BTC prices have just hit $46,000 despite the setback from the US Senate Bill. How significant are the recent developments to its moves? We discuss the possible implications.

- The number of transactions exceeding $1 million has risen significantly.

- Institutional acceptance of BTC is still growing.

- BTC prices defy the Senate’s harsh new bill to surge.

Bitcoin prices were down by 0.88% at 1008 GMT on Tuesday, as it continued to look for stability in the $46,000s. BTC reached $46,000 on Monday, consequently reaching its highest level in 11 weeks, but stability above that point is still elusive.

Whale investors are taking over

As BTC retraces its way up, the latest data from Glassnode reveals a significant rise in the large-scale holding of the digital asset. The so-called “whale accounts” refer to accounts with more than $1 million worth of BTC.

According to Glassnode, “whale” transactions have risen from 30% in September last year to account for 70% of transactions as of July 2021. This is despite the depreciation of BTC in Q2 of this year. It points to a favorable view of BTC as an investment asset among the high net worth individuals.

Over the same period, small-scale BTC transactions have declined to about 30%. Therefore, should the trend continue, it may reach a point where the availability of BTC in exchanges will be reduced significantly if the whales decide to hold their assets in private wallets.

Further evidence of large-scale holdings of BTC was provided yesterday by Santiment. According to the cryptocurrency data firm, Bitcoin millionaire accounts added about 10,000 Bitcoin to their inventory in the past week. The trend is likely to keep on rising as BTC appreciates and as more institutions accept it.

Institutional adoption continues

On the institutional front, global cinema giant AMC Entertainment has announced this week that it will start accepting BTC as payment for movie tickets. The company has the largest number of theatres in the United States and globally and has just reported the reopening of more than 90% of its theatres following the loosening of Covid-19 restrictions.

According to the company’s CEO, Adam Aron, AMC plans to accept BTC before the end of 2021. According to its Q2 earnings report, the company beat analysts’ estimates to post revenue of $444.7 million and hopes to do better as the remaining outlets reopen in the coming days.

Defying the legal hurdle

The crypto market is on a rebound but has been met with a legal challenge from the United States Senate. On Monday, senators failed to amend a section of the infrastructure bill that would have specified the extent of IRS-related regulations on reporting cryptocurrency transactions worth $10,000 and above. The ambiguity in the bill leaves room for an unnecessarily broad interpretation of the entities responsible for such reporting.

Proponents of the amendment have argued that it may stifle the development of the digital assets industry in the United States, including possibly making cryptocurrencies mining companies and crypto hardware manufacturers flee. Some senators and cryptocurrency exchanges have already voiced their opposition to the bill in its current form.

However, the crypto market seemed least bothered about the Senate’s decision. In the few minutes before the passage of the bill, BItcoin was 3.4% lower than its position 24 hours earlier. However, it rebounded afterward, rising from $44,954 to close the day at $46,270. That was certainly a strong statement against the Senate and also the biggest 24-hour rise in the price of BTC in two weeks.

Technical analysis

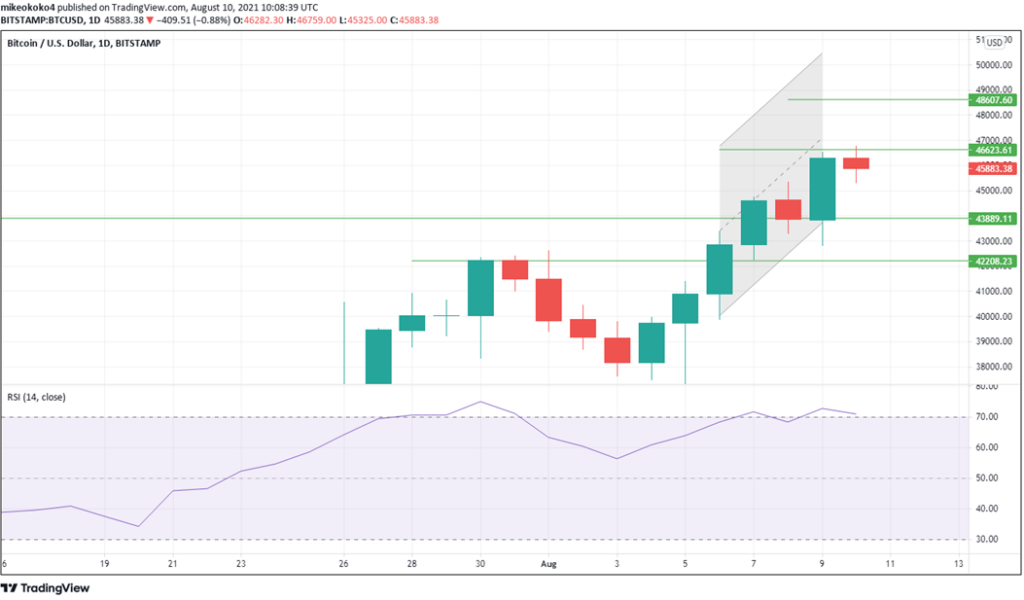

BTCUSD is showing strong momentum, which has reached the overnight territory at 70. However, the market fundamentals are likely to favor further bullish control. The BTCUSD pair is likely to be pushed further up by the bulls to find the first resistance at $46,623.

Further upward mobility is likely to encounter the second resistance at $48,607. However, if the market becomes bearish, then BTC prices may slip to get the first support at $43,889 and possibly further lower to the second support at $42,208.