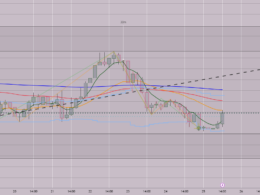

Oil futures experienced a boost on Friday in anticipation of a speech by Federal Reserve Chair Jerome Powell. However, despite this increase, crude is still on track for a second consecutive weekly loss.

Price Action

- West Texas Intermediate crude for October delivery (CL00, +1.33% CL.1, +1.33% CLV23, +1.33%) saw a rise of 84 cents, or 1.1%, reaching $79.89 a barrel on the New York Mercantile Exchange.

- October Brent crude (BRNV23, +1.30%), the global benchmark, recorded an increase of 85 cents, or 1%, with a price of $84.21 a barrel on ICE Futures Europe. Additionally, November Brent (BRN00, +1.23% BRNX23, +1.23%), the most actively traded contract, gained 81 cents, or 1%, reaching $83.73 a barrel.

- On Nymex, September gasoline (RBU23, +0.60%) experienced a slight rise of 0.3% and settled at $2.588 per gallon. Meanwhile, September heating oil (HOU23, +1.43%) saw a 1.4% increase and reached $3.17 per gallon.

- September natural gas (NGU23, -0.40%) witnessed a gain of 0.3% and settled at $2.526 per million British thermal units.

Market Drivers

Powell is scheduled to deliver a speech at the Kansas City Fed’s annual monetary policy symposium on Friday morning. Investors are eagerly waiting for hints regarding the Fed’s rate path.

Powell’s remarks carry the potential to influence overall investor sentiment. In addition, oil traders will keep a close eye on movements of the U.S. dollar, which recently reached a 10-week high. The ICE U.S. Dollar Index (DXY) remained stable on Friday. A stronger dollar tends to make oil more expensive for users of other commodities.

Crude Oil Prices Affected by Concerns Over Chinese Demand

After experiencing a rally in July, crude oil prices have declined in August. This retreat can be attributed in part to worries about the demand from China, the world’s second-largest oil consumer. The recent boost in crude oil prices can be credited to supply cuts, including Saudi Arabia’s decision to reduce production by 1 million barrels per day starting in July, a measure that is expected to continue until at least September.

However, the possibility of increased supply from other sources has contributed to the weaker tone observed in August. According to Barbara Lambrecht, a commodity strategist at Commerzbank, there is hope that Venezuela, Iran, and Iraq will contribute to the overall supply.

Reuters reported on Wednesday afternoon that U.S. officials were working on a proposal to ease sanctions on Venezuela’s oil exports if the country holds a free and fair presidential election. Additionally, Lambrecht noted that daily production in Iran has already risen by 350,000 barrels since spring, with exports now surpassing 2 million barrels per day.

If upcoming survey-based production estimates confirm the ongoing trend of increased production in August, prices are likely to fall further. This remains true even if OPEC’s supply levels remain low due to Saudi Arabia’s significant production cut.

It is important to closely monitor these developments as they have wide-ranging implications for the global crude oil market.