You can earn passive income with delta neutral, a little-known concept by retail traders. Hedge funds that manage millions of Dollars tend to use it when investing. It’s a very useful way of protecting capital. They don’t want to take high-risk operations because they have money from external people.

The main problem in an unregulated market is high leverage trading. Exchanges allow users to set orders with 125X of the capital in futures contracts. Clearly, this is not good because owners of platforms know where you put your stop loss, take profit, and they can use bots to manipulate the prices to liquidate your positions.

In order to avoid being liquidated by high-frequency algorithms, we will explain how to earn passive income with arbitrage.

It’s necessary to consider that this strategy requires some advanced knowledge of the trading options of the crypto market.

What is delta neutral trading strategy in the crypto market?

A non-directional strategy is a trading approach where the trader does not have a defined bias of the market direction. To understand it better, we are going to break down some concepts step-by-step.

- Spread: constitutes the distance between the best price on offer and the best price on the bid that an asset is receiving.

- Funding rate: ensures futures and index prices converge most of the time.

- Index price: known as reference or average.

- Spot market: It is one in which the transaction and settlement of an operation coincide on the same date.

- Futures perpetual: normally, futures markets have an expiration date, but this contract does not have it.

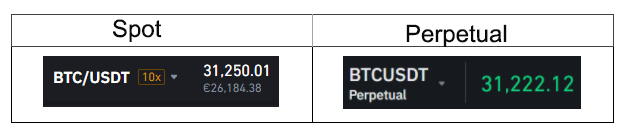

In exchanges like Binance, we have possibilities to operate in Spot and Futures perpetual in Bitcoin, Ethereum, and many other coins. The spread between those prices and funding rate is what we are going to use to profit.

Look at the picture below, which reflects prices at the same time. Watch the tight spread.

But, where do you get the benefit and earn passive income? With the funding rate, you will get paid every 8 hours on Binance, and if you use FTX, every 1 hour.

Consider the following:

- Positive funding = More traders are holding long positions. The rate is paid from long to short. So, if you are holding a short position, you will be paid.

- Negative funding = More traders are holding short positions. The rate is paid from short to long. So, if you are holding a long position, you will be paid.

Observe the screenshot below taken in Binance exchange – the funding is -0.0035% in Bitcoin. If you are in a long position in perpetual, you will be paid in 07 hours and 14 minutes (see countdown).

Payment calculation: (position size* price when countdown is 00:00) * funding

Example: Perpetual position size = 1BTC ; Price = $30; calculate the 0.0035% of $30K = $1.09.

Imagine that funding and price stay the same; receiving $1.09 every 8 hours would be $3.27 a day. In a month, $98.1, and in a year, $1.177. Clearly, this varies. It’s just an example.

Notice the historical positive average of funding rate (vertical bars) from Bitcoin in the 2021 bullish trend, from January to May. Assuming you executed the strategy in those months, you had been earning from 0.05% to 0.30% every 8 hours.

How to find a coin to execute a delta neutral position?

- First, using a scanner tool like this bybt.com/FundingRate

- Look for the highest percentage of positive funding. It’s recommendable to select high liquid coins of the top 10 market cap.

- Watch spread between spot and perpetual should be tight. Tradingview pro gives access to intraday spreads.

- Place the orders simultaneously in equal amounts of coins, for example, 2 BTC (buy 1 BTC in spot and short 1 BTC in perpetual).

Select coins that have maintained positive funding in time, remember it’s a passive income strategy, so you should hold the position at least a couple of weeks or a month to see good results.

How to run the strategy in the safest and easiest way?

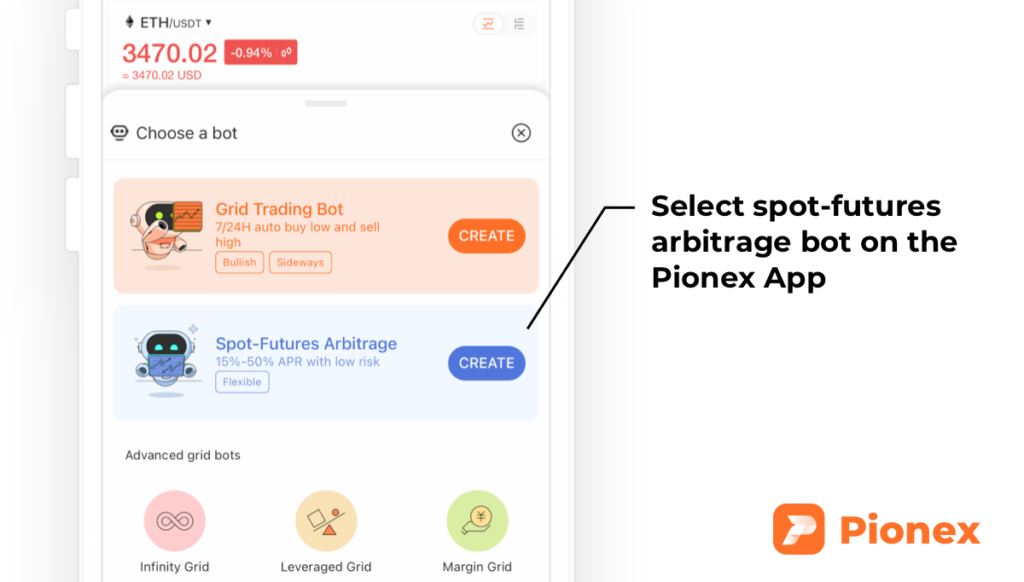

There is some risk associated with this strategy which is to execute trades manually.

If you close your position in the futures market but can’t close your spot position, you can lose money in your spot trade if the price suddenly starts falling.

With a bot, you can avoid the total liquidation of the position and have better risk management. I recommend checking out this one pionex.com/en-US/.

Conclusions

Delta Neutral trading allows us to make passive income while maintaining low risk. It’s vital knowing how to reduce the risk associated with the volatility of the cryptocurrency market to manage our portfolio properly. Using spreads, we can develop this type of strategy.

It’s ideal for all those people who are afraid of placing positions that, from one day to the next, can cause great losses. We have already seen corrections of up to 20-30% in just a few hours, especially in Altcoins.

It’s possible to trade without having an expectation of where the market will go, and the best of this is that we can make gains without watching the charts all day long. Of course, there will be other variables to take into account.

Please remember that your trading results are your trading results. Always do your due diligence and monitor risk carefully. Happy trading.