Bitcoin has a number of fans, but between This is known as altcoin season. We are going to talk about what indicators you should pay attention to for finding the best time to invest in altcoins and make nice profits.

Few digital currencies have maintained some relevance in the market over time. For example, now we have Ethereum, which is number two in the market cap. This is something that the metric known as dominance helps us to see.

What is Bitcoin Dominance, and why is it important?

It’s a metric that indicates the percentage of capitalization (in Dollars) that a coin has relative to the rest of the cryptocurrency market.

This indicator was originally created to illustrate how important Bitcoin was at the beginning of the crypto-times. When the King of the coins was created, its capitalization value was the same as the total market – 100%, since there were no other cryptocurrencies. When new projects like Litecoin, Ripple, Ethereum were created, supremacy started to diminish.

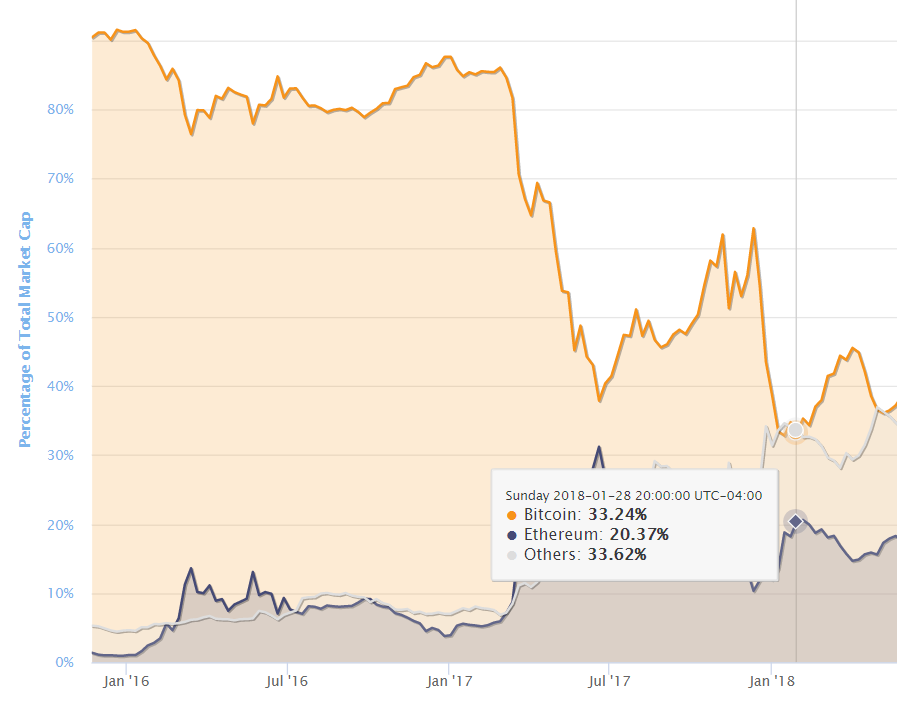

Bitcoin is historically the most robust, secure, and consolidated of all, because it takes the highest percentage of the crypto market. Until 2017, the dominance always remained above 70% of the total.

However, that year an unprecedented phenomenon emerged that led to a minimum percentage of 33% for January 2018. Since that period, analysts have called the phenomenon the alt season.

TIP: You can find the indicator on TradingView, searching BTC.D.

Path to Altseason: how money flows in cryptos

This is usually triggered by the BTC mining supply halving every four years (which causes a surge in price) or a sudden loss of faith in centralized fiat currencies. The duration of the phases is parabolic. Phase 1 takes the longest, and phase 4 goes the fastest.

