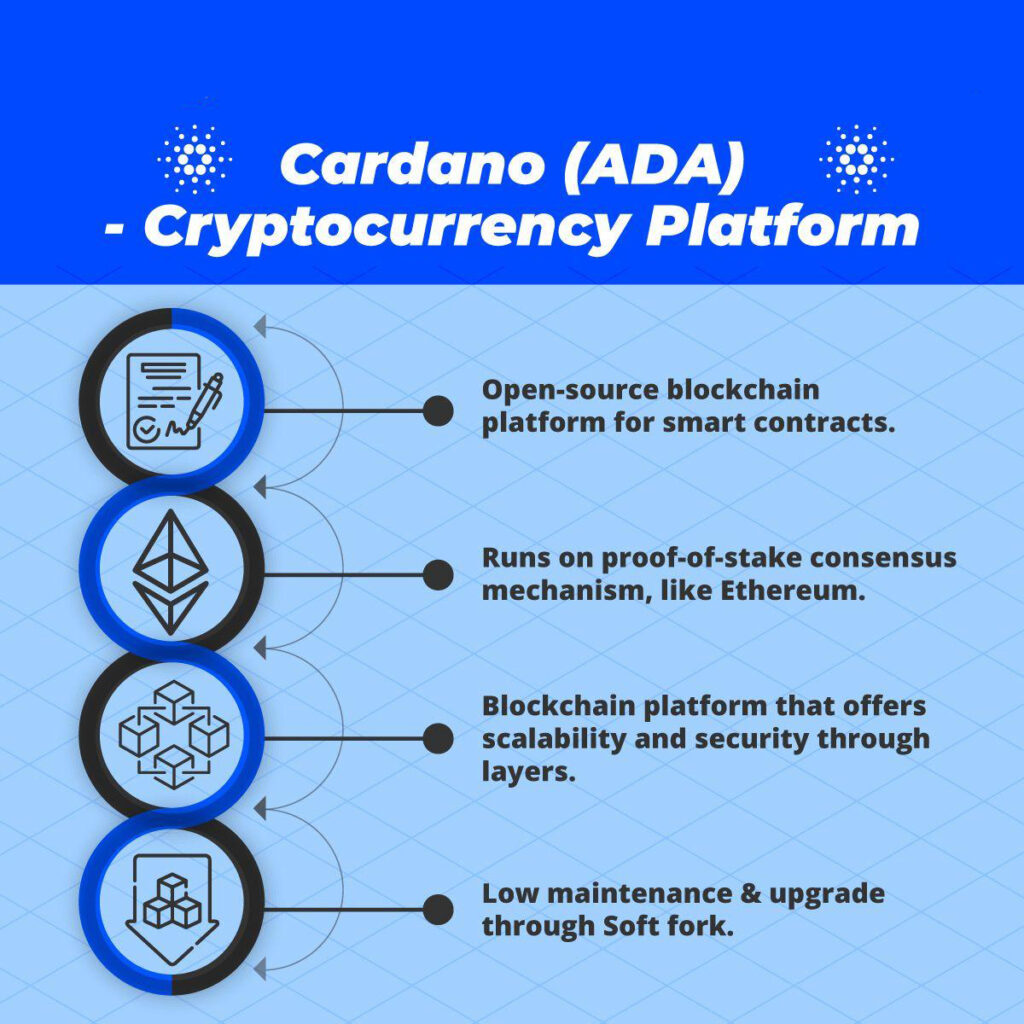

Cardano is a blockchain network that seeks to offer scalability and security on the deployment of decentralized applications. It differs from similar projects on offering and delivering more advanced features while leveraging the ledger technology. While it is still in development, its native currency ADA has emerged as one of the biggest, sending shockwaves in the burgeoning sector.

Two layers power the network. The Cardano Settlement layer acts as the network’s balance ledger that generates blocks used to confirm transactions. The Cardano Computation layer, on the other hand, serves as the computation layer for smart contracts.

Understanding Cardano network

Cardano network came into being to enhance the development of smart contracts and deployment of decentralized applications. It leverages the proof of stake mechanism and a unique layer of architecture that enables enhanced security and scalability of the system.

The layered architecture ensures smart contracts are executed on a different layer than where transactions take place. For this reason, the net can deploy a wide range of smart contracts on the blockchain and process transactions at the same time with the limited downturn.

The network distinguishes itself from other links by being guided by academic research and scientific philosophy. Additionally, its development is in the safe hands of expert engineers and researchers, all with related academic papers published on the website.

Three organizations are at the heart of the development of Cardano:

Cardano Foundation: Headquartered in Switzerland, it is a nonprofit organization that seeks to expand the Cardano network by collaborating with governments and institutions.

