Summary

- Polkadot’s efficiency in supporting interoperability is a key selling point.

- Institutional adoption is showing promising prospects.

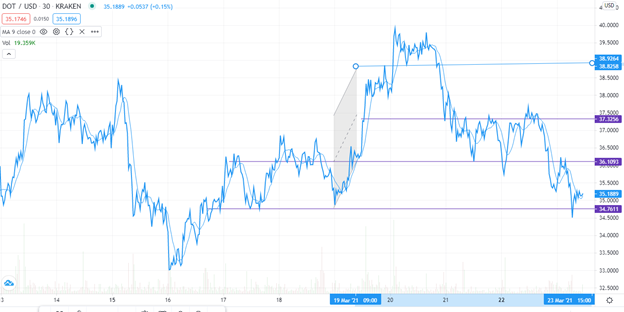

DOT prices were down 6% today, after falling from yesterday’s $37.50. However, the price at the time of going to press was an improvement from the 24-hour low of $34.71. In addition, the trading volume had risen by 18.2% over the previous 24 hours. With that, Polkadot is still the sixth most valuable cryptocurrency, with a market capitalization of $32 billion.

Good market performance paying off

As a result of its recent market performance, DOT has steadily built institutional confidence. Its growth potential has seen it being mentioned as a potential replacement for Ethereum, thanks to its efficiency in the smart contracts segment. The altcoin has also firmly established itself as a preferred platform for interoperability.

The return on investment from DOT is also proving irresistible to many institutions. For instance, KR1, a digital investment company, has been staking on the crypto-asset. The company revealed last week that it had made a mouthwatering $2.4 million from short-term staking on DOT. Such returns will promote institutional infusion into DOT.

One such move recently involved Bybit, which incorporated Polkadot in its trading platform. DOT was one of three altcoins taken up by Bybit due to their impressive market performance and better prospects going forward. The development will allow users to choose between 1x and 25x for trading in USDT-margin perpetual contracts with DOT.

The blockchain industry is evolving, and cryptocurrencies are getting more coverage and attracting prospective investors. In light of this, Polkadot has developed a platform to provide support for enterprises whose operations incorporate blockchain technology. For example, Unido, a crypto custody enterprise, has integrated Polkadot in its system and, as a result, it has been approached by other institutions, such as Moonstake, for a joint partnership.

The market trend points to successful results for most institutions, integrating Polkadot. Projects such as Ren, Ocean Protocol, and Celer Network have taken the lead in utilizing Polkadot’s function in cross-chain interoperability between networks. As a result, the three projects have had an increase in their token prices. This is attributable to Polkadot’s efficiency and lower gas charges, which have given them an edge over projects running on Ethereum.

Expanding network base

Polkadot recently announced that it will collaborate with web3 protocols to provide a network bridge to its platform and open cross-network functionality with other decentralized ecosystems. This partnership will enable inter-chain compatibility in the digital market. Moreover, it will provide traction for the long-term growth of DOT as a result of an expected increase in demand for the Polkadot network. This will certainly pull in more institutional investors and traders.

In the latest development, ZK Roll-ups are set to be integrated into the Polkadot network. This will be a significant milestone for Polkadot, bearing in mind that the upgrade is one of the key improvements integrated in the forthcoming ETH 2.0 upgrade. It will support multi-chain applications and enhance efficiency in executing smart contracts.

Technical outlook

DOT’s Relative Strength Index (RSI) has largely stayed at or below 50, in the past week, pointing to a market controlled by bears. The cryptocurrency will find the first support level at $34.7. The first resistance will be at $37.3, beyond which it will encounter a second resistance at $38.9.