Computers and revolutionary technologies have enhanced the art of trading. Gone are the days when traders had to spend hours glued to the screen scavenging for opportunities. Automated trading systems have made monitoring the market simpler and executing and locking in profits.

The need to gain an edge and take advantage of all the opportunities that crop up regardless of time is forcing investors to turn to automated trading systems. Automated trading systems are finding great use in the crypto market, which can be extremely volatile.

Automated trading systems work by executing a predefined set of rules and instructions. The rules are programmed into an algorithm that trading bots follow. The rules define all the market conditions that must be met for a bot to execute a buy or a sell order and lock in profits and keep losses low.

Below are the top 5 automated trading strategies.

Momentum and trend-based strategy

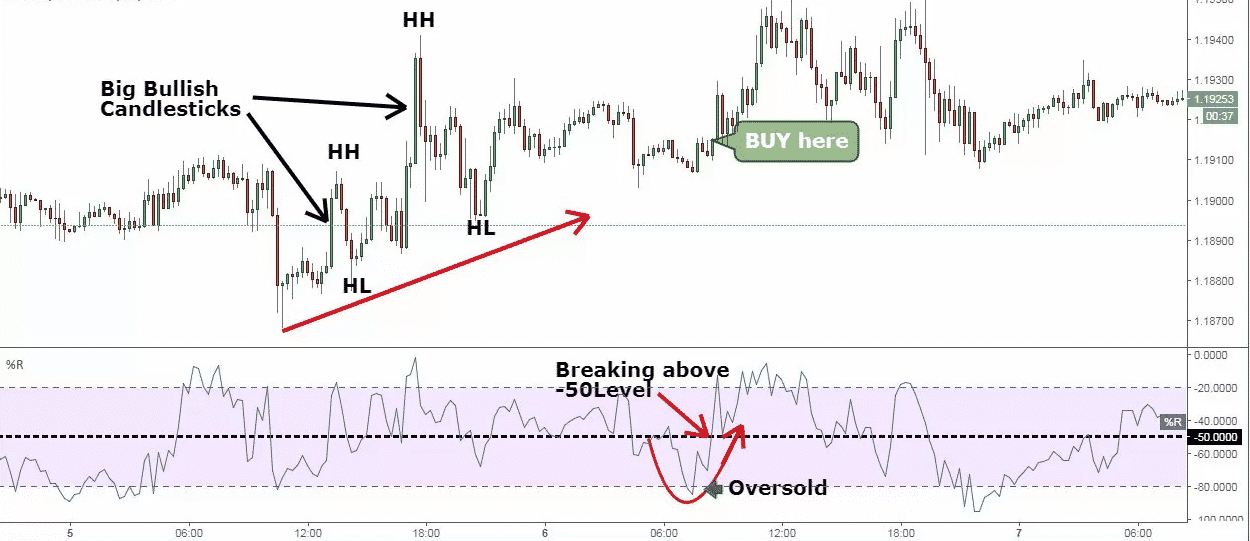

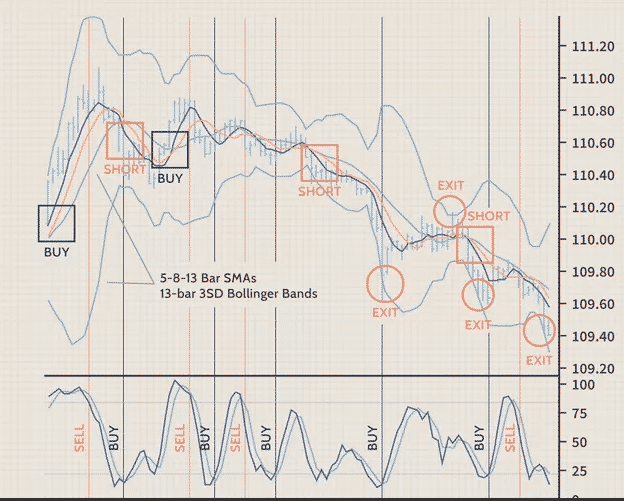

Arguably one of the easiest strategies to automate for use in trading various cryptocurrencies. It involves using Moving Averages to determine the direction the market is moving and ideal entry and exit levels. An oscillator such as the Relative Strength Index is used to ascertain the prevailing momentum.

Conversely, a program is written and programmed into a trading bot. In this case, two MAs, fast and slow-moving, are used to generate buy or sell signals. For instance, the bot would be set to take note of when the 50 Simple Moving Average crosses the 200 Simple Moving Average and moves up. If this happens and the price settles above the two 50 SMAs, it implies a buy signal.

The trading bot would then have to confirm the buy signal using the Relative Strength Index. If the Index reading is above 50, then it implies momentum is to the upside. The trading bot would then open a buy position as long as the price is above the fast-moving 50SMA.

