Bancor Network is a decentralized exchange that was designed to unite traders, liquidity providers, and developers for cooperation. Bancor is ruled by its community as a decentralized autonomous organization (DAO). The Bancor Protocol is governed via a clear and relevant voting system which allows all stakeholders to get involved in the protocol development. Bancor allows exchanging crypto tokens without being involved in real trading on the market with high slippages.

Bancor Network overview

BNT is the Bancor Network Token that can be useful within the Bancor network. In 2021, it united the top-100 the most valuable tokens. We can find the next claims about the system “Bancor is an on-chain liquidity protocol that enables automated, decentralized exchange on Ethereum and across blockchains.The protocol was initially developed in Israel in 2017 by Eyal Hertzog, Galia Benartzi, and Guy Benartzi. Their whitepaper (dated March 18, 2018) states Bancor, “enables automatic price determination and an autonomous liquidity mechanism for tokens on smart contract blockchains.”

How does Bancor Network work?

Bancor Network allows for all the following:

1. Purchase BNT tokens.

2. Stake tokens.

3. Join liquidity pools.

4. Become stakeholders to help the protocol evolve.

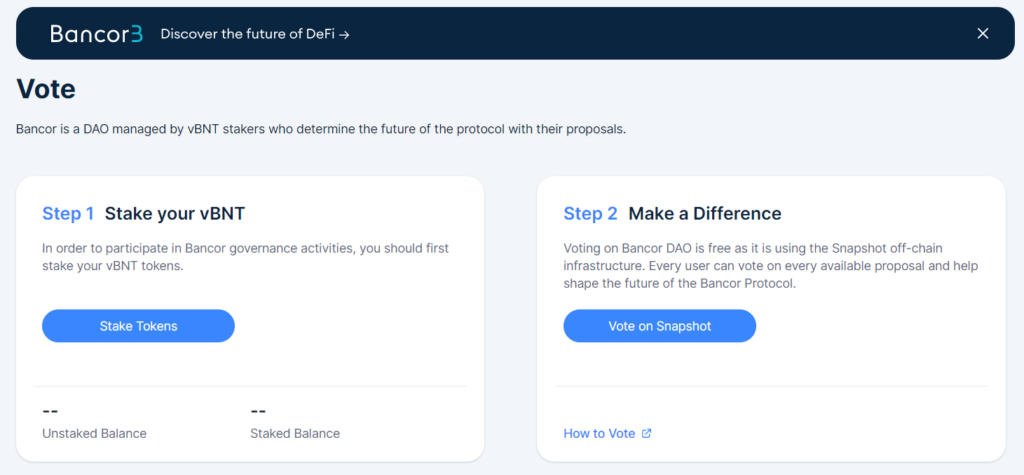

As we mentioned before, all participants can be involved in voting for upcoming updates. This allows investors to be in touch with how the project works and what they have to expect from its functionality.

