Analysts have projected a 39 per cent return on the Nigerian Exchange All-Share Index by the end of 2025, driven by strong dividend momentum and renewed investor confidence.

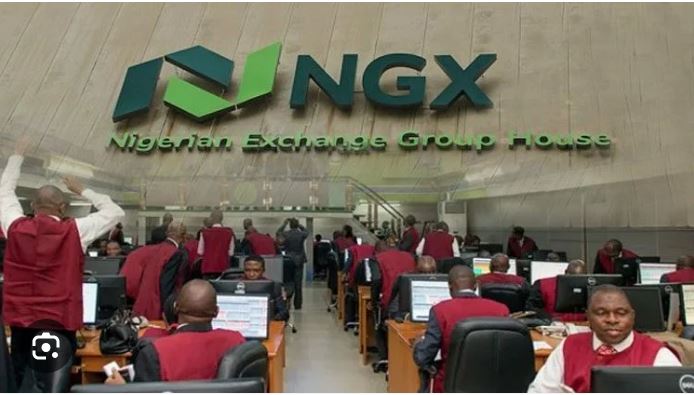

This forecast was revealed during the mid-year 2025 Macroeconomic Webinar hosted by Arthur Steven Asset Management.

The event featured insights from Managing Director/Chief Executive Officer of Arthur Steven Asset Management, Olatunde Amolegbe; Chief Executive Officer of Nigerian Exchange Limited, Jude Chiemeka; and President of Capital Market Academics of Nigeria, Uche Uwaleke.

Amolegbe said the local bourse had already recorded a 33 per cent gain year-to-date as of June 2025 and is on course to deliver a 39 per cent return by year-end if current trends persist.

He attributed the positive market outlook to sustained dividend inflows, particularly from banks undergoing recapitalisation in line with new Central Bank of Nigeria guidelines.

“Going into the second half of the year and beyond, we expect stronger investor sentiment, especially as earnings season picks up and the recapitalisation process continues to attract strategic interest,” Amolegbe said.

Chiemeka noted that the capital market has shown resilience despite inflationary pressures and exchange rate volatility. He highlighted that domestic transactions in equities accounted for 81 per cent of total trading volume as of June 2025.

Uwaleke projected Nigeria’s GDP growth to fall between 3.4 and 4.17 per cent in 2025, with inflation expected to ease below 20 per cent by year-end. He also forecast the exchange rate to stabilise around N1,550 to the US dollar, supported by improved foreign exchange inflows and fiscal and monetary reforms.

On monetary policy, Uwaleke said the CBN is likely to maintain the Monetary Policy Rate at 27.5 per cent through the end of 2025 to control inflation and encourage foreign portfolio investments.