Every year is unique as new blockchains crop up designed to address different needs and solve some of the deficiencies of previous digital ledgers. The rapid evolution of the crypto ecosystem has seen tremendous innovation, affirming the limitless future powered by revolutionary technology.

Despite the proliferation of different blockchains, mainstream adoption has partly stalled because other chains are designed to operate independently. The winner takes it all stance has significantly affected the uptake of the revolutionary technology. It has also made it difficult for people and developers to enjoy the full benefits of digital ledger technology.

However, things are slowly changing as the need for a key infrastructure that connects different blockchains grows. Blockchain bridges are the latest sensation proving to be a game-changer in blockchain use and uptake.

What is a Blockchain Bridge?

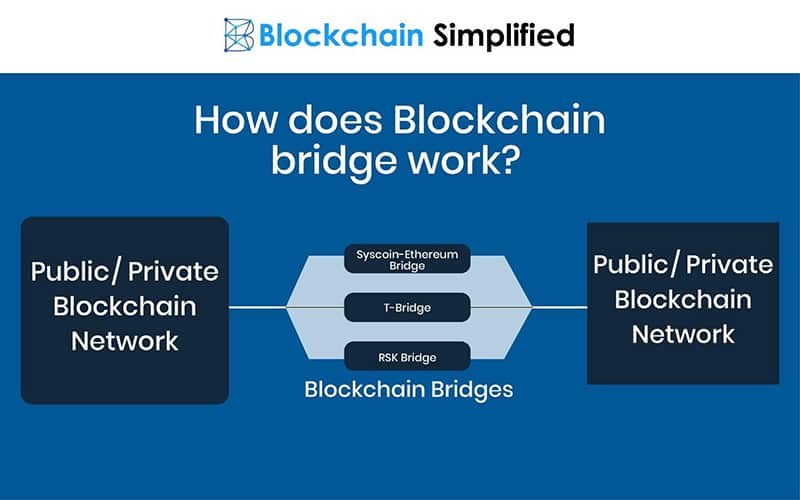

It is a network designed to connect two different blockchains. It works like bridges in the physical world designed to ensure that two other ledgers are connected, thus providing easy sharing of information and data.

Blockchains are independent networks that come with their own set of rules and native assets. A bridge connects, enables, and enhances the transfer of crypto assets and data between different chains. In addition, such systems enhance interoperability while enhancing compatibility between different chains.

Bridges work by enabling communication channels between two ledgers. In most cases, there is usually a one-way communication path. This means that a blockchain can only send a message to another using one pathway, which the other blockchain cannot use or confirm it has received a message.

Here is where a bridge comes into play, establishing a two-way communication channel by bridging the gap between the two networks. Therefore, transferring message data and other resources becomes much easier while also enabling cross-chain asset transfer.

In most cases, blockchain bridges leverage different mechanisms to overcome trust issues between chains. The off-chain actors enable trust and communications between different chains.

Types of bridges

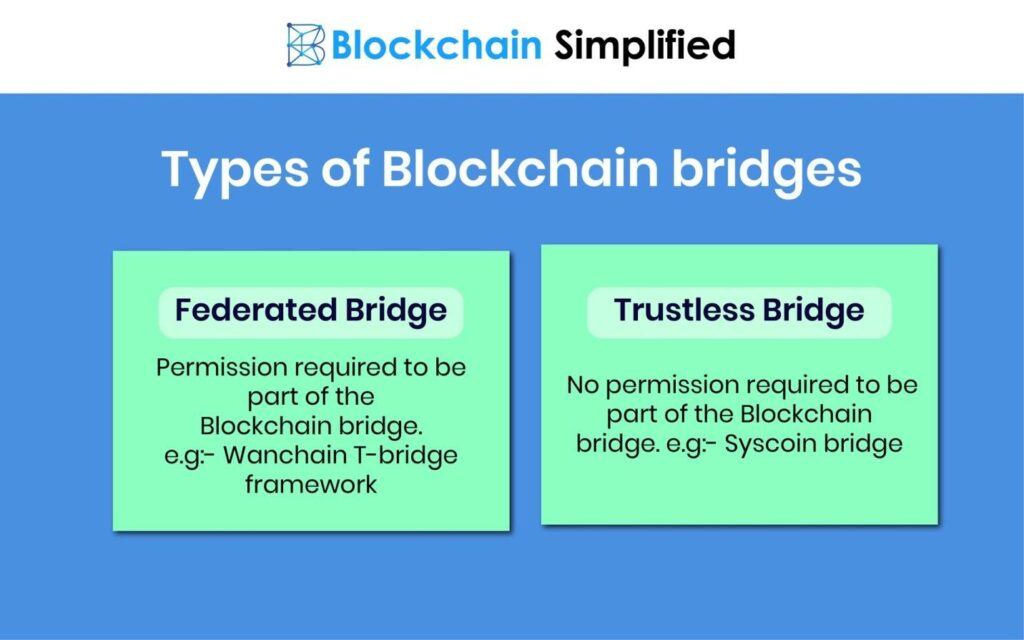

Blockchain bridges are broadly classified into two kinds.

Trusted Bridges: They depend on a central entity or systems to enable connections between different ledgers. Therefore, users are required to trust a third party to use and hold their funds. In addition, they have trust assumptions regarding funds custody and security in the networks.

