Crema Finance is a decentralized exchange that is developed on the Solana blockchain offering superior performance for crypto traders and liquidity providers. It comprises four modules namely a concentrated liquidity market maker, an NFT liquidity farming, a smart router, and veCRM-driven DAO governance. We could not find info on the vendor such as the founding year, location, team members, etc. as the vendor does not divulge company info on the official site.

Crema Finance overview

Some of the key features of the DEX are listed below:

- The CLMM feature improves the strategy flexibility in capital injection which the vendor terms as programmable liquidity that can increase with the increase in capital efficiency.

- The CLMM feature is 50x more efficient when compared to the conventional AMMs.

- Users get transaction fees and liquidity farming rewards as incentives to attract LPs for long-term liquidity contribution.

- Traders will find a better market depth, stable prices, and lower slippage.

- Flexible ordering mode is present which allows users to add a single-side asset in a specified price range that is similar to the limit order method used in centralized exchanges.

- The CLMM Crema pools can be integrated into the pools of the developer .

- A full SDK is provided to simplify the integration complexity for external parties allowing them access to the historical and liquidity info on the Crema pools.

- CRM is the official token of the DEX designed for governance and value accrual.

- veCRM is a vote-escrowed CRM and a non-standard SPL token.

How does Crema Finance work?

The DEX allows for the following:

- Users with vCRM will get a percentage of the DEX’s revenue which is determined by DAO. This includes 50% of the earnings of the platform. This includes CLMM Swap, fees for cross-chain transactions, and pool setup.

- veCRM holders get to boost their farming rewards up to 2.5x whenever they perform a deposit, withdrawal, etc.

- The governance token holders can start or vote for DAO proposals with their power based on the balance of tokens they have.

What can you buy on Crema Finance?

This DEX works on the Solana blockchain. The main tokens you can buy on the DEX are:

- SOL

- USDT

- USDC

- UST

- PAI

- USDH

- pUSDT

- pUSDC

- and many more

Is Crema Finance safe?

The vendor does not reveal info on the security measures that the DEX uses such as data encryption, two-factor authentication, audits, etc.

Crema Finance fees, compatible wallets, and transactions

The main wallets the DEX supports include most of the Solana wallets such as:

- Solong

- Sollet

- Phantom

- and more

The Phantom wallet is recommended for users not having the Solana wallet. IT can be installed on your browser and toped with sol before accessing the DEX.

For the fees, three tiers are present namely 0.01%, 0.3%, and 1%. The 0.1% fee is suited best for pegged coins and stable coins. A 0.3% fee is charged for all mainstream pairs while the last fee percentage is for unique or emerging trading projects.

What are the ways to trade on Crema Finance?

You can trade on the DEX in many ways. Here are a couple of them.

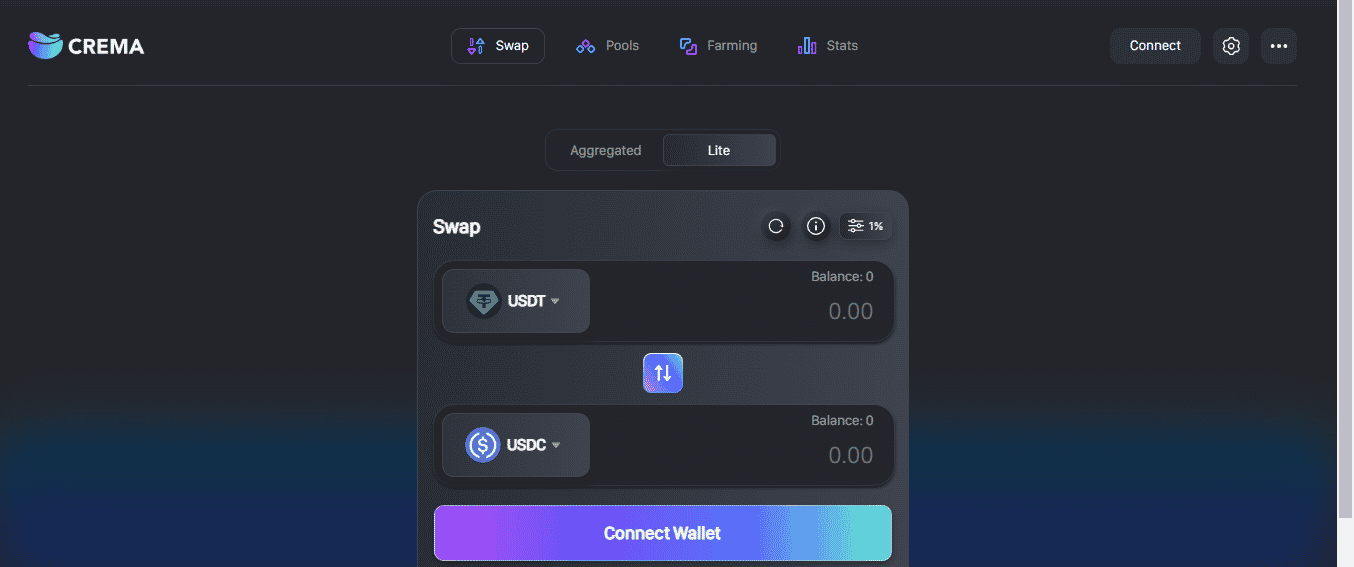

- Trading tokens is the common and most popular way to use the DEX. You can swap tokens on the platform by following the steps shown here:

- Click on the ‘swap’ feature and choose from the C tokens you want to swap from and to by using the drop-down menu

- Enter the amount that you want to swap

- Set the slippage tolerance level

- Click on ‘swap’ to initiate trading

- You will get a popup notification indicating the ‘waiting for confirmation’ option. Click on ‘approve’ on the top right side of the wallet on the ‘approve’ option

- Other ways you can use the service include adding or removing your assets using the liquidity section of the DEX and farming by choosing an asset pair or adding liquidity from pools

Customer support

For support, the vendor provides an FAQ section and links to its social media pages on Twitter, Discord, Medium, and Telegram group.

Should you trade with Crema Finance?

Crema Finance summary

Crema Finance summaryPros

- Use low price slippage swaps

- Developer will find the service essential

Cons

- No vendor transparency

- Lack of security info

- No verified performance proof