Maiar Exchange is introduced by the developers as a digital wallet and social payment app. It offers “global, near-instant, inexpensive transactions among an expanding suite of assets.” The main page has a claim about “DeFi for the next million. Swap assets instantly, globally, inexpensively, and automatically.”

Maiar Exchange overview

Let’s talk about how the platform works:

- They work globally. So, we are allowed to use this service from any country.

- Maiar Exchange is based on the Elrond Network. It is built by the same team that has built the Elrond blockchain.

- So, it’s almost an official DEX. We should be safe here.

- The Elrond blockchain is the first live blockchain with state sharding.

- Maiar Exchange LP tokens can be traded. We can provide liquidity, then sell your position, or take a loan against it.

- Maiar allows automatically and securely creating a wallet in seconds, using a phone number.

- Maiar Exchange has its own token – MEX. It was created in November 2021.

- Its stakeholders allow it to be involved in participating, developing, and controlling the system.

- We can deposit our funds via our wallet or via fiat services. The system supports the following wallets like Maiar Defi Wallet, Elrond Web Wallet.

How does Maiar work?

Maiar allows for all the following:

1. Trade tokens.

2. Staking tokens to get profits from fees, swaps, and commissions.

3. Creating a liquidity pool.

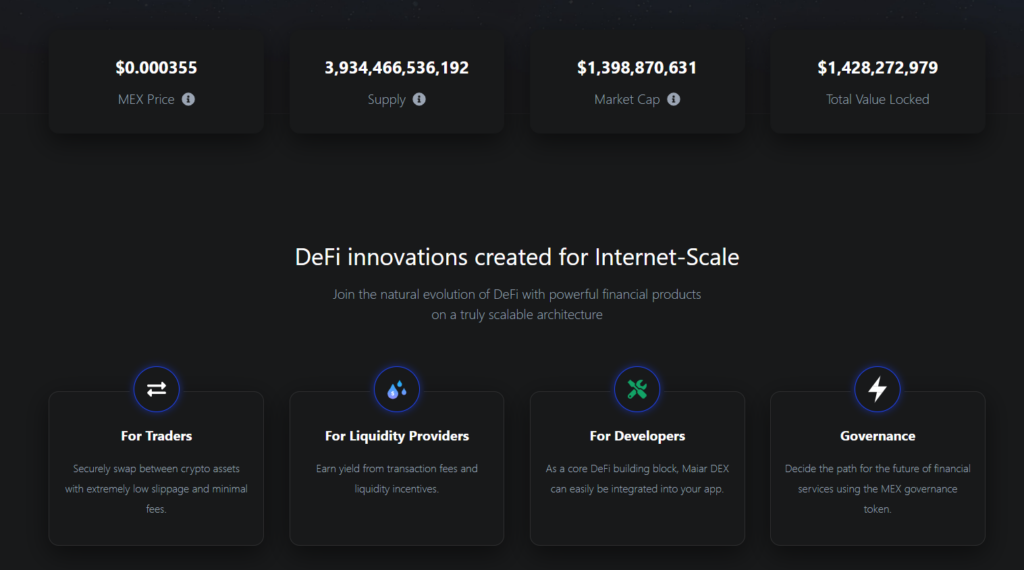

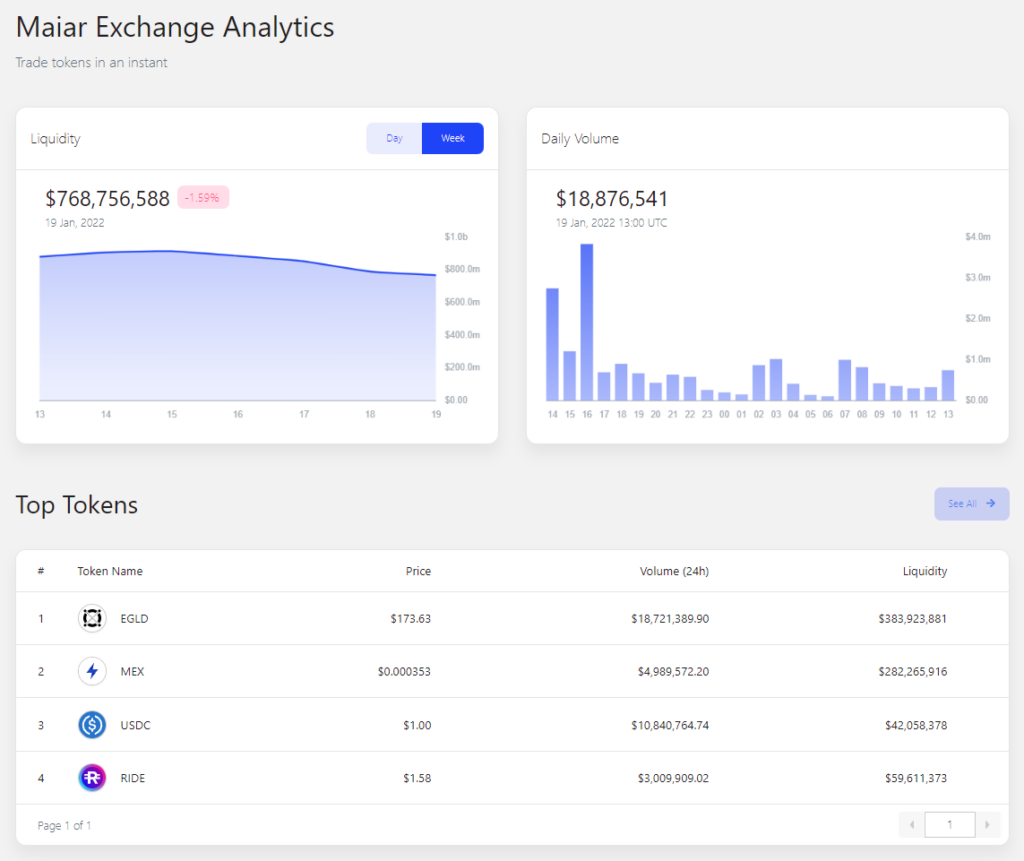

We can see the MEX price, available supply, market cap (1,3B), and total value of tokens locked (1,4B). The cap and locked value numbers look solid. There’s intel for traders, liquidity providers, developers, and gov. Maiar supports Elrond Gold (eGLD), Binance (BNB), Ethereum (ETH), and Bitcoin (BTC).

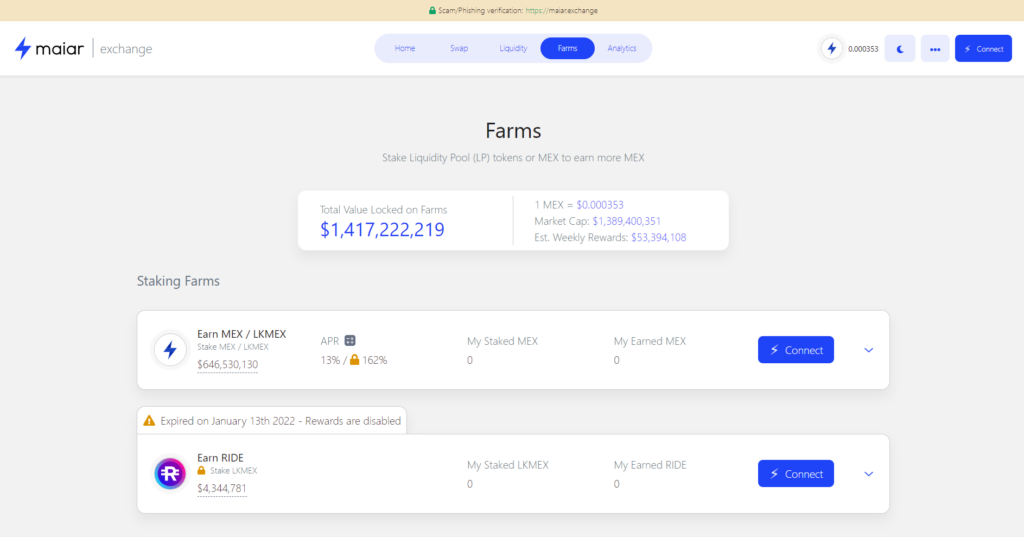

There’s a number of assets locked in framing and the lick of stacking farms. So, MEX staking provides 13% APR in MEX and 162% in LKMEX.