IOHK is a limited technology company that seeks to use peer-to-peer innovations to offer financial services to three billion people who don’t have them while leveraging the Cardano system.

Emurgo: It is a company that is helping develop and support businesses looking to utilize Cardano’s technology in various applications

Why Cardano network stands out

Cardano shares many attributes to the likes of Ethereum and Blockchain. However, it differs a great deal based on the problems it was designed to solve in the burgeoning sector.

Scalability

In the blockchain space, scalability refers to the number of transactions that a given net can process at any given time. While almost all projects are formed to enhance the number of transactions on the grid, Cardano goes the extra mile addressing one of the biggest problems that have clobbered the sector for years.

As the size of transactions on a network increases, the number of transfers within one block tends to decrease. It has successfully utilized the Ouroboros algorithm to ensure more transactions are processed on the system than in any other blockchain project.

The proof of stake mechanism also ensures the blockchain consumes the least energy and enhances transaction speeds.

Interoperability

The inability of blockchain systems to connect with one another has always been a big problem facing the emerging sector. The lack of interconnectedness among cryptocurrencies has also made it impossible for people to enjoy the full benefits of the emerging asset.

For this reason, third parties online exchanges have had to crop up to make it easy for people to exchange one crypto for another. On the other hand, the Cardano system seeks to undercut these third-party exchanges and ensure people enjoy the full benefits of decentralization.

Consequently, Cardano has made it possible for people to do cross-network transactions while using sidechains. A sidechain is simply a different blockchain connected to the main blockchain. The extended link creates connections between different blockchains, thus allowing the easy transfer of digital tokens between them.

The connection created enables the transfer of digital tokens between different blockchains, thus solving the interoperability problems that are a big problem among different projects.

Sustainability

Cardano is seeking to be the go-to platform for financial transactions. For this reason, the IOHK is working on a reliable treasury model that will act as a voting system whereby funding for the system will be generated. Funds generated are to be deposited in a bank account whereby the yearly inflation rate will be applicable and cover any operating costs.

Additionally, it is seeking to serve the interests of the community rather than a small subset of a small group. The net is designed in such a way that it averts the risks of potential splits on one group feeling neglected. By doing so, it should become a public infrastructure catering to the needs of the bigger population.

What is ADA and its purpose?

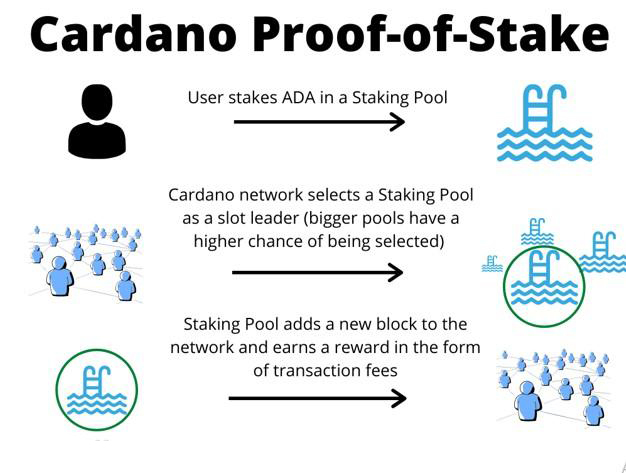

ADA is the native cryptocurrency that powers the Cardano blockchain. Its primary use emanates from the proof of mechanism whereby anyone looking to participate in the development of the network must hold some of the tokens. The consensus mechanism requires token holders to lock away some of the ADA coins to be able to validate transactions and secure the network.

ADA tokens cannot be mined; instead, they are acquired through a process dubbed stacking. The process requires people to deposit and lock ADA tokens for a period of time.

All transactions finalized on the network incur a fee that must be paid in ADA coins. The fees paid are usually used to pay the validators that process transactions on the blockchain. Additionally, all applications and smart contracts that are built and run on the project use ADA for transaction fees.

The fact that the ADA tokens carry a monetary value means they can be used to transact between friends. Additionally, they can be used to pay for goods and services or deposit funds on an exchange or decentralized applications.

The supply of the ADA tokens that will ever be in circulation is capped at 45 billion. With over 32 billion ADA tokens already in circulation, the supply is decreasing at a high rate. Consequently, the limited supply amid strong demand given the increased use cases of the network continues to drive ADA’s crypto value high.

ADA is already one of the best performing cryptocurrencies in 2021. Its value has increased by over 700% since the start of the year. The crypto has outperformed the likes of Ethereum and Bitcoin, a stellar performance that has seen it emerge as one of the top five cryptos by market value.