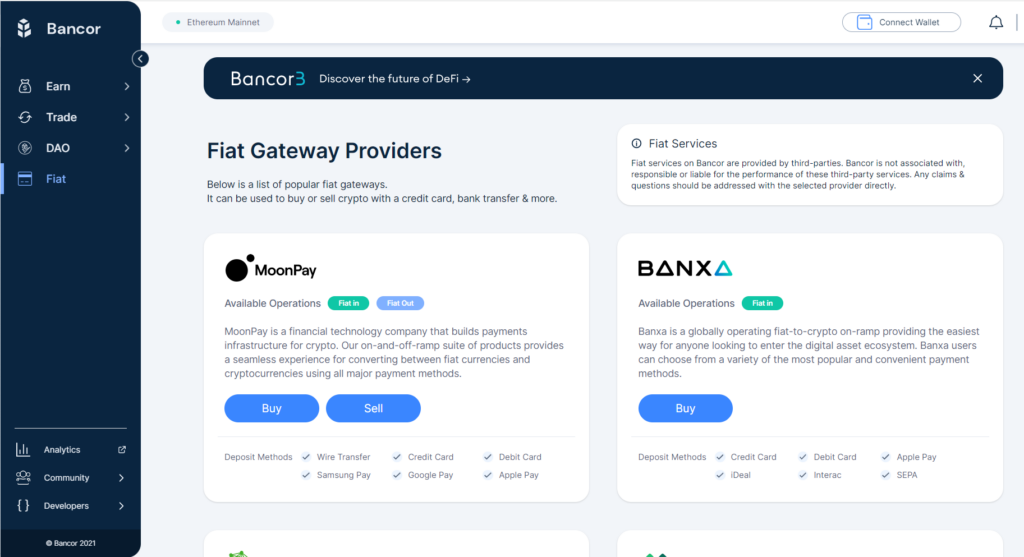

We can use one of those fiat gateways to purchase some tokens that can be invested in stacking or liquidity pools.

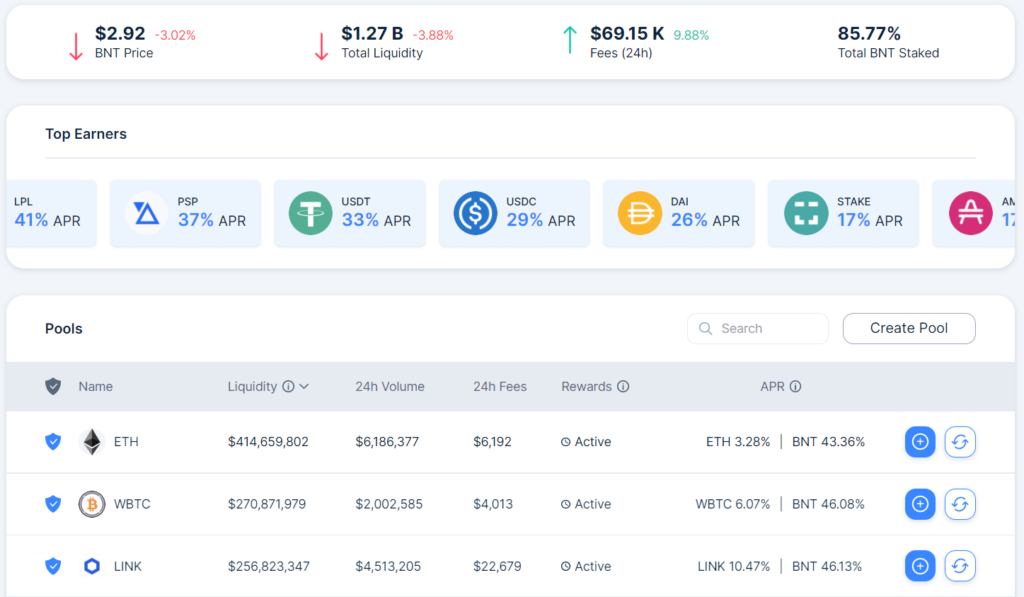

We can see the real BNT price, total liquidity in pools, fees, and how many BNT tokens are staked. The number of staking, 85.77% is high. The liquidity level is solid too, $1.27B. Next, we can see the list of top earners depending on the coin. There’s a list of pools with annual profits expectation in the pool currency or BNT. The last reward is much higher.

