The cryptocurrency market is like no other, being one of the most volatile yet dominated by a few popular virtual currencies. The unregulated nature adds to the risks that investors are always exposed to while trying to profit from price swings. However, it is how prices fluctuate and factors that trigger wild swings that are giving concerns even to the most experienced investors.

In the forex or the stock market’s fundamentals in the form of substantial news releases are known to sway traders’ and investors’ sentiments, consequently affecting price action. In the crypto market, it’s a different ball game as fundamentals often take a back seat, focusing on rhetoric from some of the big names in the industry.

Elon Musk crypto tweets

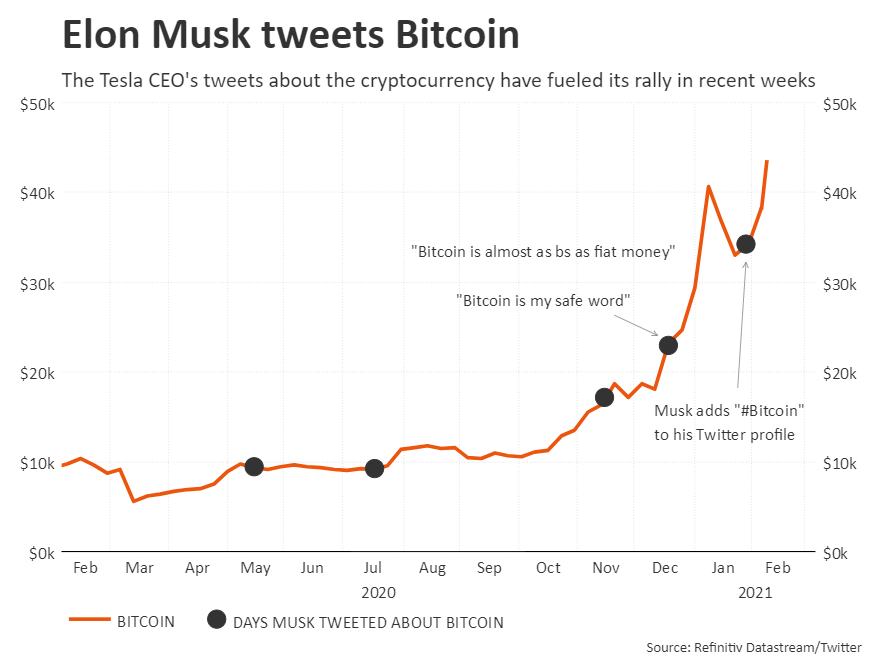

Elon Musk’s tweets have created trading opportunities over and over, becoming a key driver of price action in the multibillion-dollar industry. Whenever the Tesla CEO tweets about digital currencies, wild swings often come into play.

Tweets, fewer than 280 characters messages, have become a powerful tool that has allowed some people to make a fortune while others left gnashing on missed opportunities. This year alone, the tweets have been the catalyst behind Bitcoin and Dogecoin powering to record highs as it became clear that Musk was bullish about the overall industry.

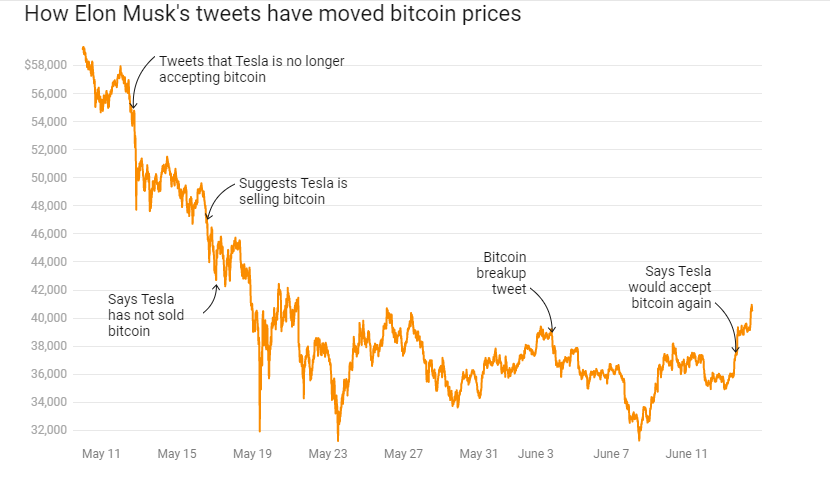

Amid the rallies, so have Musk’s tweets caused havoc fuelling some of the biggest sell-off from record highs to multi-month lows. For instance, in June, a tweet confirming that Tesla had halted BTC payments resulted in a 20% plus sell-off on Bitcoin on a single day.

The chart above clearly shows the kind of impact Musk’s Tweets appears to have had on price action. Chatter that Tesla had sold all its bitcoin holdings, citing the amount of energy used to mine it sent BTC price from $46,000 to lows of $42,000.

In the aftermath of Musk insisting they had only sold a small fraction to test the market, liquidity prices bounced back only to drop again.

While it’s clear to note that the tweets have influenced Bitcoin price, they are not the only factor that drives prices in the overall crypto market. It’s becoming increasingly clear that cryptocurrencies’ price action tends to follow the normal market cycle.

