Tethys Finance is an exchange platform that provides everyone with solutions that are based on the L2 of the Ethereum blockchain. The service should be secure, fast, reliable that can be used from the browser and application. The release date was several months ago on December 17, 2021 on the Andromeda network.

Tethys Finance overview

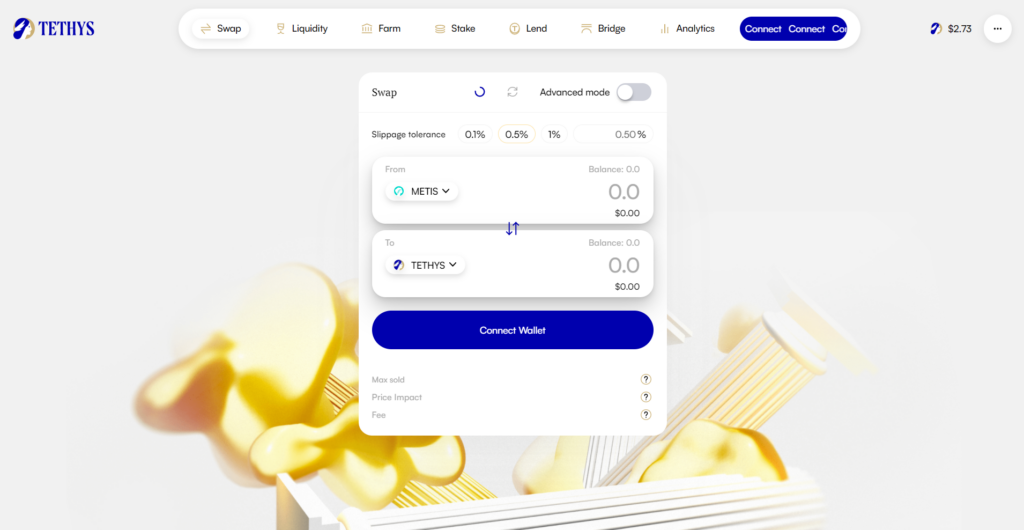

- The platform provides us with swapping, staking and depositing our liquidity services.

- The platform provides us with a possibility of trading ERC-20 tokens.

- The solution was designed as a layer- service.

- The developers charge 0.2% fees.

- It’s 30% lower than other Uniswap protocols.

- 0.17% goes for those who provide liquidity.

- 0.03% goes for stalkers of xTETHYS.

- The system looks the best pair to work with.

- It can be a simple route like METIS-TETHYS.

- Or even three coin routes like METIS-USDC-TETHYS.

- The price will be determined by the METIS-USDC and USDC-TETHYS liquidity pools.

- We can set the slippage that we can tolerate.

- The recommended level is 0.5%.

- There are liquidity pools of two tokens.

- Each swap moves the price up or down, depending on the trade direction.

- If we provide liquidity, we can rely on trading fees.

- There are farming possibilities.

- The devs use a progressive fram model.

- The more you stake your tokens on the farm, the more multipliers you get applied to your harvest amount until 30%.

- We are able to buy TETHYS tokens freely.

- xTETHYS is an ERC-20 token that we can obtain during the staking process before releasing.

- The devs perform buyback activities based on 0.03% swap fees.

- The buyback occurs every two days at a randomly selected time to avoid any kind of market manipulation.

- We can purchase MÉTIS native tokens with USDT, USDC, and ETH.

How does Tethys Finance work?

The developers of Tethys Finance provide us with opportunities:

- Trading ERC20 tokens

- Providing our liquidity to the pools that support trading activities.

- We can create our own pools.

- Staking of coins is possible as well.

What can you buy on Tethys Finance?

- The service allows us to purchase MÉTIS tokens.

- We can purchase any ERC-20 token.

Is Tethys Finance safe?

The service looks average. This means that there are always irks that after providing our liquidity we won’t lose it because someone exploits the pool.

Tethys Finance fees, compatible wallets, and transactions

- The service charges 0.2% fees for every transaction.

- The liquidity providers can expect to get 0.17%.

- The token stakers will get 0.03% only.

- The service supports only three wallets: MetaMask, WalletConnect, and Coinbase Wallet.

- Developers provide us with quick orders execution.

What are the ways to trade on Tethys Finance?

We can work with TETHYS tokens on Binance, Coinbase Pro, Kraken, and other exchanges.

Customer support

We have no testimonials written about how good the service is and it works well for clients. It would be great to know how safe their liquidity pools are.

Should you buy a Tethys Finance token?

Tethys Finance summary

Tethys Finance summaryPros

- A native token released

- It works with all ERC-20 tokens

Cons

- No team revealed

- No risk of using a pool explained

- The service has a short list of typical DEC functionality

- No people feedback written