Karura Swap is a non-custodial, automated market maker decentralized exchange that runs on the Karura network. The DEX allows users to transact native Substrate tokens and ERC-20 tokens. Liquidity provision is one of the main activities that provide the platform with the liquidity it needs to facilitate trades.

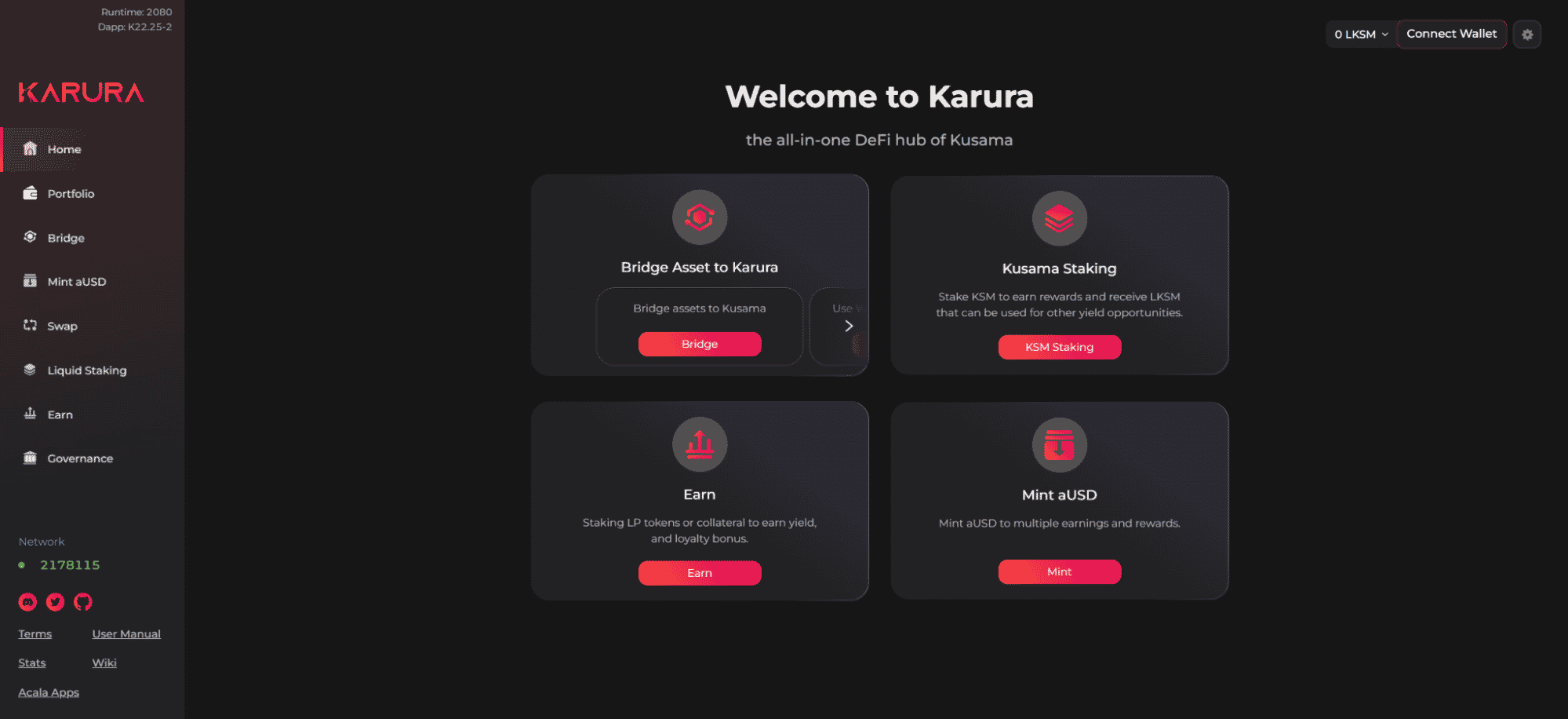

Karura Swap overview

The platform is characterized by several features, which are described below:

Trades without intermediaries

The Karura network protocol allows users to interact with themselves directly without involving any third party.

