Interest rates have an impact on all assets. Higher interest rates in the US have a positive impact on bond yields and the US dollar. Similarly, they hurt assets like stocks and cryptocurrencies. This article will look at what interest rates are, how inflation impacts them, and their impacts on cryptocurrencies.

How interest rates are set

The Federal Reserve is the body responsible for setting interest rates in the United States. Other popular central banks around the world are the Bank of England (BOE), People’s Bank of China (PBOC), and the European Central Bank (ECB).

These banks meet several times a year to deliberate on the state of the economy and the most appropriate response. They look at several data points to make this judgment. The two most important ones are inflation and unemployment. They are essential since central banks are primarily mandated to ensure that the unemployment rate remains low and that inflation remains stable.

Central banks also look at other data points when setting interest rates. These numbers are the performance of the retail sector, manufacturing, services, and other industries.

Therefore, in most cases, a central bank like the Federal Reserve will lower interest rates in a period of economic uncertainty. For example, it brought interest rates to zero during the 2008/9 Global Financial Crisis (GFC) and the coronavirus pandemic.

Lowering interest rates in such periods has several implications. First, it discourages saving since bank accounts generate no return in a period of low-interest rates. Second, it encourages people to spend and invest money.

Indeed, house and vehicle prices rose between 2020 and mid-2021 since low rates incentivize people to buy houses and other items. Finally, low-interest rates help lower the cost of consumer, business, and government spending.

On the other hand, central banks tend to start normalizing or hiking interest rates when the economy starts recovering. It does this for two main reasons. First, by hiking interest rates, the bank gives itself tools to use in case of a significant crash. Second, hiking helps to prevent the economy from overheating.

Inflation and interest rates

Inflation has an impact on how interest rates are set. For starters, inflation refers to a situation where critical items like furniture, food, and beverages change over time. For example, if a packet of milk goes for $20 today and $25 in the next year, it means that your $100 will buy fewer packets. Therefore, the central bank works to ensure that inflation does not rise or drop too much.

Central Banks have several tools to use to check the state of inflation in a country. The most common tools are:

- Consumer Price Index (CPI). CPI is an essential tool that looks at the overall change of prices of items in an economy. Core CPI excludes volatile products like food and energy. The CPI figure is released every month.

- Producer Price Index (PPI). This figure shows the change in the price of goods sold by domestic producers. At times, the central bank looks at the spread between the PPI and CPI.

- Personal Consumer Expenditure (PCE). This number looks at the change of expenditures for products used at home in a certain period. It is well-known as the Fed’s most helpful measure of inflation.

Other numbers that can show inflation are the unemployment rate and retail sales. The unemployment rate and inflation have a relationship known as Philip’s curve. The curve simply says that inflation will mainly decline when the unemployment rate rises.

Inflation and cryptocurrencies

Cryptocurrencies are moved by various factors, such as the overall demand and supply. Inflation and interest rates also have an impact on their prices. This is because inflation impacts interest rates, and the fact that some traders view cryptocurrencies as a hedge against inflation.

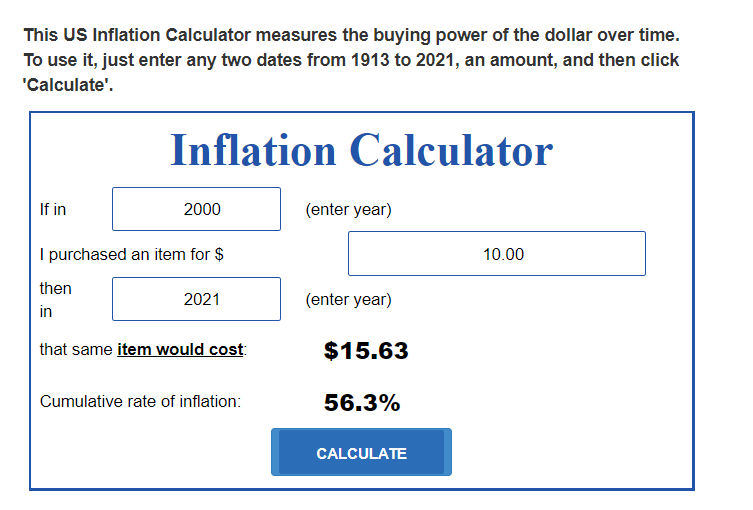

As mentioned, inflation leads to the depreciation of money over time. If you bought an item for $10 in 2000, you would need to spend $15.63 in 2021 to buy it. This means that the value of the US dollar has dropped over time, and the cumulative rate of inflation over this period is 56.3%, as shown in an inflation calculator example below.

Therefore, investors allocate their cash to various assets to hedge against inflation. For example, they invest in stock indices like the S&P 500 and Nasdaq 100 that will appreciate over time. Gold is another popular hedge against inflation.

Many investors believe that Bitcoin is an equal hedge against inflation since they equate it to digital gold in the past few years. Others believe that Bitcoin is a data a better version than gold because of its scarcity. Unlike gold, which can be discovered, Bitcoin has a limit on the amount that will ever be mined.

Interest rates and cryptocurrencies

Historically, cryptocurrencies like Bitcoin and Ethereum do well in a period of low-interest rates. This is because low rates incentivize people and institutional investors to allocate funds to risky assets. For example, the Bitcoin prices surged between March 2020 and May 2021 when the Federal Reserve slashed interest rates to deal with the coronavirus pandemic.

Bitcoin started to weaken in May. Interestingly, this weakness coincided with a sharp increase in American inflation. Data published by the Bureau of Labor Statistics (BLS) showed that inflation rose by more than 3% in April and 4.2% in May. As a result, investors increased their bets that the Fed will start tightening. This is partly the reason why Bitcoin and other cryptocurrency prices declined.

On the other hand, the chart above shows that Bitcoin had a rough year in 2018 and a better year in 2019. This price action was notable since the Fed hiked interest rates four times in 2018. It then made two cuts in 2019.

Summary

Inflation has an essential impact on interest rates. Various Fed policies impact all asset classes, including cryptocurrencies. This article has looked at the close relationship between interest rates, inflation, and employment.