Similarly, the trading bot would be programmed to execute a short position whenever the 50SMA crosses the 200SMA and starts moving lower. The sell signal would be confirmed on the RSI crossing the 50 lines and moving lower, implying bearish momentum. Conversely, the sell position would be opened as soon as the crossover happens and the price is below the 50SMA.

Arbitrage strategy

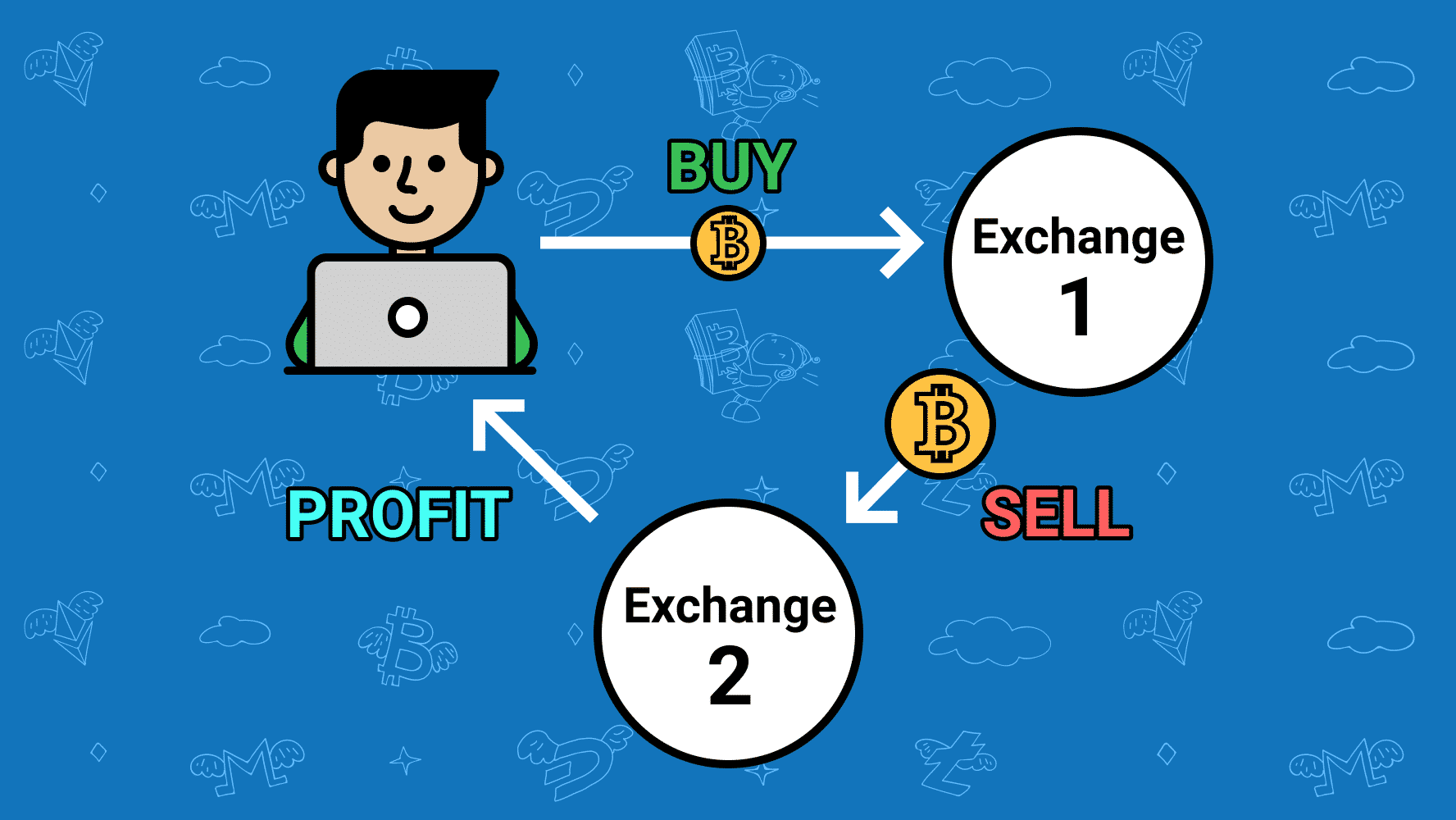

The Arbitrage strategy is also finding strong use amid the emergence of many markets where cryptocurrencies are bought and sold. The strategy seeks to take advantage of price inefficiencies due to different exchanges having different prices for the same coin.

In this case, a trading bot would be programmed to identify price differentials in the different marketplace of the same coin. For instance, if Bitcoin is priced at a much lower price in one exchange, the bot would open a buy position to try and profit from the price bouncing back until the underlying asset is fairly valued.

