OolongSwap is a decentralized exchange that was built around the Boba network. It’s the last Ethereum’s L2. The platform provides all features we can need from a common exchange, adding Protocol Controlled Value (PCV) in its DeFi 2.0. The system provides the best possible level of liquidity to the swapping, trading, and pools.

OolongSwap overview

- OolongSwap is a deventilezed network that grew from a liquidity hub of Boba Network.

- The developers aimed to be the safest, smoothest, and useful platform ever built.

- They provide the best trading experience, fees, lowest slippage, and all liquidity that we need.

- It wanted to be a portal between the Boba network and other blockchains.

- We can trade tokens in various pairs at the best rate.

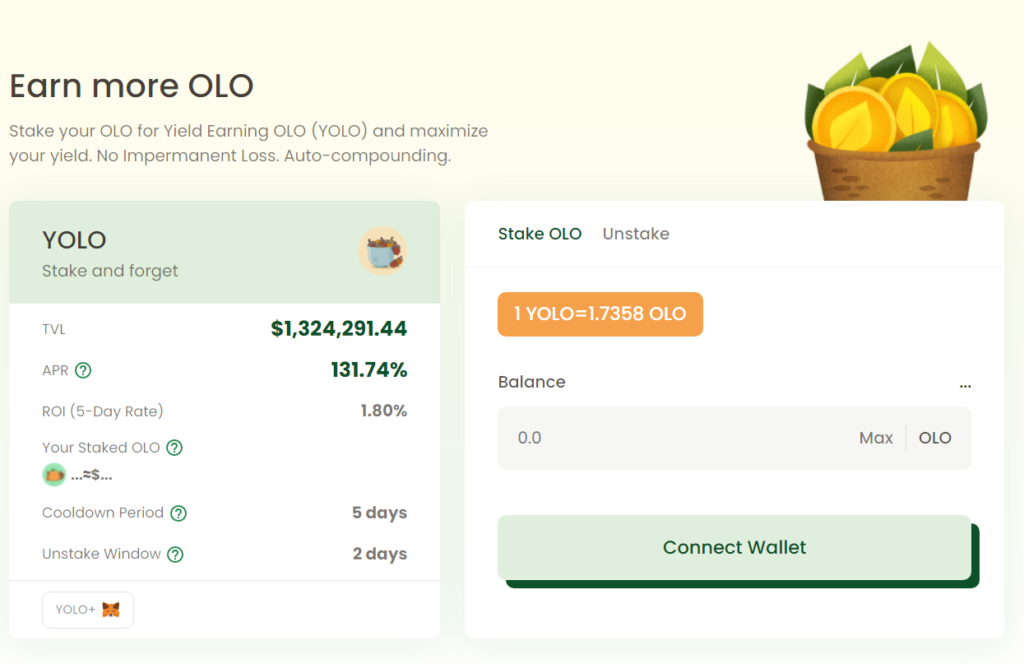

- Staking of OLO and YOLO is possible either.

- We are allowed to purchase discounted OLO and earn high interest through Oolong bonding.

- Oolong (OLO) has a price of $0.0085.

- The total volume is $890M.

- The total liquidity is $50M.

How does OolongSwap work?

- Common trading and swapping is available at the best rates and slippages.

- We can purchase OLO and YOLO tokens.

- We are allowed to participate in the bond program.

- There are native tokens stacking possibilities available.

- We can bring our margin to the liquidity pools.

- We can add various liquidity like ETH-OLO to pools.

The pool functionality looks common. We have some of them: OLO-WETH, TVL $859,197, APR 282.36% +1.38%. OLO-USDC, TVL $375,246, APR 232.46% + 1.45%(LP), BNB.a-WETH, TVL $356,342, APR 15.30% + 3.95%(LP), BUSD.a-USDC, TVL $952,356, APR 11.45% + <0.01%(LP), and others. So, the profitability looks interesting.

What can you buy on OolongSwap?

The platform provides us with swapping coin possibilities. There’s only one slippage level – 1%.

There’s a staking option for YOLO. TVL $1,324,291.44, APR 131.74%, ROI (5-Day Rate) 1.80%, Cooldown Period 5 days, Unstake Window 2 days. 1 YOLO=1.7358 OLO. So, the requirements look average among other DEXs’ tokens.

We can receive OLO at a discounted price. USDC Bond Price is $0.0085, ROI is 0.49%, Purchased $34,274. USDC-OLO Bond Price is $0.0082, ROI is 4.04%, and Purchased $28,373.

Is OolongSwap safe?

Most likely, the platform is safe because we should proceed with registration providing our details.

OolongSwap fees, compatible wallets, and transactions

- The developers work with the dynamic fees. The default ones are 0.3%. The gov protocol can set fees for any pair as low as 0.01% or as much as 1%.

- The fees are set by the government.

- We can work with Boba Gateway, Anyswap, Synapse, BoringDAO, and Celer Network.

What are the ways to trade on OolongSwap?

We can trade OLO and YOLO on Binance, Coingecko, Coinbase, and other platforms.

Customer support

The developers provide support via email, Telegram, and Discord.

Should you buy a OolongSwaptoken?

OolongSwap summary

OolongSwap summaryPros

- The platform doesn’t require us to register on it

- Native tokens available

- Various staking and farming possibilities provided

Cons

- Pool profitability is low

- The platform is built on the young Ethereum L2 protocol

- Lack of people testimonials