Raydium is a DEX platform enabling quick transactions, new ways to earn yields and shared liquidity. It can access the central order book of Serum, thus offering low gas fees and adequate liquidity. Apart from trading, it also lets you earn incentives through staking. It was founded by an anonymous team in February, 2021.

Raydium overview

Here are the main features of this exchange:

- Supported cryptocurrencies

This platform supports a wide range of crypto assets. These include popular choices like BTC, ETH, LITTE, RAY, SOL, MATH, DALI, etc.

- Native token4

The native token of this DEX is known as RAY. You can earn them by staking and farming liquidity pools.

- Funding methods

You can swap one SPL token for another on this exchange. For this, you are required to connect your wallet.

- Wallets supported

Raydium supports a large number of wallets through which you conduct transactions. Some of the choices include Phantom, Solflare Extension, Solong, Bitpie, Slope, and Safepal.

How does Raydium work?

This platform lets you do the following things:

- Swap coins

You can trade tokens while enjoying features like limit orders, access to an order book, and advanced charting tools.

- Add liquidity

You can add two tokens at a time to the liquidity pool. This will provide you with LP tokens that represent your share of the pooled coins.

- Stake in Raydium farms

There are multiple Farms on this platform. By adding liquidity to these farms, you can earn RAY and project tokens, depending on the type of farm chosen.

- Stake RAY

You can stake your existing tokens to earn more. You will be able to view the pending rewards and can unstake the coins any time you wish.

- Create a pool

You can build a liquidity pool via permissionless pools. After that, you can trade it on the swap interface. The pairs supported must include tokens like USDT, USDC, SRM, RAY, and SOL.

What can you buy on Raydium?

This DEX is based on the Solana blockchain. It is a public blockchain network using a proof of stake protocol. Some of the popular coins on this platform include Solana, Solice, Prism, Star Atlas, Invictus, Serum, Tether, Bitcoin, and Ether.

Is Raydium safe?

There is not much information available on the security features of this DEX. At this moment, there is an ongoing audit being performed by Kudelski Security. This means the platform has not yet been audited and it lacks some of the advanced safety features offered by other platforms.

User reviews

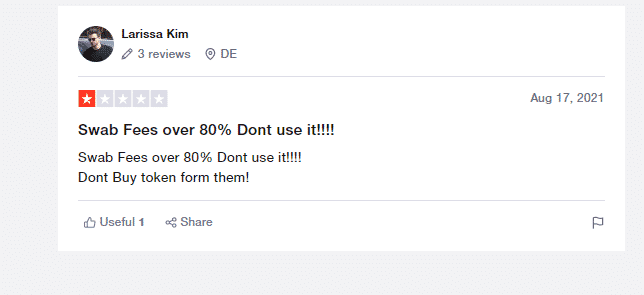

There is only one review for this DEX platform on Trustpilot. Here, the user has complained about the high swap fees. Since it is a new exchange, not many people are currently using it for conducting trades.

Raydium fees, compatible wallets, and transactions

You can collect different wallets to this platform such as Phantom, Solflare Extension, Sollet Web, Sollet Extension, Ledger, MathWallet, Solong, Coin98, Blocto, Safepal, Slope, Bitpie, and Solflare Web. For each transaction conducted through this exchange, there is a 0.25% fee out of which 0.22% is used for incentivizing liquidity providers and the rest goes to RAY token stakers as their reward.

What are the ways to trade on Raydium?

First, you need to navigate to the Swap tab and link your wallet. Next, you must choose the coins to be swapped. After entering the amount, you have to confirm the transaction. Your order will not be canceled if the price exceeds the slippage tolerance. After confirmation, you can view your balance. Another way to trade is through a limit order where you need to specify the limit price and the amount. The transaction will get activated once the price reaches the specified value.

Customer support

There is no support team for this DEX. You can check out the help docs if you need assistance. Also, you can drop your queries on the official Telegram and Discord channels of this platform.

Raydium summary

Raydium summaryPros

- Order book access

- Swift processing of transactions

- Integration with Serum DEX

Cons

- No interaction with other DEX platforms

- Lack of vendor transparency