Cryptocurrencies have to be the biggest innovation of revolutionary blockchain technology. Since Bitcoin’s inception in 2009, the landscape has changed with the emergence of new altcoins designed for different use cases.

For the longest time, cryptocurrencies have been associated with payments, with Bitcoin leading the fray. Fast forward, they are increasingly being used for other purposes, key among them being opening up access to financial services and representing real-world objects.

While there were less than 1,000 cryptocurrencies four years ago, the number has exploded to more than 4,000, thanks to the emergence of new projects beyond Bitcoin. While digital currencies may look alike, they are all powered by blockchain technology and still differ a great deal.

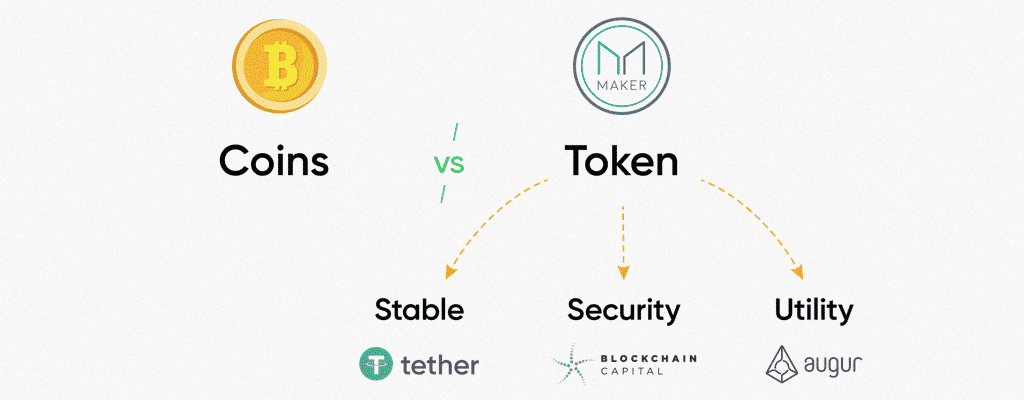

Crypto vs. tokens

Cryptocurrencies are broadly classified into two: coins and tokens. Coins are powered by their own blockchain, thus able to act as traditional money. Such assets are commonly used to store value and enable exchange between two parties. Bitcoin and Ripple are some of the coins built on their blockchains.

On the other hand, tokens are created on existing blockchains and whose use cases go beyond being digital money. They are commonly used on software to offer access to an app or even verify an identity.

More coins and tokens are cropping up in a world where blockchain technology adoption is increasing by the day. The increase is being fuelled by the ease of coming up with new ones on top of existing chains.

Increased price speculation has also fuelled the urge of developers to come up with unique masterpieces, all in the effort of profiting from exponential price appreciation. Amid the influx, some cryptocurrencies have proved to be extremely dominant than others.

Now, let us dive into the examples of the main types of cryptocurrencies.

Bitcoin

Bitcoin is arguably the biggest and the most popular as it was the first cryptocurrency. It has grown in popularity thanks to its ability to enable payments and digital transactions. The anonymity of sending and receiving money on the blockchain has been the catalyst in fuelling Bitcoin growth.

In addition, the listing of the coin on the biggest exchanges has seen increased price speculation. Consequently, more retail traders and institutional investors in the recent past have pushed Bitcoin valuation to levels not seen.

Consequently, Bitcoin is seen as an investment tool in the capital markets and a hedge against inflation in addition to enabling payment and transactions.

