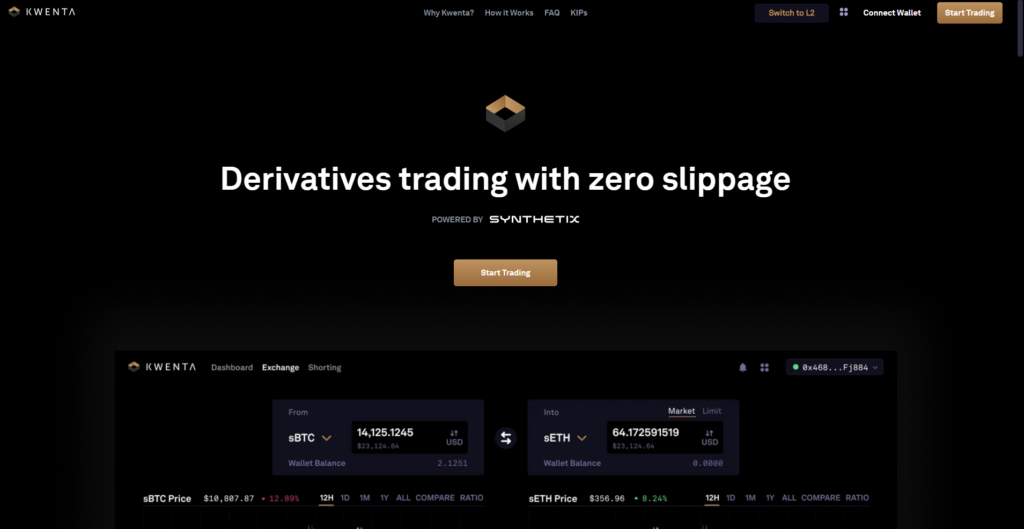

Kwenta is a platform that works with the Synthetix protocol that allows avoiding creating an account, depositing or withdrawing, and surrendering custody of our funds. Kwenta is a decentralized exchange (DEX) on which you can trade Synths (which can also be traded across a variety of DeFi protocols). Unlike other DEXs, the exchange does not have an order book and instead utilizes peer-to-contract trading, meaning all trades are executed against a smart contract. So, we can expect a proper level of safety, executing speed, and relevant levels of fees and commissions.

Kwenta overview

We have prepared a list of features to work with in the following list:

- The Kwenta devs are going to release a native token – KWENTA in the first quarter of 2022.

- We have to trade only synthetix pairs: sUSD, or we can use Uniswap or DEX.AG to exchange ETH for sETH or sUSD to trade on Exchange.

- We have synthetic assets that collateralize more value than represent.

- Those synths are created after user stack collateral and mining synth asses against them.

- We don’t know if average traders understand what the developers are going to say.

- Synth is essentially debt against the posted collateral.

- Synthetic assets are derivatives that are based on blockchain.

- This allows them to work with common financial instruments from a decentralized platform. This is a safe way to attract Forex traders to trade also crypto assets.

- All trading activities go on peer-to-contract, using the Synthetix protocol’s pooled liquidity model.

- Zero Slippage is based on the fact that we don’t need to move the order book and being affected by slippage.

- Trading is possible when all orders are performed against the Synth smart contracts. As a result, traders don’t care about such limitations like peer to peer trading models, liquidity, slippages, and order books.

- We can trade one Synth against another one instantly.

How does Kwenta work?

- We can deposit our tokens and exchange them in synthetic ones.

- Kwenta is on the Ethereum blockchain, so we need a web3 wallet with ETH in it as gas to pay for transactions to be processed.

- To start trading, we need a synthetic asset derivative supported by Kwenta, known as Synths. The most accessible Synth is sUSD, which can be purchased on dApps such as Uniswap, Curve, or 1inch.

- We can use Kwenta to trade the full range of Synths.

The system allows us to work with different derivatives. We can work with the Ethereum based derivatives: unique indices, traditional equities, commodities, Forex, cryptocurrencies, and short positions.

What can you buy on Kwenta?

We can work with sUSD, sEUR, sJPY, sAUD, sGBP, sCHF, sKRW, sBTC, sETH, sLINK, sADA, sAAVE, sDOT, SETHBTC, and sDEFI.

Is Kwenta safe?

The system can be safe. Anyway, to work with it, it’s up to you.

Kwenta fees, compatible wallets, and transactions

We can work with various wallets: Browser Wallet, Trezor, Coinbase Wallet, Portis, Torus, Ledger, WalletConnect, Lattice, Gnosis Safe, and Authereum. The devs claim that the slippage is 1% for a transaction.

What are the ways to trade on Kwenta?

Kwenta works with Optimism as well as L1, offering users low gas fees and near instant transactions.

Customer support

The support looks average where the devs answer within 5-9 hours averaly. They usually use Telegram and Discord to connect with the community.

Should you buy a Kwenta token?

Kwenta summary

Kwenta summaryPros

- Tokens will be able to be bought when they get released

- We can trade crypto and fiat without registration

- Trading without slippages

Cons

- The platform looks mediocre

- No stacking provided

- No pools to deposit available

- Lack of people’s testimonials