Voltswap is the first exchange on the meter blockchain and is a community-driven service that allows swapping tokens and adding liquidity to the pools. The DEX claims to provide lightning-fast transactions and ERC721 contract-based smart wallets on top of the layer 2 scaling platform. We will review the service in our article and list all its benefits and demerits so you can have an idea of investment.

Voltswap overview

Voltswap has the following features:

- Forum for governance discussion

- More cross liquid mining programs

- Low gas transaction fees

- No KYC restrictions

- Maximizing liquidity mining

As the exchange is decentralized, traders from all corners of the world can participate in trading. It currently supports VOLT as the governance token for the meter ecosystem.

Traders can purchase VOLT tokens by depositing money in their wallets. Currently, the supported options are Metamask, ledger, Trezor, and wallet.meter.io. It is also possible to transfer funds from CEX or bridge them via meter or theta mainnet.

How does Voltswap work?

Voltswap allows for all the following:

- Swapping tokens

- Adding liquidity to the pools or creating a new farm

- Earn APY and maximize yields

- It is front running resistance allowing providing security for retail traders

What can you buy on Voltswap?

The governance token in the exchange is VOLT. Traders have the option to buy a range of tokens, including BNB, MOVR, MTR, MTRG, USDT, USDT, VOLT, WBTC, and WETH.

Is Voltswap safe?

As Voltswap is a decentralized exchange, it is prone to attacks from hackers. No regulatory authorities are looking over the DEX, and traders are prone to losing their funds.

Voltswap fees, compatible wallets, and transactions

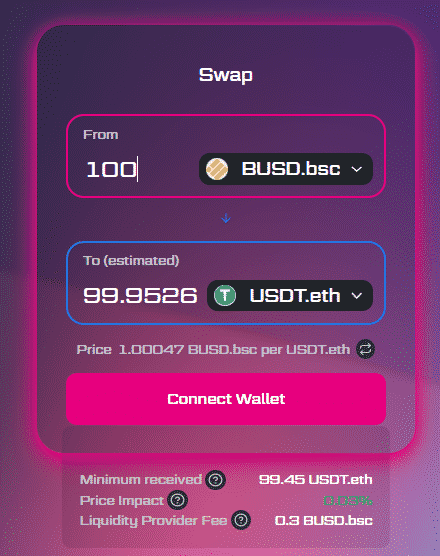

The liquidity provider fees are charged on the DEX, which can vary while swapping tokens. For example, exchanging 100 BUSD to USDT will incur 0.3 BUSD.

The compatible wallets with the exchange are Metamask, ledger, Trezor, and wallet.meter.io. A 0.3% fee incurs for each transaction on Voltswap. The liquidity providers get 0.25% while the rest is distributed to the volt staking pool.

The team also provides a smart wallet design that uses ERC721 NFT, allowing investors to subscribe to multiple liquidity mining programs without removing funds. On the platform, only liquidity stacking and unstacking options are at hand without the choice of harvesting. The transactions are fast and include low gas fees.

What are the ways to trade on Voltswap?

Traders have the following options available on the Voltswap for trading:

- Swapping tokens with one another

- Adding or removing liquidity

- Swapping assets from different chains

- Earn tokens via liquidity mining program

- Get APY and maximize their profits

As the community drives the program, investors have the option to submit and vote proposals for any new listings. The platform supports staking and liquidity mining to help community members’ engagement. The cross-chain functionality is helpful in staking through multiple chains.

Customer support

The decentralized exchange has its own Telegram group, which anyone can join. It is possible to ask questions to the general community. Unfortunately, there are no live chat options available on the website.

The DEX first came into existence on September 9, 2021, by Meter.io. There is no further information on the developers and their whereabouts. The authors aim to introduce more improvements in the coming times.

Should you trade with Voltswap?

Voltswap summary

Voltswap summaryPros

- Low gas fees and fast transactions

Cons

- Customer support is available via Telegram only

- Complex for beginners