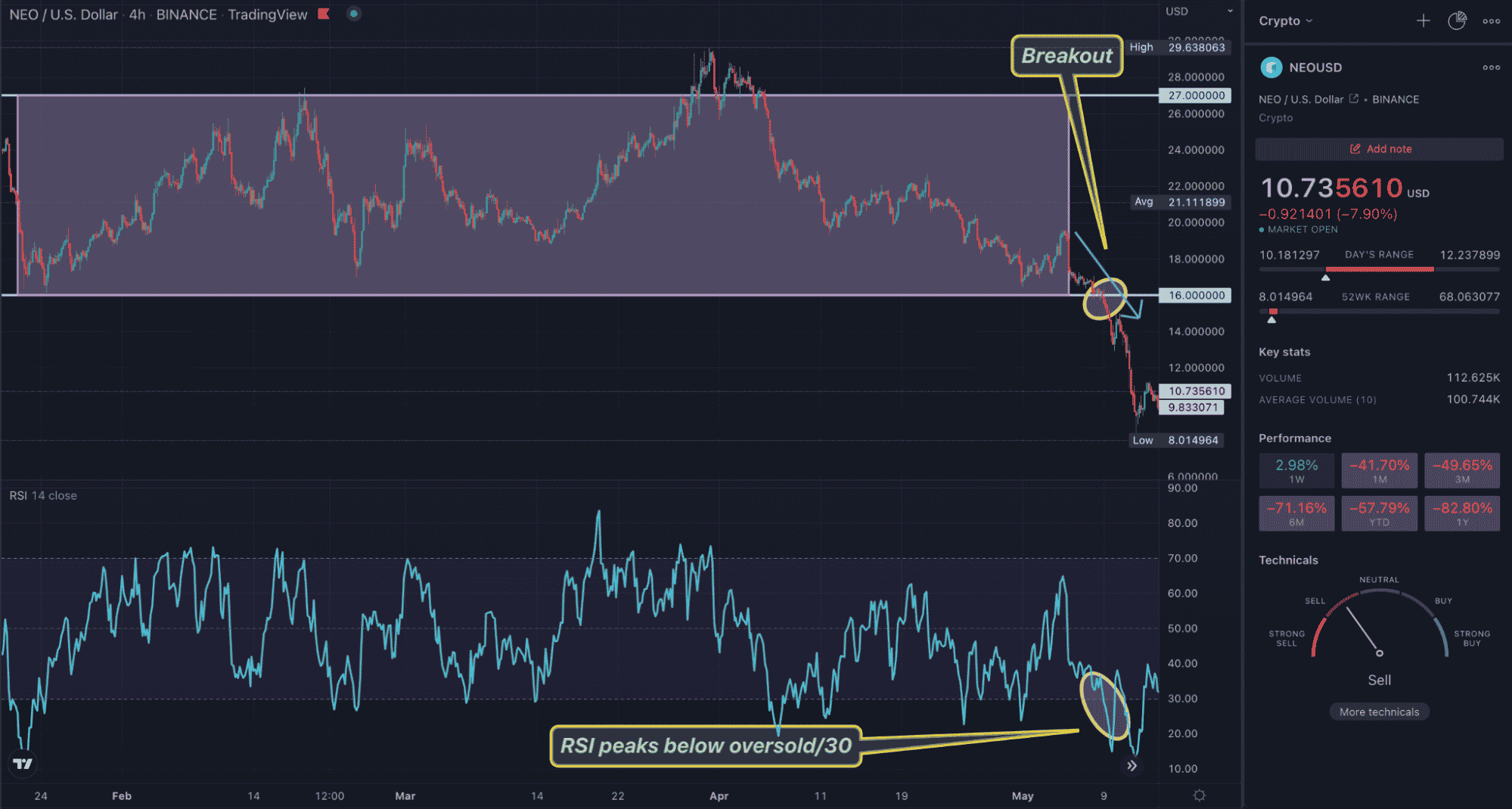

Breakout strategies look to exploit consolidation periods. In the example below, we’ll observe a simple range formation between support and resistance levels using the RSI on NEO’s 4HR chart.

You generally don’t hold for as long (compared to trend and reversal trading) with breakouts since the movements are less sustained. Nonetheless, the key to using the RSI is entering in high momentum through oversold or overbought conditions.

When the market is oversold, it’ll typically move aggressively downwards during a breakout (and vice versa for overbought). The chart above shows a range between $16 and $27 before an eventual drop in the latter price level, accompanied by the RSI dipping below 30 (oversold).

Curtain thoughts: pros and cons of crypto swing trading

Becoming a swing trader is certainly not easy because it requires you to adopt a long-term approach, which many people cannot do. Yet, when done correctly, it can be incredibly rewarding.

In summation, let’s cover the main advantages and disadvantages of swing trading in cryptocurrencies.

Pros

- Higher risk to reward: The profit potential in swing trading is higher because you hold your positions for longer, resulting in more significant price movements.

- Lower time commitment and stress: With swing trading, you can hold a full-time job or engage in other business or leisure activities and still have the chance to make money.

- Lower trading fees: Since swing traders execute fewer orders weekly, they pay less in spreads than more active speculators.

- Reduced exposure: With swing trading, you don’t expose yourself to many unfavorable conditions like volatile and illiquid markets.

Cons

- Requires massive patience: The number of opportunities with swing trading is severely limited, meaning long waiting periods between positions.

- Exposure to unwanted negative swaps/rollover: The longer you hold a trade, the more in rollover you pay. This might dent your account, depending on what is charged and the holding period.

- Best for experienced chartists: The entire philosophy of patience is something that only comes with years of experience and practice, making it less suitable for newer traders.