Overview

The late South African bishop and theologian Desmond Tutu once said, ‘there is only one way to eat an elephant: a bite a time’; this is what dollar cost averaging (DCA) essentially is. Instead of buying a financial asset in one lump sum, you buy it in bits over time.

The concept of DCA is attributed to Benjamin Graham’s seminal 1949 book on value investing titled The Intelligent Investor. In this material, dollar cost averaging was spoken about in the context of stocks.

Over the years, it has been recommended and used in other numerous investments like retirement plans, mutual funds, and, of course, cryptocurrencies. This article will cover how it works in the latter, the benefits and drawbacks, and some guidelines on implementing it.

What is dollar cost averaging?

Dollar cost averaging (sometimes referred to as the constant dollar plan) is a strategy whereby you divide the total amount of an investment across periodic purchases regardless of the asset’s price.

For instance, you may decide to allocate $200 every month to buy a coin instead of committing a whole amount at one time. There are several purposes to DCA, but one of the main ones is reducing volatility risks (especially if the asset in question is somewhat overvalued).

Imagine you wanted to buy Bitcoin, but the price was worth $65 000, near its all-time high of $68 789. Many experts would agree purchasing at such a point is risky as the price could decline at any moment, leaving you with a considerable loss.

If you only invested a portion of the value, your floating loss would be a lot less than if you committed the entire $65 000. DCA is also used by investors who are not worried about market timing or ‘timing the market’ as the present value of the asset in question doesn’t matter in this strategy.

Lastly, DCA usually (not always) lowers the overall investment cost as you’re spreading it out over time. The ‘cost averaging’ system potentially reduces the average cost of a financial asset. Let’s go over a simple illustration that encapsulates DCA.

Example

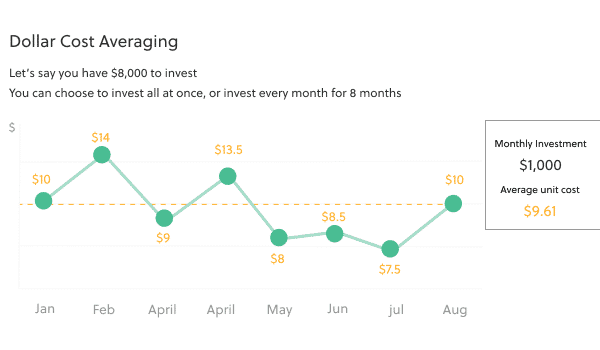

The chart above illustrates a scenario where an investor has $8 000 to invest. Rather than investing it at once, they decide to put down $1 000 monthly for 8 months, purchasing the asset at $10.

The line chart shows the price upswings and downswings and points where the investor keeps committing $1000. In the end, the average unit cost is $9.61, which is lower than the $10 from the beginning.

The benefits of dollar cost averaging in crypto trading

Aside from the lower unit cost on average, DCA is also cheaper purely from a budgetary perspective. If something costs you $1000 to acquire, but you don’t have the whole amount, paying it over time would be more economical and lighter on your pocket.

This is practical for those with smaller amounts to invest at a time. Using dollar cost averaging means you can free up your remaining capital for other things in the meanwhile.

With the DCA system, you don’t need to worry about patiently waiting for opportunities to ‘buy the dip.’ In some cases, if you decide to wait on the most favorable time to buy a token, you may miss out on the move altogether.

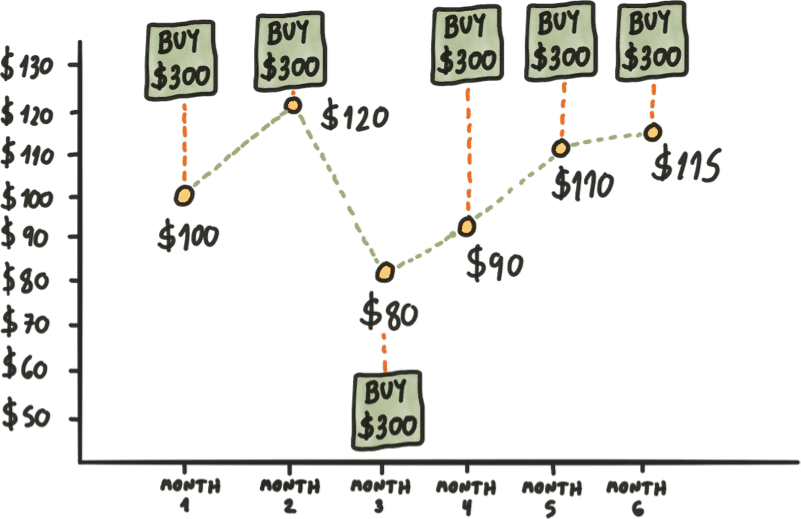

The main point of DCA is to enter into a position gradually by purchasing less of a coin while its value is relatively high and more units as its price decreases. While buying the dip is preferable, it requires strong analytical skills and emotional control. It goes back to the concept that time in the market beats timing the market.

The downsides of dollar cost averaging in crypto trading

Various studies continue to be performed on the adverse effects of dollar cost averaging and how lump-sum investing is sometimes the better approach. For instance, in 2020, PWL Capital concluded in several countries that the latter beat DCA 65% of the time over a decade.

Some investors use dollar cost averaging as a crutch even if a particular coin may not necessarily be a good investment in the long run. In this manner, such a strategy sees one not doing enough research and investing for the sake of it.

The second disadvantage is that using DCA leaves a large portion of your funds sitting idle. Your money would lose purchasing power over time (due to inflation) and would not grow as much if you had invested it all.

It also takes discipline to consistently commit a set amount each time (not to mention it’s time-consuming).

Lastly, with DCA, you’re at the risk of losing money if a particular coin goes into sustained bearishness. This is where learning about the most optimal time makes more sense, as it can save you financially and ensure you buy as much of an asset as possible.

Therefore, rather than chasing a project which may be overvalued or due for a massive correction, you may be better off looking at undervalued coins which are cheap to buy and have untapped growth potential.

How to apply dollar cost averaging in crypto trading

Here are the simple few steps to apply the constant dollar plan in crypto trading:

- It goes without saying that you first need to decide on the most promising asset to invest in for the long term.

- Most experts advocate applying dollar cost averaging over at least six months, committing a predetermined affordable amount monthly (or weekly/fortnightly).

- The next step is choosing a platform or exchange that can automatically link to your bank account and debit it at scheduled contributions. Alternatively, you may perform this part manually using your own accounting system (e.g., spreadsheets).

The hardest part is keeping a calm head since you will be investing when a coin’s value is either increasing (not preferable) or in a sell-off (preferable). As expected, this strategy takes massive consistency and commitment while resisting the temptation to withdraw money.

Curtain thoughts

Ultimately, dollar cost averaging in crypto trading is a low-risk, low-reward activity. If you’re lucky, you could be investing in periods of massive sell-offs where you could buy your favorite coin at a ‘discount.’

DCA is less emotionally taxing, doesn’t require timing the market, and removes FOMO (fear of missing out). Moreover, this strategy encourages a long-term investing mindset which may be profitable in the long term.

However, this method is not without its drawbacks and may not be a suitable approach for every investor.