Crypto natural circle plus tweets

The natural cycle revolves around four main phases: accumulation, markup, distribution, and markdown. Depending on when Musk’s tweets come into play, they can only accelerate the prevailing market phase.

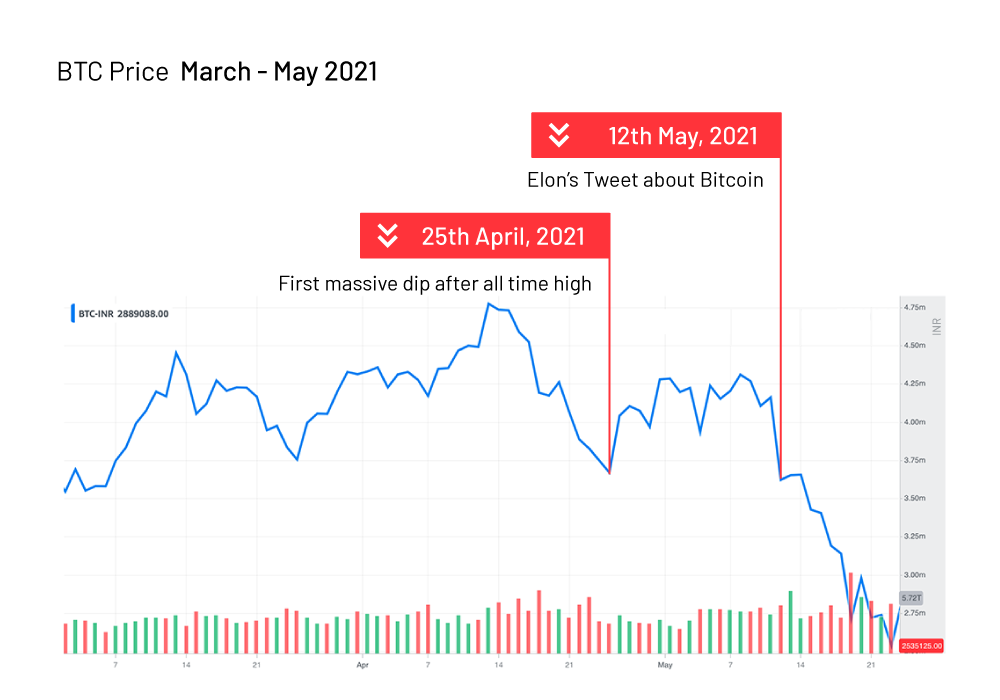

Towards the end of last year, activities in the crypto market were building up, and sentiments had improved significantly. Consequently, there was a lot of accumulation as more investors entered the market. It is at this juncture that Tesla did confirm it would start accepting BTC payments for EV cars.

With more people entering the market and Tesla confirming BTC payments, the price edged higher as people interpreted the same as Bitcoin acceptance into the mainstream sector. It is also during this period that Square and MicroStrategy did confirm investments in BTC.

The result amid the accumulation phase was a spike in BTC price to record highs, resulting in the overall crypto industry turning bullish. Most virtual currencies also raced to record highs, sending the overall industry’s market cap to over $2 trillion.

The distribution phase kicked in with prices at record highs and major indicators led by RSI signaling overbought conditions. Traders and investors started exiting positions to lock in profits after the impressive run to record highs.

A markdown resulted in Bitcoin price pulling lower amid increased sell-off as people locked in profits. The sell-off was only accelerated on Musk, hinting that Tesla was suspending BTC payments concerned by the amount of fossil fuel used to mine it.

The meltdown from Tesla was further accelerated by China embarking on a massive crackdown on crypto trading and mining. With the broader industry in the markdown phase, prices edged lower, with BTC shedding all the gains accrued for the better part of the year to six-month lows.

Following the massive sell-off with BTC prices near six-month lows, the RSI’s major indicators signaled oversold conditions. The conditions only went to affirm the accumulation phase as part of the natural price oscillation process.

The accumulation phase took place as Bitcoin tanked below the $30,000 level before bouncing back. At this stage, traders who had missed on the initial leg higher entered the market, all but fueling a bullish momentum on the flagship cryptocurrency and the broader cryptocurrency market.

At the $30,000 level, most institutional investors are believed to have entered the market, causing a bounce back as part of the markup phase. Additionally, Musk opened the door for Tesla to resume Bitcoin payments through a series of tweets, fueling the positive traction.

The result was BTC bottoming from six-month lows below the $30,000 level to four-month highs above the $45,000 level. With Bitcoin turning bullish on the Musk positive rhetoric, the overall industry bounced back, with a good chunk of cryptocurrencies also racing high as part of the markup phase.

Bottom line

Extreme volatility is a distinctive attribute of the cryptocurrency industry. The volatility tends to increase significantly when forces with huge influence sway sentiments. Elon Musk’s tweets targeting the sector have proved to have a significant influence in swaying market sentiments.

However, it is important to note that no single force has total control of the crypto market. Like other asset classes in the capital markets, cryptocurrencies tend to follow a natural price cycle that revolves around accumulation, markup distribution, and markdown.

Depending on how forces like Musk’s tweets come out, they are always likely to accelerate the prevailing market cycle. For instance, a positive tweet about Bitcoin or Dogecoin during a markup phase will trigger a significant spike in BTC prices and propel the overall market.