Additionally, users must give up control of their holdings as there is a central authority in control. Some of the examples under this category include Multichip.

Trustless Bridges: They stick to the principle of decentralization, whereby they operate using smart contracts and algorithms rather than relying on a central entity. Unlike the Trusted systems, Trustless removes the need for a third party to operate.

The trustless nature of the network means the underlying security is similar to that of the underlying blockchain. The use of smart contracts allows users to maintain full control of their funds. Some of the best bridges under this category include Connext and cBridge.

In addition, blockchain bridges can be classified based on what they connect. For instance, L1 bridges are designed to connect L1 digital ledgers. Such systems connect Ethereum with the Avalanche.

L2 bridges, on the other hand, connect Mainnets with different L2 solutions. For instance, an Ethereum Mainnet could be connected with a Layer 2 solution such as Arbitrum or Optimism, which addresses Ethereum’s high transaction fees and congestion issues.

Additionally, they can be classified based on their function. Chain to chain bridges enables the connection between two blockchains, while multi-chain bridges are for transferring assets across multiple blockchains. On the other hand, specialized bridges are designed to operate in specific ecosystems and are intended to enable the transfer of data and information across focused regions.

Example of Blockchain Bridge

Consider an Ethereum token holder who wants to use some of his holdings on the Cardano network. Without direct connection, it would not be possible, given that the Ethereum and Cardano blockchains come with unique protocols. Interoperability between the two networks is impossible.

However, it becomes possible to transfer information from the Ethereum to the Cardano blockchain with a blockchain bridge. In this case, the holder would be able to transfer ETH holdings via the bridge from the Ethereum Mainnet to Cardano. Consequently, ETH would be converted to wADA on Cardano.

Why Blockchain Bridges?

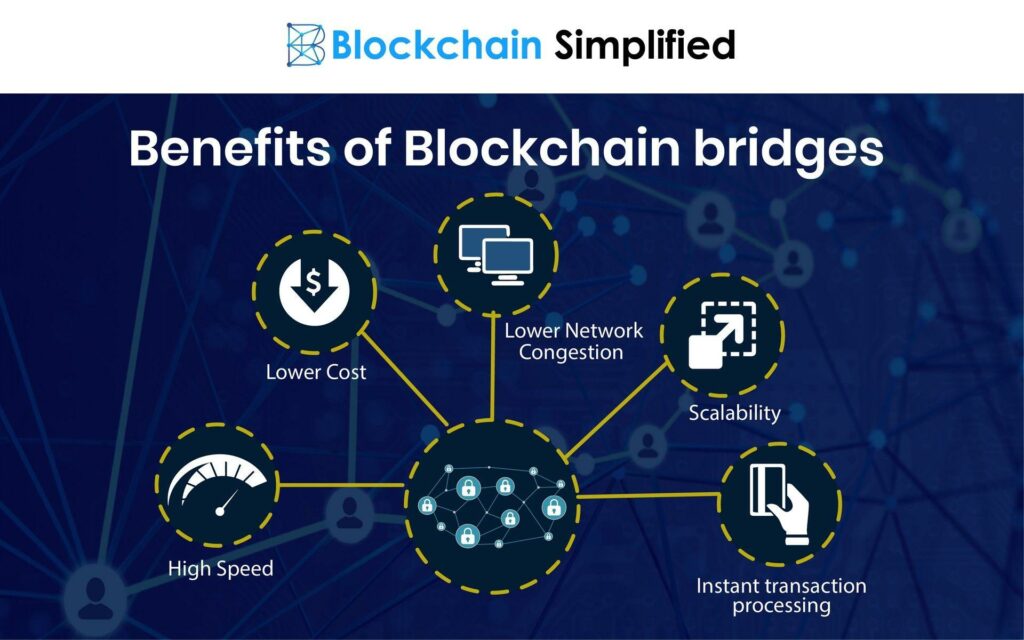

No blockchain is sufficient. Every chain has its fair share of limitations that often affect its adoption and use in different operations. Therefore, interoperability made possible by bridges ensures developers are able to use two or more blockchains at any given time without any restrictions. The connections that come into play enable the easy sharing of resources and data, thus curing the deficiency of one digital ledger with another.

The cross-chain transfer of assets and information that come into play, as a result, allows developers and people to enjoy the full benefit of the ledger technology. Low cost and high speed of transactions are some of the synergies always up for grabs. In addition, decentralized applications can access the strengths of different blockchains, therefore enhancing the capabilities and protocols.

Blockchain bridges also make it possible for developers from different platforms or ecosystems to collaborate and develop platforms that work without any restrictions. Users are also accorded the opportunity to access new platforms and leverage the benefits of different chains much easier with the connections that come into play.

Risk of Blockchain Bridges

Just like any technological innovation designed to enhance efficiency, blockchain bridges also come with their fair shares of deficiencies. Because they are in the early stages of development, developers have yet to develop an optimal design.

The risk of a bug is usually high, leading to smart contract risk or the loss of the user’s funds. Technological risks associated with software risk, human error, or buggy code may also result in operation disruptions.

The fact that trusted bridges come with a centralized system can result in some users being stopped or prohibited from transferring assets to other chains. There is also a risk of bridge operators colluding and stealing users’ funds or data as it is being transferred.