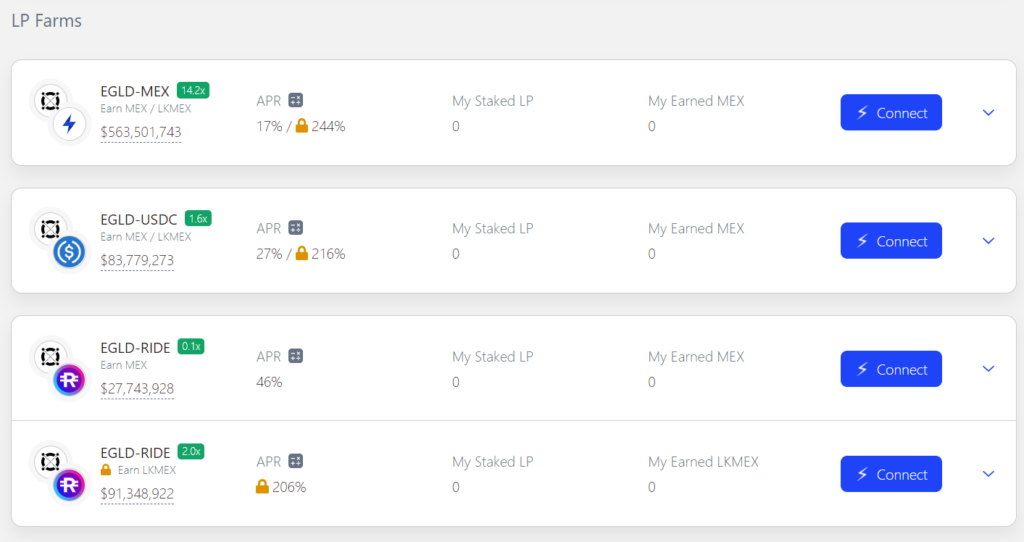

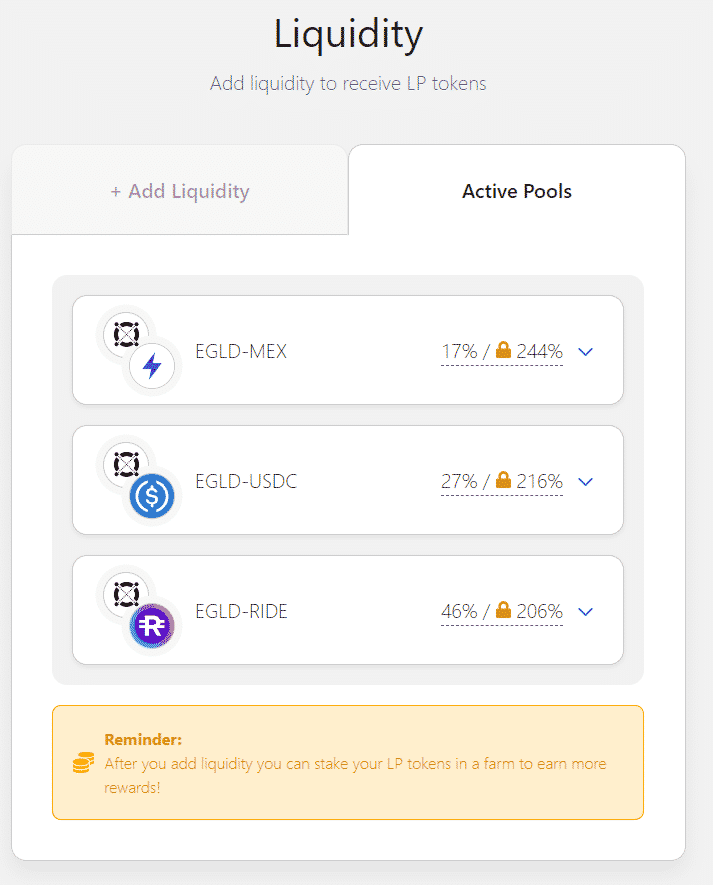

There are other LP-based farming possibilities available. Anyway, the list of pools looks short.