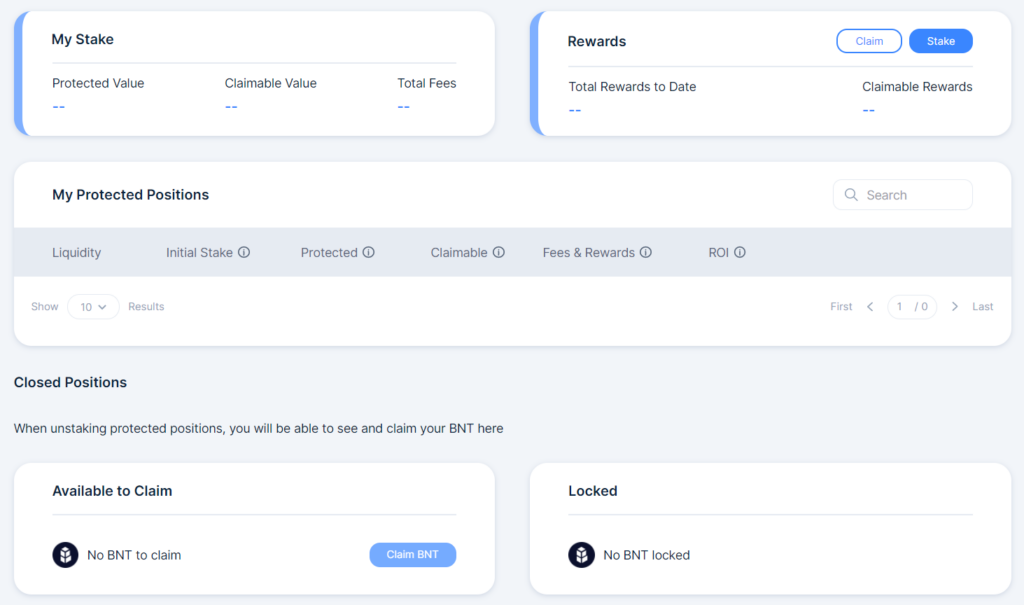

There’s a list of staking details like: value, fees, rewards to date, claimable rewards, list of protected positions, closed positions, claimable/locked BNT.

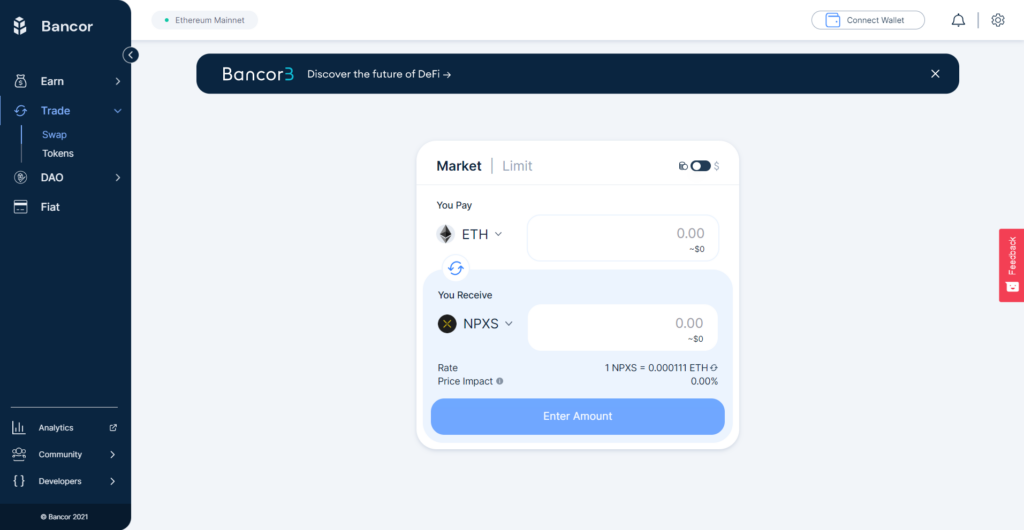

What can you buy on Bancor Network?

We can buy many various tokens using other tokens that are available on our wallet.

Is Bancor Network safe?

Bancor is built on both Ethereum and EOS. So, the platform should be safe and secure for our funds.

