Cryptocurrencies’ growing popularity can be attributed to several things. Top on the list has to be the exchange that has come into being and made it possible for people worldwide to buy, sell, and hold various crypto assets for various reasons. In essence, they are the heart and soul of the burgeoning sector still in the nascent stage of growth.

Crypto exchanges are essentially platforms that connect buyers and sellers. They allow people to buy and sell various cryptocurrencies. Additionally, they are part of a multibillion-dollar industry that generates income through fees and commissions from the various trades they facilitate.

In these platforms, people are allowed to exchange fiat for digital currencies. For instance, one can spend $100 to buy an equivalent amount of Litecoin or Bitcoin cash. Additionally, it’s possible to exchange one asset for another, for instance, Bitcoin for Ethereum, based on a set conversion rate.

Crypto exchanges charge fees for facilitating the trading and swapping of the various virtual currencies. The fees vary from one platform to another, depending on the model deployed. In addition, exchanges come with varying compliance frameworks that anyone signing up to them should pay close watch.

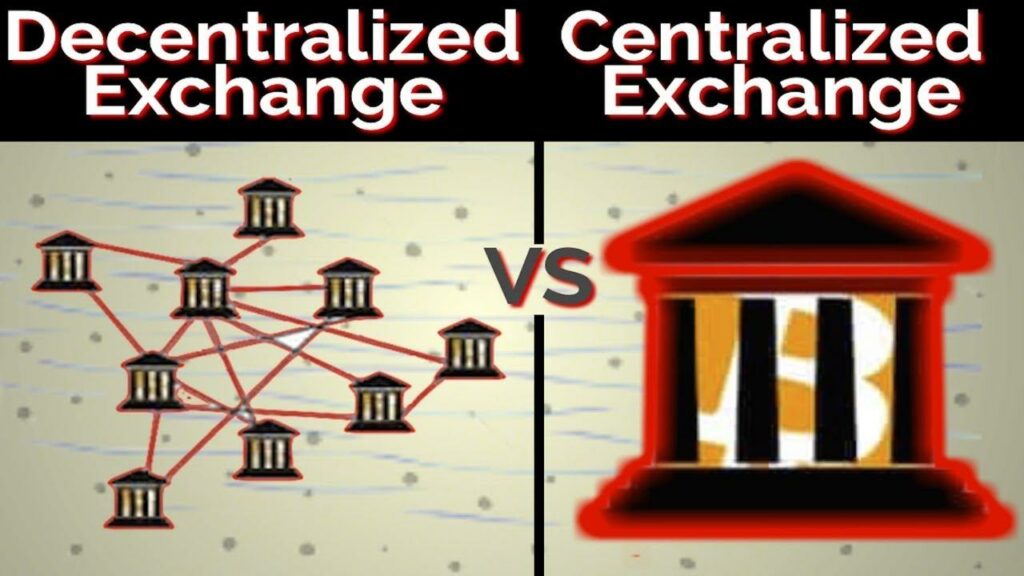

Centralized vs. decentralized

Cryptocurrency exchanges can broadly be classified into either centralized or decentralized. Centralized are the most popular and common, operated by a company that often acts as an intermediary for connecting buyers and sellers.

As is the case in the stock market, centralized exchanges pool buyers and sellers into one platform, allowing them to do business with one another. In this case, if one needs to buy $1000 worth of Bitcoins, there will always be a seller on the other side of the trade willing to facilitate the trade with the exchange acting as the intermediary of the transaction.

Buyers and sellers trust the middlemen to handle and facilitate their transitions. Binance, Coinbase, Kraken, and Gemini are some of the most popular under this classification.

Advantages

Centralized exchanges are user-friendly in that they enable the easy trading of various digital assets in contrast to having to deal with crypto wallets and peer-to-peer trading networks. They only provide a centralized platform whereby one can log in and transact whichever amount they wish.

In addition, they are extremely reliable for anyone looking to carry out quick transactions involving fiat. Additionally, they provide a layer of security when it comes to trading cryptos and the completion of transactions.

The cons

One of the biggest downsides of these platforms is that they are prone to hacking incidents. Given that crypto holdings are usually stored or saved in a centralized location has always left them susceptible to theft through cyber-attacks.

High transaction fees associated with dealing with these platforms can also eat into the profits that one generates. The platforms are known to charge a decent amount of fees for services rendered.

Decentralized exchanges (DEX), on the other hand, operate as a peer-to-peer platform connecting buyers and sellers directly without an intermediary. Such platforms live up to the principles of blockchain, which is all about the distribution while shunning third parties.

Unlike centralized exchanges, decentralized exchanges don’t support the trading of fiat for virtual currencies. Instead, they mostly allow the swapping of one coin for another, for instance, Ripple for Cardano, among others. The most popular platforms under this classification include AirSwap, Bartdex, and Blocknet.

The pros

DEX stands out partly because they guarantee customer anonymity. Unlike their counterparts, they don’t require customer information for opening accounts as they don’t have to follow Know Your Customer procedures.

Consequently, they offer the highest level of privacy. Given that persons’ holdings or virtual currencies are not kept or stored in a centralized location, peer-to-peer crypto trading platforms are not susceptible to hack attacks.

Additionally, they are immune to attacks as they don’t require clients to transfer their assets to a third party. Instead, they provide a platform that people use to transact with one another directly and store their holdings in crypto wallets rather than a centralized location.

The cons

Their major downside of DEX is that they don’t handle fiat; consequently, they don’t allow people to trade fiat for cryptocurrencies or vice versa. In this case, one must first convert fiat to digital currencies in other platforms to do any business on these platforms.

Liquidity has always been a challenge when dealing with distributed platforms, as most people do not use them. Consequently, it can be a challenge to complete the transaction at desired price points. The low liquidity also translates to wider spreads which can result in increased costs.

Differences

The major difference stems from the fact that centralized exchanges enable fiat conversions to cryptocurrencies and vice versa. In contrast, decentralized exchanges enable the swapping or trading of digital currencies and don’t offer support for fiat currencies.

Additionally, centralized platforms act as middlemen connecting buyers to sellers and vice versa. In this case, they facilitate the transfer of coins between parties. In contrast, decentralized exchanges don’t have any middlemen. Instead, they offer a platform whereby market participants interact with one another.

Bottom line

Cryptocurrency exchanges serve the purpose of providing a platform whereby people can buy, sell, or hold virtual currencies. While some allow the trading to occur in fiat, some don’t and only support crypto to crypto swapping or trading.

Additionally, some are better suited for experienced crypto enthusiasts, while others are ideal for retail investors. Similarly, some platforms are mostly geared towards institutions looking to transact in huge volumes, while some are perfect for full-time traders.

Given that cryptocurrencies are unregulated financial instruments, the law that governs crypto exchanges varies widely from one jurisdiction to another. Additionally, the kind of services these platforms offer depends on the applicable regulations in a given location.