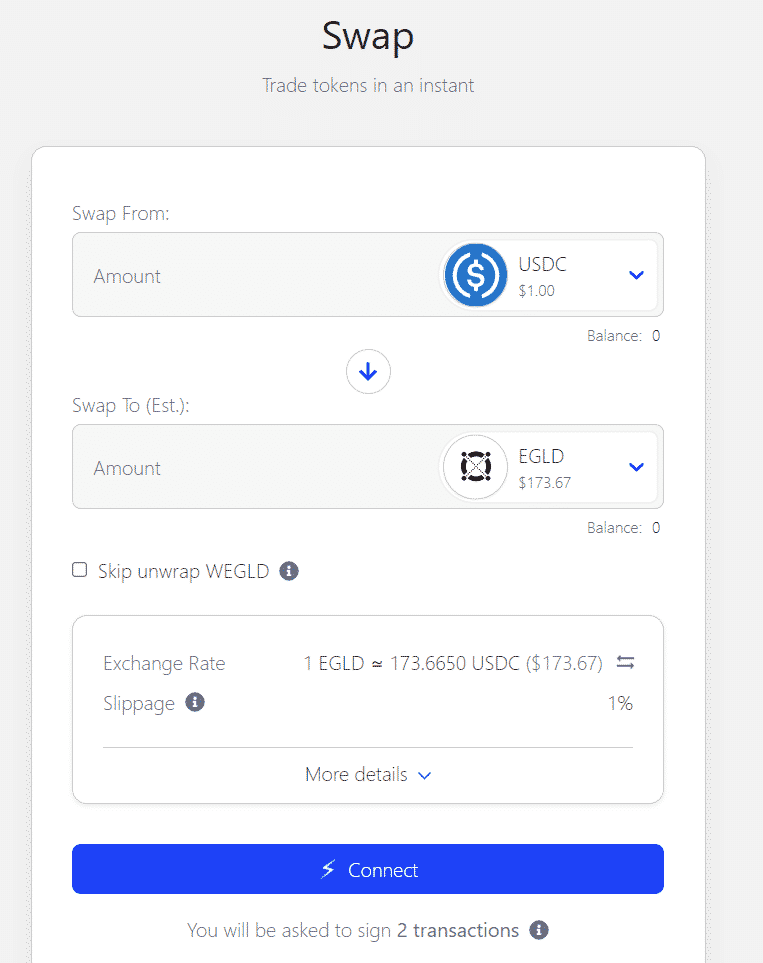

We can exchange coins via the swap service. There’s a slippage of 1% that we should tolerate.

The list of available pools with explanations and expected ATR.

What can you buy on Maiar?

Maiar is powered by the technology of the Elrond blockchain. We can check liquidity, volume, and available tokens. Top tokens are: EGLD, MEX, USDC, and RIDE.

Is Maiar safe?

Yes, the Mair exchange based on the Elrond blockchain looks pretty safe. Anyway, the final decision is up to you.

Maiar fees, compatible wallets, and transactions

We have seen 1% slippages for exchanging. Maiar doesn’t collect any part of network fees. The Elrond Network however, has minimal fees (as low as $0.001 per transaction). Maiar is a non-custodial wallet.

What are the ways to trade on Maiar?

We can stack, and participate in pools. Tokens can be traded on other trading platforms.

Customer support

We can rely on solid and quick support via email, telegram, forum, and twitter.

Should you trade with Maiar?

Maiar summary

Maiar summaryPros

- The Elrond Network behind it

- Low commissions within network

- There’s much liquidity locked in the pools

- The devs provide good support

Cons

- A few pools available

- The profitability on the pools can be better