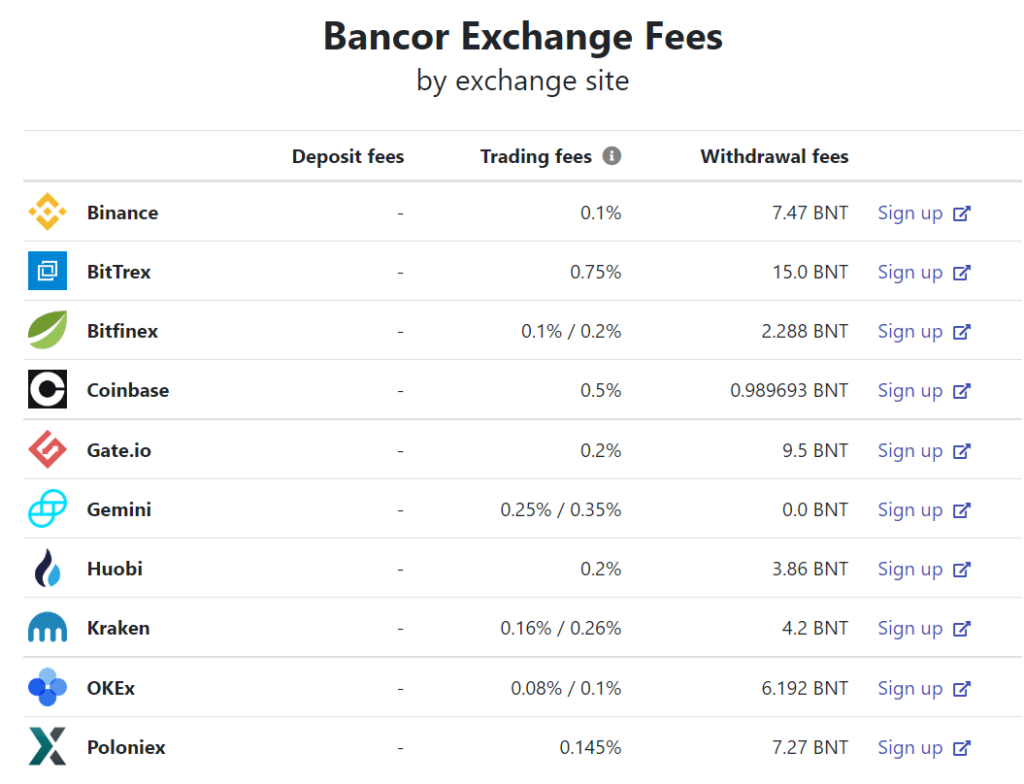

We can see that other platforms have various fees policies with BNT. Bitnex has the highest fees – 0.75% for trading and 15.0 BNT for withdrawing.

Bancor Network fees, compatible wallets, and transactions

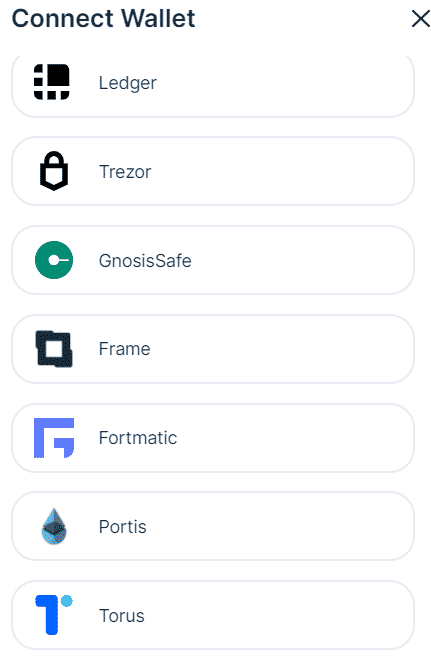

There’s a list of wallets that can be connected to the platform. So, the service must be safe enough to work with.

When we talk about fees: “Trading fees: APR from trading fees is calculated by measuring the total fees earned by the pool over a given time (e.g., 1 day or 7 days), dividing it by the current liquidity in the pool, and then annualizing it. For example, if there are $30,000 worth of fees in a pool with $10M liquidity over the course of 7 days, the APR is $30,000 / $10,000,000 * 100 * 52 weeks = 15.6%.”

What are the ways to trade on Bancor Network?

The network is focusing mostly on exchanging, stacking, and participating in pools.

Customer support

The devs provide support via email and Telegram. Usually, they answer within several hours. We can also ask questions on the project forum.

Should you trade with Bancor Network?

Bancor Network summary

Bancor Network summaryPros

- Bancor Network was built on Ethereum blockchain

- Total liquidity is over 1 billion

- Various pools with different profitability in main token of the pool and BNT

Cons

- Various well-known platforms charge medium fees for trading and withdrawing

- Lacks of people feedback

- The site functionality looks simplified