Holderlab claims to provide advanced portfolio management with features like optimization, correlation evaluation, rebalancing bot, social portfolios, and more. This platform supports many exchanges and allows analyzing of data from different exchanges under a single window. The automated platform assures a ready-to-use portfolio in just 5 minutes.

What is Holderlab?

Other than the info about the domain being registered from 2019 to 2022, there is no info on the company present. We could not find the year of establishment, developer/team member info, location address, phone number, etc. From the info available on the official site, this crypto portfolio management platform aims at providing an efficient instrument for crypto users with its easy setup and diverse features.

How does Holderlab work?

The software is fully automated and uses the correlation matrix and optimization as its operating technique. The application helps you check your portfolio’s correlation which is influenced by the big crypto coins and stable coins you have. It also allows backtesting using rebalancing approaches, optimization with the Markowitz method, and copying of other user portfolios in addition to displaying your own in the community.

How to use Holderlab?

The steps below help you to get started with Holderlab:

1. Visit the official site and click on the Get Started option.

2. Enter the required information like your email, password, name, etc.

3. Click on the Go button once you have read and accepted the terms and conditions.

4. You will receive a verification link in your email. Click on the link.

5. Your account is active now. You can login and begin using the software.

Security of Holderlab

The company uses 256 hash encryption for storing keys. Other than this there are no other details on the security measures the company uses to safeguard user data.

What crypto exchanges does it support?

At present the automation software supports 11 crypto exchanges shown below:

Deposits & withdrawals

The service helps in creating, analyzing, and rebalancing your crypto portfolio. It does not have withdrawal and deposit features.

Holderlab fees

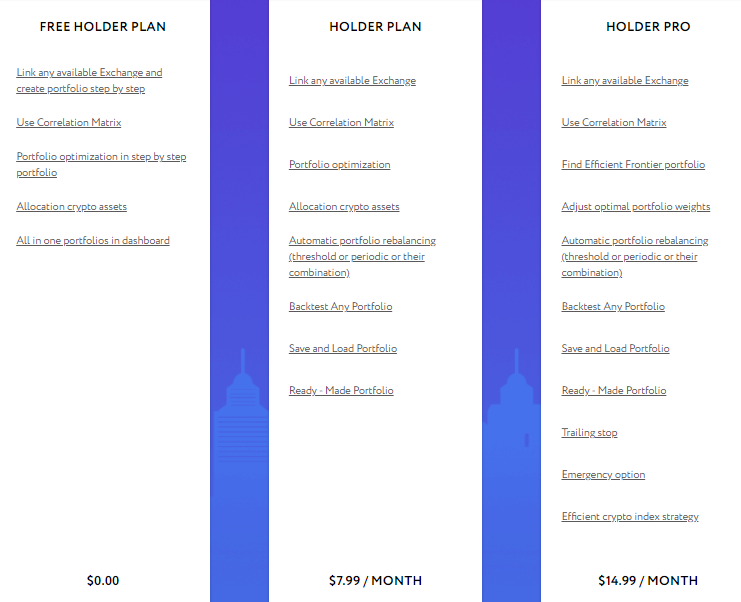

The various fee plans the company offers for users are listed below:

Free plan

With the free plan, you get features like linking to an exchange and establishing a portfolio, use of a correlation matrix. Optimization and allocation of assets are also part of the allowed features.

Holder plan

Under this plan, you have to pay a monthly subscription of $7.99. In addition to the features found in the free plan, you get programmed rebalancing, backtesting, and a ready-made portfolio. You can also save and load your portfolio.

Holder pro

To use this plan, you have to pay a monthly subscription of $14.99. Additional features available with this plan include the emergency option, trailing stop, and a capable crypto index method.

Quick summary of Holderlab

The key features of this crypto portfolio management software are:

- It can identify uncorrelated or weak crypto coins and help create a diversified list.

- With the optimization feature, you can use the Markowitz method for forming the right portfolio concerning the risk and profitability.

- The platform allows you to make changes to your portfolio weight and pick a rebalancing time.

- You can use the backtesting to include or exclude crypto coins from your portfolio.

Key details of Holderlab

| Headquarters | N/A |

| Founded in | N/A |

| Listed Cryptocurrency | N/A |

| Supported Fiat Currencies | USD |

| Trading Pairs | N/A |

| Supported Countries | N/A |

| Minimum Deposit | N/A |

| Deposit Fees | N/A |

| Transaction Fees | $7.99-$14.99/month subscription |

| Withdrawal Fees | N/A |

| Customer Support | Online contact form |

Customer support

An online contact form is available for support. The vendor provides social media links for Twitter, Facebook, and Telegram.

Is Holderlab legit?

From the info provided on the official site, the platform has a registered domain from 2019 up to 2022. We found two user reviews for the company on the Trustpilot site with a rating of 3.8/5. From the testimonials, it is clear that the customers are happy with the firm.

Final word on Holderlab

Final word on HolderlabPros

- Diverse features

- Free subscription plan

Cons

- API keys needed for linking portfolio to exchanges