Instantaneously, if Bitcoin is priced at a much higher price in another market, the automated trading system would be prompted to open a short position to take advantage of the price tank expected to come into play until a fair value arrives.

Given how volatile cryptocurrencies can be, arbitrage will only work if one is using an exceptionally powerful, high speed and accurate automated trading system. The price inefficiencies that come into play in the market are often erased within minutes or even seconds. Therefore, the system must be quick in spotting them and taking advantage of them in the shortest time possible.

Mean reversion strategy

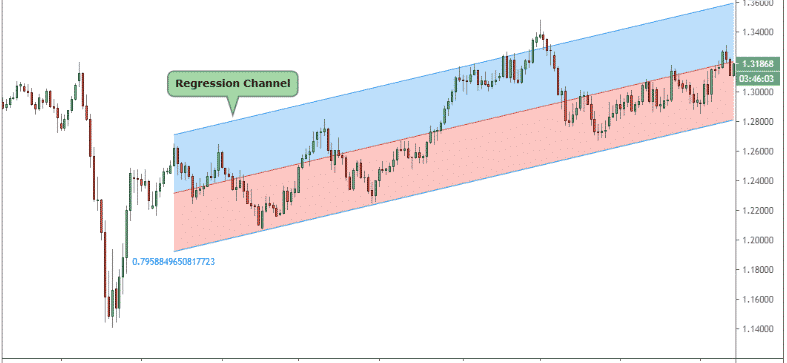

It is a strategy based on the idea that a cryptocurrency or a financial instrument would always return to its mean price level after a significant fluctuation. The strategy entails identifying the upper and lower price limit within a channel cryptocurrency has been trading.

Once the limits are ascertained, an automated system is programmed to identify any breakouts above the upper limit and below the lower limit. Once the limits are ascertained, the average price must also be calculated within limits.

The automated system would then be programmed to enter a buy position as soon as the price breaks out below the lower limit. The buy position would seek to take advantage of price bouncing back and coming back to the average price level after the failed breakout.

Similarly, the automated trading system would trigger a short or sell position as soon as the price breaks out of the upper limit. The sell order would look to lock in profits in anticipation of the cryptocurrency pulling back to the average price after the failed breakout to the upside.

The mean reversion strategy works best when prices are at the extreme levels as a pullback or bounce back to the average will always result in significant profits. However, a stop loss should always be used whenever a trade is triggered, as there is always the risk of the price continuing to move in the new direction after the breakout and failing to return to the average price.

Dollar-cost averaging

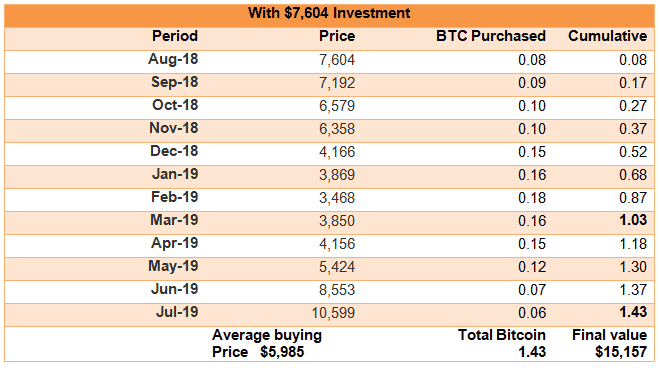

It is a widely used trading strategy that entails investing a fixed amount of money into a cryptocurrency. The strategy seeks to take advantage of the bounce-backs and pullbacks that come into play as the price oscillates from one level to another.

Instead of investing the entire amount at once in a cryptocurrency, one can look to invest the amount in bits to try and buy the crypto cheaply. If planning to invest $8,000, one can look to invest a fixed amount of money on each buy order.

Conversely, if the price was to pull back, you would be able to buy more of the cryptocurrency with the budget at hand. If the price was up, one would end up with less amount of the cryptocurrency.

Overall, one would buy more of the cryptocurrency, investing in bits rather than spending the entire $8,000 with one large order.

High-frequency scalping

Automated trading systems stand out in their ability to operate at a pace that a normal human being cannot. Their ability to get in and out of the market is an invaluable tool that can be of great benefit while trading volatile cryptocurrencies that experience wild price swings from time to time.

In the chart above, buy and sell orders are triggered as price oscillates from highs to lows and lows to highs.

During periods of wild price swings, an automated trading system would be programmed to execute the buy and sell orders, opening and closing them within seconds, locking in small profits. A system that can execute hundreds of thousands of trades within seconds can end up generating significant returns when the small profits are compounded.