THORSwap is the first multi chain decentralized exchange that works on the THORChain network to provide a front-end user interface to perform cross-chain swaps. This is a non-custodial trading platform. There are no pegged or wrapped assets implemented. It works only with native ones.

THORChain overview

It’s time to discuss parameters, functionality, features and other details of THORChain.

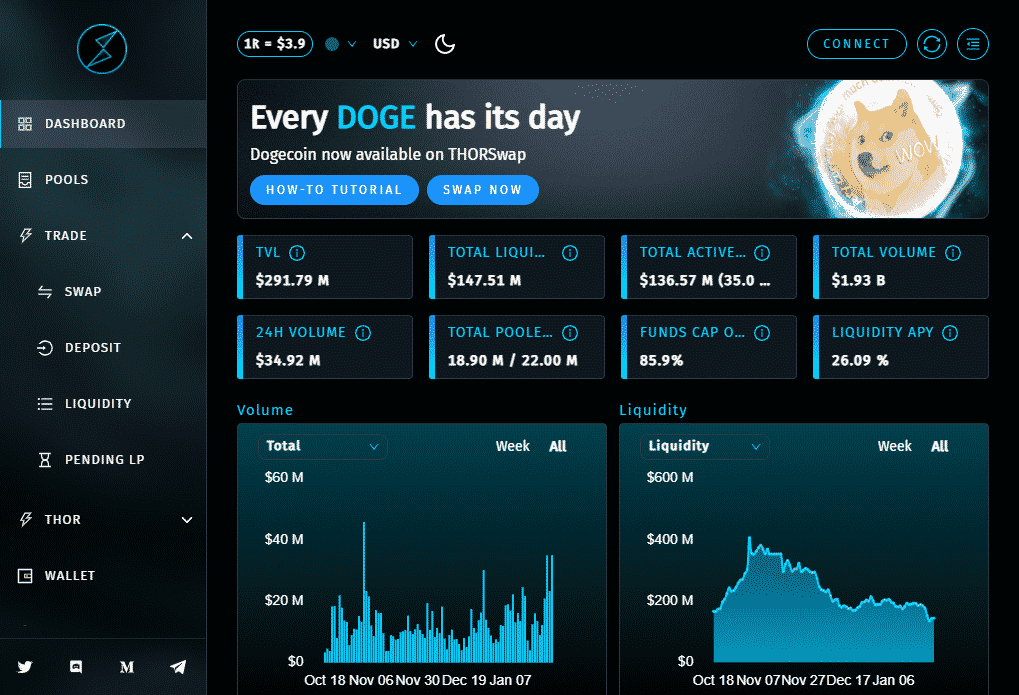

- The platform informs us that DOGE is available for trading here and now.

- We can see standardized information like TVL, total liquidity, total volume, total actives, 24h volume, funds cap, and liquidity APY.

- The site includes pools functionality, swaps, deposits, liquidity, and pending LP.

- The developers provide information about liquidity pools caps within Twitter.

- If we provide liquidity when caps are FULL, then we will be refunded. We will be returned with less than you originally had in order to pay for the gas to refund you.

- To get started we have to create a wallet, migrate from BEPSwap to THORSwap, and upgrade our BNB.RUNE and ETH.RUNE to native RUNE (THOR.RUNE)

- The liquidity providers make profits from those clients who use the liquidity pool for swapping their coins.

- Yields can be earned on Bitcoin, Ethereum, Binance coin etc.

- Liquidity provides at a 50/50 ratio where 50% is RUNE and 50% other assets.

- Providers are rewarded for keeping their assets in THORChain.

- APY comes from block rewards, incentives and the swap fees.

- There are 500 million progressively emitted to nodes for security and liquidity over time.

- The system pays back all fees to users.

- There’s no revenu model behind it.

- We can provide liquidity using the following assets: BTC, ETH, LTC, BNB, BCH, ERC-20 (USDT and SUSHI), BEP2 (BUSD and BTCB) Soon – XHV, BSC, DOGE, ZCASH, DOT, KSM, XMR, SOL, LUNA, ATOM, AKASH, SCRT, INJ, SIF, FIL and others.

How does THORChain work?

- The site allows us to trade tokens in various pairs.

- We can stack RUNE tokens for a profit.

- We can stack THOR tokens.

- The system allows us to participate in various pools using our tokens.

- The site uses its functionality to provide us with a list of pools. There’s intel about the name, price, 24h volume, and APY.

- We can stack THOR for 126.62% of APR. The reward can be claimed in ETH-THOR liquidity pool.

- We can use SuchiSwap exchange. There’s a 35.76 APR. The rewards can be claimed in the THOR-RUNE liquidity pool.

- There’s a linear vesting functionality. The information about vesting time, vesting period, and vesting amount of THOR isn’t available.

- We have a list of Thorchain nodes provided with addresses, versions, IP, rewards, slash, bond, and active block.

What can you buy on THORChain?

We can purchase a native token THOR using our coins. Also, the swapping functionality is available. We have a RUNE fee of 0.02 RUNE. BTC fee is 0.000025 BTC. The total fee is $0.98.

Is THORChain safe?

We don’t know for sure. For now, there are no claims that the funds were exploited. So, the service can be treated as the safe one.

THORChain fees, compatible wallets, and transactions

- We can work with XDEFI, TERRA STATION, WALLETCONNECT, METAMASK, LEDGER, KEYSTORE, and ETHEREUM WALLETS.

- The system has various commissions.

- It doesn’t charge fees for swapping THOR.

What are the ways to trade on THORChain?

We can swap or trade tokens using the platform functionality. The service is non-custodial. So, we can work from our wallet directly.

Customer support

The developers provide support via site functionality, email, and Telegram.

Should you buy a THORChain token?

THORChain summary

THORChain summaryPros

- The system has its native token

- Trading functionality looks familiar

- All commissions are back to the community

Cons

- The presentation lacks details about the team behind it

- There’s a short list of liquidity pools

- Their profitability is below average

- No people testimonials published