Supports numerous token pairs

With Karura Swap, it is possible to transact directly between multiple token pairs that are continually added to it.

No exchange crashes

Unlike centralized exchanges, this DEX’s performance will not degrade when the market is very volatile to the extent of causing service outages. Therefore, you will always be able to access your assets and transact during these periods.

Liquidity in illiquid markets

The DEX’s design enables traders to place trades anytime when the markets are illiquid.

How does Karura Swap work?

The exchange supports the following activities:

- Bridging assets from one network to another

- Staking tokens

- Minting

- Swapping different tokens

- Participation in governance

What can you buy on Karura Swap?

Find below a list of assets you can work with on the platform:

- BNC

- USDC

- ARIS

- USDT

- KAR

- KSM

- CSM

- QTS

- RMRK

- KBTC

- KINT

- PHA

- TAI

- Etc

Is Karura Swap safe?

As mentioned before, Karura Swap is trustless. This means that it doesn’t entrust your funds to a third party. All assets are in your custody, and you are solely responsible for protecting them. However, you may be prone to impermanent loss or slash risks when you provide liquidity and engage in liquidity staking.

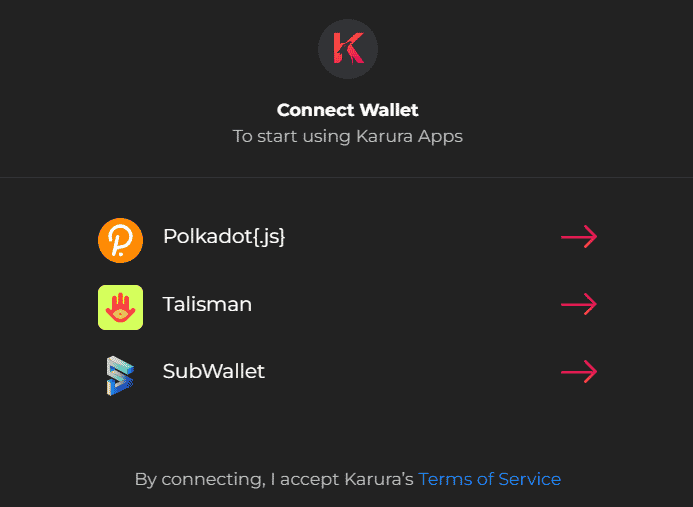

Karura Swap fees, compatible wallets, and transactions

Karura Swap connects with three main wallets. They are Polkadot, Talisman, and SubWallet. Each trade you conduct on the platform is subject to a 0.30% fee.

What are the ways to trade on Karura Swap?

There are several trading options available to traders:

- Staking

Users can stake KSM (Kusama Network’s native cryptocurrency) and earn a yield on their KSM tokens, as well as safeguard the network.

- Liquid staking

Unlike regular staking, this trading option permits you to access your staked KSM liquidity. In other words, you will not be required to unstake and sell your KSM to access liquidity. Therefore, it is possible to mint LKSM and borrow against LKSM so as to produce kUSD. You will still be able to keep your KSM and earn staking rewards.

- Liquidity providing (LPing)

As a user, you are allowed to provide liquidity on the platform and earn a small percentage of the trading fees for the pair you supply liquidity to.

- Swapping

The platform supports the trading of different tokens so that users can earn money from fluctuations in price.

Customer support

You can join the company’s Telegram or Discord to receive customer support. Several tutorials and FAQs are available to help you navigate the platform with much ease.

Should you trade with Karura Swap?

Karura Swap summary

Karura Swap summaryPros

- Support for many tokens

- It is not prone to exchange crashes

- No registration is needed

Cons

- Impermanent loss and slash risks are present

- High trading fees