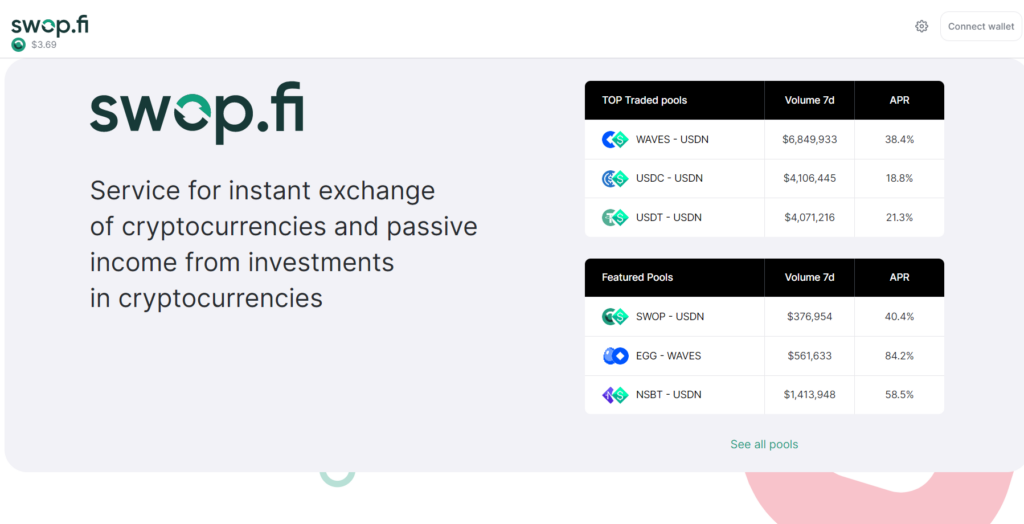

Swop.Fi is an Automated Market Maker that allows for the addition of transactions to the network within a few seconds while offering a low network fee for invoking smart contracts. It merges different types of pools with distinct price calculation formulas for distinct pairs. The platform was launched in February 2021.

Swop.Fi overview

Here are the key features of this exchange:

- Supported cryptocurrencies and countries

The tokens supported by this platform include USDAP, BTC, WX, BAG, USDT, LTC, ETH, and BTC. It supports different languages like English, Russian, and Spanish.

- Native token

SWOP is the native token of this exchange. You can stake share tokens and receive rewards in SWOP. This token can be staked and invested in the SWOP-USDN pool.

- Funding methods

To exchange tokens on this platform, you need to have WAVES tokens in your wallet. The minimum amount is 0.005 WAVES.

- Wallets supported

To use this DEX platform, you need a Waves wallet account. You can sign in via Exchange Email, Exchange Seed, or the Waves Keeper browser extension. It is also possible to sign in through the Ledger Nano S or Ledger Nano X device.

How does Swop.Fi work?

Swop.Fi lets you do the following things:

- Exchange tokens

After connecting your wallet, you can visit the Exchange tab to swap tokens. Here, you need to remember that price impact increases with the number of tokens traded. Thus, you should not conduct large transactions through this service. The price may change in case other individuals make swaps before you.

- Add liquidity

You can become a market maker by investing in a liquidity pool. This gives you a share token that represents your share in the pool. You can replenish the pool with both tokens having the same ratio as on the smart contract. Alternatively, if the price varies with the present market price, you can replenish it with a single token. You get a portion of the accumulated liquidity when you withdraw liquidity.

- Farm SWOP tokens

You can stake share tokens to receive incentives in the form of SWOP. This in turn can be staked for farming rewards in the form of the SWOP governance token. Stakers can vote for the distribution of rewards in the liquidity pools. This also lets you vote for or against a new pool being added.

What can you buy on Swop.Fi?

This DEX platform is built on the Waves blockchain. This network lets you create and trade crypto tokens without extensive smart contract programming. The most popular assets on this platform include WAVES, BTC, ETH, CRV, SIGN, WEST, USDC, USDT, and USDAP.

Is Swop.Fi safe?

This exchange uses the Ride language for smart contracts, which is considered secure. It has been audited by fairy proof and by Dmitri Pichulin. The auditors did not find any critical vulnerability with the system.

User reviews

We were not able to find any customer reviews for this exchange on third-party websites. Without them, it is impossible for us to determine how the general experience of users has been with this platform.

Swop.Fi fees, compatible wallets, and transactions

The standard fee is 0.3% of the amount exchanged. For USDC-USDN and USDT-USDN, the fee is 0.05%. Liquidity providers are rewarded with 60% of the fees, while the system uses the rest to purchase SWOP and incentivize SWOP stakers with governance incentives. You must have a Waves wallet in order to perform transactions on this platform.

What are the ways to trade on Swop.Fi?

Once you have connected your wallet via Waves Exchange or Waves Keeper, you can navigate to the Exchange tab to trade in tokens. You need to select the crypto pair and enter the amount to be paid. Once you review the estimated amount, you can click on Swap to finalize the transaction. From the settings, you can modify the slippage tolerance.

Customer support

Swop.Fi has an official Telegram group that you can join. You can also get in touch with the team using messaging apps like QQ and WeChat. There is no official email address for the support team.

Should you trade with Swop.Fi?

Swop.Fi summary

Swop.Fi summaryPros

- Instant exchange of assets

- Passive income for liquidity providers

- Security audits passed

Cons

- Only Waves wallets supported