Mars Ecosystem is a decentralized exchange that includes the DeFi platforms such as Mars Swap and Mars StableSwap. The developers suggest we invest in USDm that performs the basic functions of a stablecoin being a medium of exchange and store of value. So, the platform looks well-designed. Let’s check it out.

MARS Ecosystem overview

We have many details about its functionalities explained in the documents by the devs. So, we have systemized the most important features, details, and explanations in the following list:

- The platform provides us with standardized services like swapping, depositing, trading.

- We can also enjoy a lottery feature.

- Here, the liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool.

- The fees are brought to the pool in real time.

- Mars Swap is a Uniswap-type AMM DEX (Automated Market-Maker Decentralized Exchange).

- There’s their own token – USDm.

- We can use them in the staking and depositing programs.

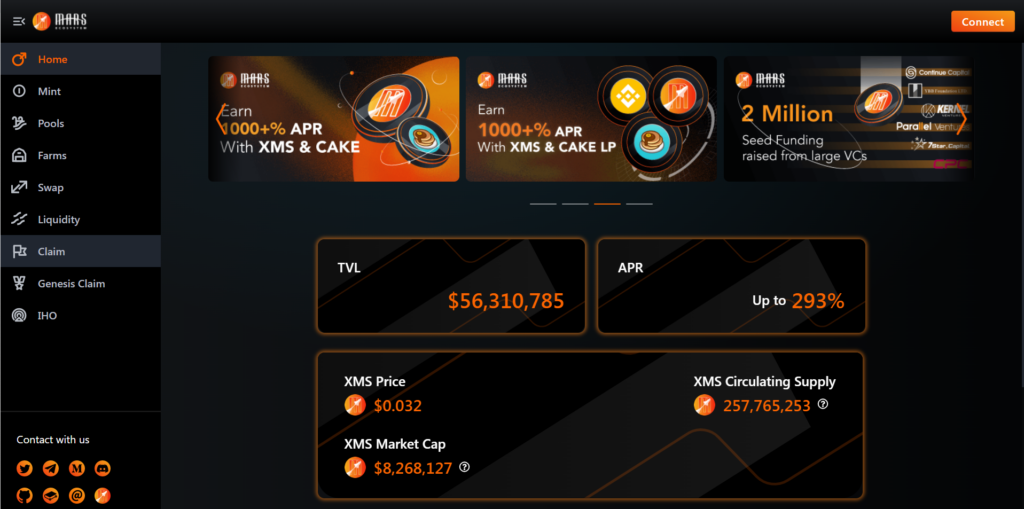

- There’s a government token – XMS.

- Decentralized stablecoins is still less than 10% of the total stablecoin market.

- The potential for decentralized stablecoins is significant.

- It has to run truly decentralized operations.

- The platform provides high price stability, a high degree of decentralization, and scalability.

- Mars ecosystem includes three parts: Mars Treasury, Mars Stablecoin and Mars DeFi protocols.

- There are features like Treasury assets classification, Mintage control, Anti-“bank run,” Integrated native stablecoin within the DeFi protocol, Treasury assets classification.

- Minting provides us with a possibility of putting $1 to get 1 USDm.

- Redeeming works on giving us back $1 after and destroying 1 XMS/USDm.

- The maximum circulating supply of USDm is determined and controlled by the market cap of XMS.

How does MARS Ecosystem work?

- We can mint/redeem USDm stable coins.

- The platform allows us to purchase XMS native tokens.

- There’s staking possibilities for XMS.

- We can swap coins.

- We are allowed to deposit coins.

- There are two-coin pools available: USDm – XMS, USDm – BNB, USDm – BTCB, USDm – LTH, USDm – CAKE, XMS – XMS (staking). We can check how much we earn, APR%, liquidity, details.

- The list of farms on MarsSwap includes: XMS – USDm, XMS – BNB, etc. that vary by APR%, liquidity, and details.

- There are claim farms, PARK IHO tokens, XMS IMO tokens events available.

- The platform issued two initial holder offerings of XMS and PARK tokens.

Mars Ecosystem (XMS) IHO parameters:

- IHO target: 709,782 BUSD

- IHO committed: 668,247 BUSD

- IHO price: 0.045 BUSD

- ATH price: 1.45 BUSD

- ROI: 3122.22 %

Parking Infinity (PARK) IHO parameters:

- IHO target: 9,000,000 XMS

- IHO committed: 42,278,460 XMS

- IHO price: 0.18 XMS

- ATH price: 0.98 XMS

- ROI: 444.44 %

What can you buy on MARS?

We can swap tokens within the platform functionality. We should choose slippages that we are ready to tolerate. The system allows us to mint USDm from other coins.

Is MARS Ecosystem safe?

The platform looks safe and stable. We have no negative comments about it.

MARS Ecosystem fees, compatible wallets, and transactions

- The transaction fee on Mars Swap is 0.3%

- 0.25% of those 0.3% goes to liquidity providers.

- 0.05% goes to XMS holders who stake XMS at Mars Swap.

- We can use the following wallets: MetaMask, Trust Wallet, Match Wallet, TokenPoket, WalletConnect, Binance Chain Wallet, SafePal Wallet, ONTO Wallet.

What are the ways to trade on MARS Ecosystem?

We can trade XMS tokens on platforms like Binance or Kraken.

Customer support

The devs provide support within Telegram, email, and forum functionality.

Should you buy a MARS token?

MARS Ecosystem summary

MARS Ecosystem summaryPros

- Native token released

- The platform has its own stable coin

Cons

- No team revealed

- Lack of provided pools

- No people’s testimonials written