NearPAD is a decentralized exchange that was built based on the Near blockchain. The site doesn’t look informative and doesn’t provide us with extended information about how the service functions. Nevertheless, let’s check and analyze the info we are provided. We don’t know details about their location. The service was launched in 2021.

NearPAD overview

- The service has a DeFi ecosystem that allows us to participate in it, stake government tokens or provide our liquidity within the liquidity pools functionality.

- There’s a PAD native token that allows us to join pools.

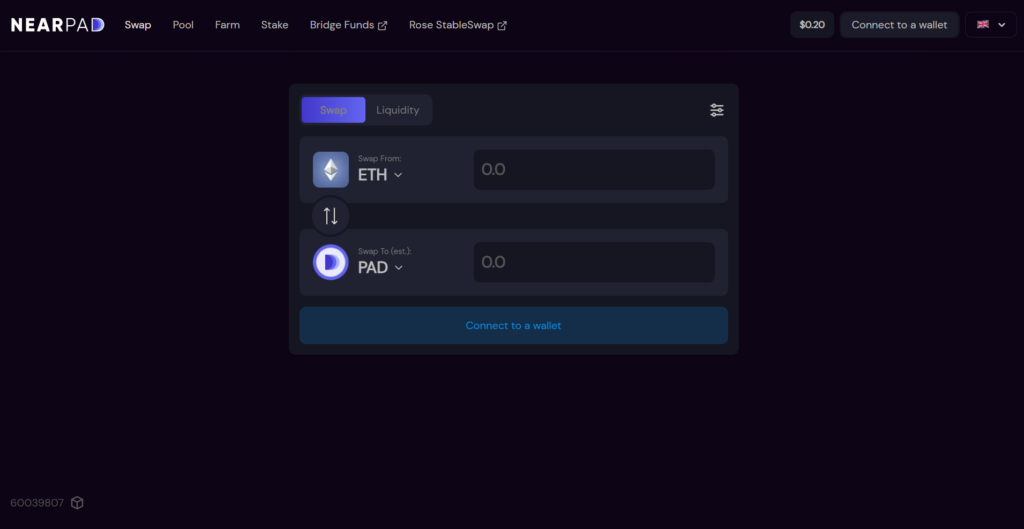

- We can swap the following: MNFT, ManuFactory, MODA, NEAR, PAD, ROSE, TRI, USDC, USDT, WBTC.

- It’s possible to work from any country that supports crypto trading and crypto assets owning.

How does NearPAD work?

Let’s talk about the available information about the system and its functionality.

- There is a total value locked of $3,877,396.

- The PAD token is ERC20 executive token.

- The current price is 1 PAD=$0.25.

- We will have 150,000,000 tokens issued.

- The platform provides us with liquidity pools.

- We can bring our margin to earn 0.25% fees as rewards from all trades executed on the platform.

- Those coins will be shared proportionally.

- Adding fees into the pool is going on automatically.

- We can claim them when we click to withdraw.

- We have various pools like: PAD/egEUR, 230% APR, PAD/MNFT, 221% APR, PAD/WETH, 198% APR, PAD/FRAX, 182% APR, MODA/PAD, 178% APR, PAD/NEAR 176% APR, PAD/atLUNA, 170% APR, PAD/TRI 167% APR, USDT/PAD, 164%.

- We can get the best yield possibilities.

- For this purpose we have to stack PAD to get iPAD tokens.

- The rewards provided as iPAD tokens.

- When we are going to withdraw our tokens they are turned into PAD.

- Also, we have to rely on having corgi rights.

- The pool parameters is PAD, 6.54% APR.

- The token costs 1 iPAD=200.7841 PAD.

What can you buy on NearPAD?

- We can purchase tokens within the swap functionality.

- There’s a possibility to purchase PAD tokens.

Is NearPAD safe?

There are common risks that the pools can be exploited or tokens will go down in pricing and APR can’t cover this.

NearPAD fees, compatible wallets, and transactions

- We can rely on getting 0.25% from swapping fees.

- The platform supports the following wallets: Metamask, WalletConnect, and Coinbase Wallet.

What are the ways to trade on NearPAD?

We can work with it on the pretty known platforms like: Binance, Coinbase Pro, Kraken, and others.

Customer support

There’s average support via Telegram and Discord. So, we can expect that our questions will be answered within several hours.

Should you buy a NearPAD token?

NearPAD summary

NearPAD summaryPros

- The common services are available

- We can stake tokens for getting more then as rewards

Cons

- No team revealed

- No risk advice given

- No documentation about the DEX provided

- No people's feedback available