We are going to describe every phase.

| BITCOIN Money flows into this coin, causing price surges. Everybody is buying. The sentiment is highly positive. |

| ETHEREUM Money is going to Ethereum, and it starts outperforming Bitcoin. At this time, if you invest in ETH, your profits are going to be higher. |

| LARGE CAPS Money is flowing to the top market cap coins, and these are starting to go parabolic. Solid projects like Litecoin, Cardano, Quantum, EOS are booming. |

| ALTSEASON Large-cap have been outperforming Bitcoin and Ethereum.Mid-cap, low-cap, and micro-cap tend to grow at the same time.Memes are everywhere, and everyone is super excited about it. You feel the mania in the air. |

Ok, let’s analyze the chart. Since April 1st, the dominance of BTC broke the support and started to fall from 60%, and by April 16 reached 52%. Look at the chart below.

What does it mean when this indicator falls?

It means that altcoins will perform better as investors are putting money into, other good projects. Let’s see an example below.

Since the first day of April LTC rose 52% and BTC just 4.4%. This shows that the theory of alt season is true, Altcoins are being more attractive to traders, and money goes into them.

If you are investing, you have to be cautious when the dominance index is high because when the king of the cryptos falls, the rest of the market will move down in a higher percentage. Look at the example in the chart below.

On January 10/2021, the dominance was 70%. BTC price fell 24%, at the same time, LTC -36%, that is 12% more. If you had invested in Litecoin in those days, you had lost more in percentage.

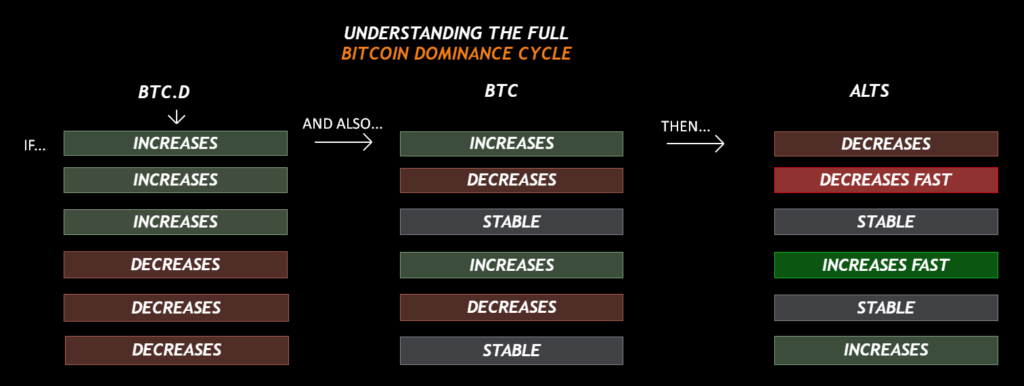

Understanding the full cycle

I made a detailed and simple-to-understand table to explain what happens with alts every time the BTC index and price move.

Remember, it is not always like that, but it is what we can expect in the market.

Summary: why do traders use the BTC Dominance Index?

● To obtain information about the market, more specifically, the sentiment of traders. The price of any asset is a function of supply and demand, so it effectively measures demand in relation to the rest of the projects.

● To predict periods of cryptocurrency alternatives, called Altseason.

● To manage market risk. If the value of altcoins starts to fall and Bitcoin does a much better job of maintaining Its value, you could interpret this that investors are buying it as a refuge.

Final thoughts

So far, experience seems to indicate that altcoin seasons are periods of big gains in a short period. But by the time the market reverses, the dips are usually the same vertical as the rises, especially for newer tokens. For that reason, I recommend you to stay away from meme-shit coins because it is high risk. It is better to invest in projects with functionality or use cases.

The recent rise of decentralized finance (DeFi) has played a major role in the decline of Bitcoin’s market dominance. This is evident from the significant growth that the tokens of this ecosystem have reported in the last months. Coins like AAVE, MATIC, CAKE have increased in price incredibly, generating good returns.

Broadly speaking, Bitcoin dominance and altcoin season are indicators that can help gauge market sentiment in the short term. With both being inversely related, a greater BTC dominance will likely cause fewer profit opportunities in the alternative coins.

Despite the extraordinary performance that altcoins are providing today and that they are capturing the attention of thousands of investors around the world, analysts remember that the crypto market is variable and is always in constant motion, so changes can occur important ones from one moment to the next, that bring Bitcoin to the spotlight again.