If you are new in this crypto world, you may be thinking, “Hey, Cardano is cheaper than Ethereum and is a good project with high scalability in Blockchain. If I invest in it, maybe I can make more money.”

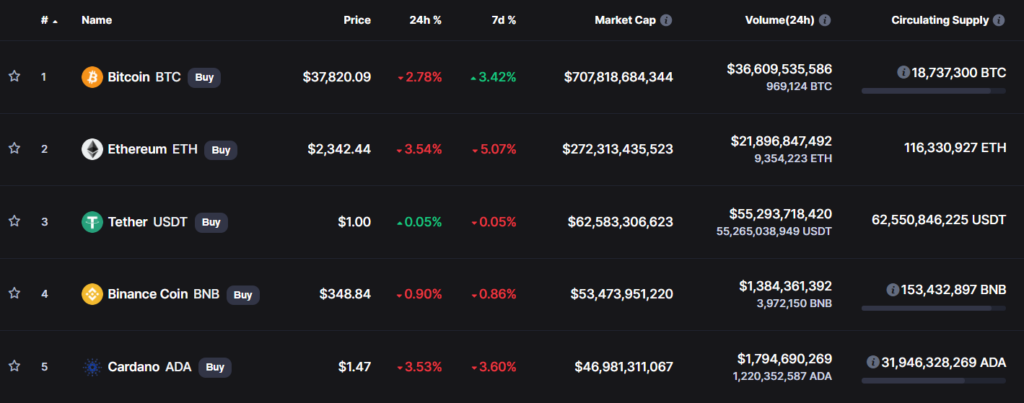

At the moment I am writing this article, one Ethereum is $2,400, and one Cardano (ADA) is $1.50. This way of thinking is not correct because you should know that market capitalization and supply of an asset influence the price.

Can Cardano, or any other crypto that replaces Ethereum, be worth 3,000$ one day? The following information sums up the factors that affect the price of digital currencies and can reflect the future. Let us give a general overview of what makes cryptocurrencies valuable.

What is the market capitalization in cryptos?

It is a metric that measures the relative size of a cryptocurrency and compares it to others. It is similar to the stock market with the number of shares and the company’s total value.

The formula is the following:

Market Cap = Current Cryptocurrency Price x Total Amount of Coins in Circulation

For example, if each unit is trading at $5.00 and the circulating supply is equal to $100,000,000, the market capitalization for this cryptocurrency would be $500,000,000.

The scarcity

If something is naturally scarce, it is more likely to have value. Supply is one of the most critical factors affecting market capitalization and is the most misunderstood metric by many newbies.

The lower the supply and the higher the demand, the higher the price. Therefore, it is very important that you analyze and research this indicator before investing or start mining a digital coin.

I’ll give you the four terms of coin supply to have in consideration:

- Total: It’s the total number that currently exists, although not all are in circulation. Circulating: It’s the amount that has been mined or generated. It is the approximate number that is currently in public hands.

- Maximum: It is the maximum number that will exist. There will be no more supply once it reaches its maximum limit.

- Infinite: Yes, you heard right! There are coins with an infinite supply (for example, Ethereum and Dogecoin).

You can find the ranking information on the websites below.

- coinmarketcap.com

- coingecko.com

Here is a screenshot of one of the top five.

We know the value of a currency is based on its scarcity. However, there is another term in economics known as time preference.

According to Wikipedia, time preference relates to the following: “It’s the current relative valuation placed on receiving a good at an earlier date compared with receiving it at a later date.”

A low-time preference investor will try to sacrifice present consumption for future consumption. A high-time preference investor relies on debt to satisfy their present needs instead of allocating smaller amounts of capital to multiple investments.

Given that traditional fiat currencies are inflationary while most of the crypto projects are deflationary, this means that buyers should derive more benefits from their holdings if they have low time preference.

A coin is designed in such a way that it should never exceed its maximum supply. The question is, when will it reach? Let’s take Bitcoin as an example.

One of the most curious properties is that the maximum BTC amount that can be created is defined: 21 million. This is because the original creator (under the pseudonym Satoshi Nakamoto) decided to create a deflationary asset, such as gold.

It is estimated that around the year 2140, BTC will reach its maximum supply. Miners have controlled the supply, and its block reward (refers to the number of Bitcoins you get if you successfully mine a block of the currency) decreases every four years. It is expected that by the year 2032,99% of Bitcoins will be mined. To extract only that last 1% will take 100 years.

So what will happen when the 21 million circulation limit is reached? It is difficult to know what will happen. If the miners continue working, there will be less and less supply remaining, making bitcoin work as a store of value.

Everything is in the air, and we cannot predict the future, but the theory says if the demand continues to increase, its value will increase substantially.

Final thoughts

If we want to put money in cryptos, especially for the long term, you must pay attention and investigate more about all the points I covered in this article.

When something is scarce, like a special edition or limited stock of a product, people tend to buy more because they believe they can earn money with this selling in the future, but this does not always happen.

Remember, markets have bullish and bearish cycles, with each maybe lasting for years. It’d make more sense to invest in deflationary assets than inflationary assets, as long as they have good fundamentals.