Ethereum

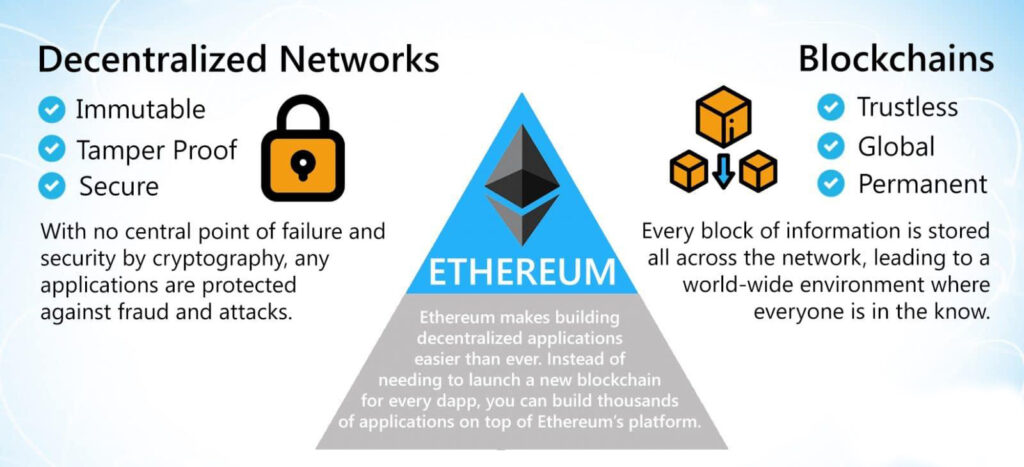

The second-largest cryptocurrency by market value, Ethereum, has continued to grow in popularity by the day, given the increased number of use cases of its blockchain. While its native token Ether is commonly used to facilitate transactions, it’s the manner in which the blockchain has been used to develop smart contracts and decentralized applications that have propelled Ethereum higher.

Ethereum is best known for its software development sandbox that has been used to come up with decentralized applications used in many sectors. For instance, Ethereum powered smart contracts are being used to enable supply chain operations.

Tether

Cryptocurrencies’ main undoing has always been the heightened level of volatility associated with them. Consequently, it has always been a challenge to pinpoint the exact value of a coin or token at any given time, given the significant price fluctuation.

Stablecoins have emerged, which are essentially cryptocurrencies pegged on stable assets, to address the issue. Tether has turned out to be the biggest stablecoin pegged on the US dollar, the global reserve currency.

Tether acts as a medium of exchange in the sector. For instance, when people move from one cryptocurrency to another, rather than move back to US dollars, they move to Tether as it is pegged to the dollars on a 1 to 1 ratio.

Tether has grown popular in combining the benefits of cryptocurrencies and fiat currencies. The fact that it is relatively stable, like currencies issued by a sovereign government and enables transactions without intermediaries, continues to affirm its edge in the burgeoning crypto space.

XRP Ripple

The use of blockchain technology in the mainstream financial system was always going to be a game-changer. No other cryptocurrency has had the biggest impact on the traditional financial system other than Ripple. It mainly operates as a global money transfer network used by financial service companies.

Ripple was essentially developed with financial institutions in mind aimed at scaling digital payments. Unlike in the past, when cross-border transactions used to take days to go through, Ripple has changed the game, making it easy to send and receive cross-border payments within seconds.

XRP, which is the native token that powers the Ripple network, cannot be mined and comes with a limited supply.

Dogecoin

Cryptocurrencies finding their way into the capital markets has also given rise to a new class dubbed meme coins. These are coins whose popularity and adoption stem from their ability to be used as investment tools to try and profit from extreme volatility levels in the space.

Dogecoin is one of the most volatile tokens and ideal for anyone who is looking to invest and profit from extreme price swings. Its edge and popularity stem from its connection to high-profile personalities and celebrities that continue to tout it.

Support from the likes of Elon Musk and Mark Cuban has propelled the coin. In addition to being a speculative altcoin, it is also being used to enable digital payments, as is the case with the likes of Ethereum and Bitcoin.

Final thoughts

Cryptocurrencies are increasingly cropping up by the day as more use cases for the underlying blockchain technology come up. While they may look alike, some are entirely different and developed to serve various functions.

There will always be dominant coins, especially in the mainstream sector. Increased speculation in the financial markets is one of the factors likely to continue driving the popularity of most coins similar to traditional securities.