If you asked a random person on the street what makes the past 12 months wild, you are likely to get ‘Covid-19’ as the answer. However, ask Chamath Palihapitiya – the anti-establishment venture capitalist and hedge-funder – the same question, and you will most likely get ‘SPACS’ and ‘WallStreetBets.’

What if you push the boundary beyond 12 months to five years? The most probable answer you will get is ‘cryptocurrency.’ However, one cannot talk about cryptocurrency without throwing in a shoutout to things such as tokenization of assets.

Asset tokenization means representing a real tradeable asset on a blockchain network by issuing a digital security token. This, dear reader, is what experts call Security Token Offering or STO. This article explains STOs. So, hitch a ride and let us enjoy this experience.

What are security tokens?

It can be difficult to explain an STO without defining a security token. A security token is merely a representation of a tradable asset. For example, it could be equity, debt, or asset-backed token.

An equity token proffers ownership of a company’s stock or bond to the token’s buyer. On the other hand, a debt token is equivalent to a short-term loan extended to a company. Lastly, an asset-backed token is a digital representation of an asset (tangible or intangible) whose value reflects the underlying asset’s value.

Is there an easy-to-understand introduction to STOs?

Yes. But first, you will need a primer. STOs are a stricter version of initial coin offerings (ICOs) but a less demanding type of initial public offering (IPO). So, if you let us, we will explain the difference between ICOs and STOs, and STOs and IPOs.

In an ICO, a company or group of people issues coins – usually utility coins – and the buyers get the right to a future product or service. Therefore, a utility token does not have a current value at the date of the issue because there are no assets for coin holders to claim. The greatest underside of ICOs is the lack of regulations, which denies coin holders protection under existing security laws.

On the other hand, an STO gives token holders ownership of a piece of the underlying asset. The offering entails detailed due diligence and strict adherence to relevant security laws. For instance, an STO can tokenize real estate and sell bits of it to investors in the form of ‘shares’ or ‘tokens.’

Of the three, IPOs are the most daunting in terms of the effort required to accomplish the task. An IPO entails listing a company on a securities exchange, where a unit of the equity is sold to investors. The share extends ownership entitlement to the shareholder. In addition, IPOs follow a strict regulatory process that might take years to complete.

The STO process

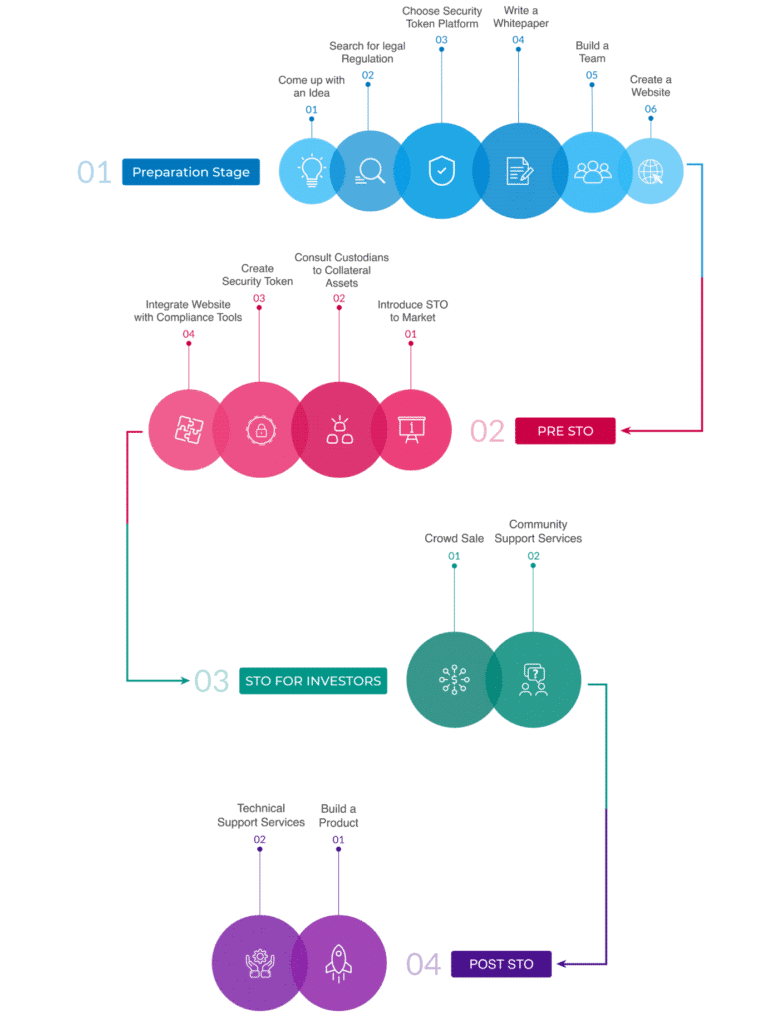

We have already seen how security tokens vary. As such, the launching process is often bespoke. For example, the equity token launching process differs from a debt token. Nevertheless, the high-level perspective of the launching process can be generalized into the following phases:

1. Preparation phase

This is the ideation stage. Founders need to conceptualize ideas that are engaging to prospective investors. Also, this phase entails detailed research on the relevant regulations because different jurisdictions maintain unique laws.

Additionally, founders must develop an excellent idea of the token’s value. You can evaluate your token’s worth based on the following principles: the token’s role, purpose, and unique features.

When talking about regulation, the token must pass the Howey test, especially if you intend to launch in the United States. The Howey test is the criteria for determining whether a coin is a security token or a utility token. The US Supreme Court established the test in 1947 during the Securities and Exchange Commission vs. W. J. Howey Co. case.

Also, choosing the right security token platform is part of the preparation phase. The ideal platform makes the launch process quick and seamless and complies with relevant laws.

Lastly, it is time to write a white paper. This marketing document outlines the product, its technical architecture, the business model, token usage details, and the team behind the project. Also, it is best to assemble a team of experts to write the white paper to ensure a proper representation of the product.

Figure 1: STO launch process

2. Pre-STO phase

This stage entails the introduction of the project to the market. A great way of doing this is to create a website and partner with an accredited cryptocurrency exchange. The exchange should have high liquidity.

Also, gather custodian participants, who, ideally, should be third parties. Once the security token is created, it is now time for marketing.

3. STO phase

Marketing the security token could be in the form of a crowd sale, where the public buys the tokens on a dedicated website or through a partner exchange. You should specify the number of tokens on sale. Most importantly, be on hand to provide support and answer as many customer questions as possible.

4. Post-STO phase

After a successful launch, now is time to manage investors’ expectations. Recall that the buyers have entrusted you with their money, and they expect a return after that. The best way to accomplish this phase is to execute the business plan as outlined in the prospectus.

Merits of STOs

STOs are attracting attention because they offer something that IPOs and ICOs can only dream of. Some of the advantages include:

- Flexibility

Tokenizing an asset is more secure and trustworthy compared to ICOs. Also, STOs are less taxing in terms of the work required to complete the process. As such, smaller companies – which would otherwise be locked out of the deep-pocketed capital markets – can raise funds without facing punitive up-front costs.

- Ability to tap into institutional capital

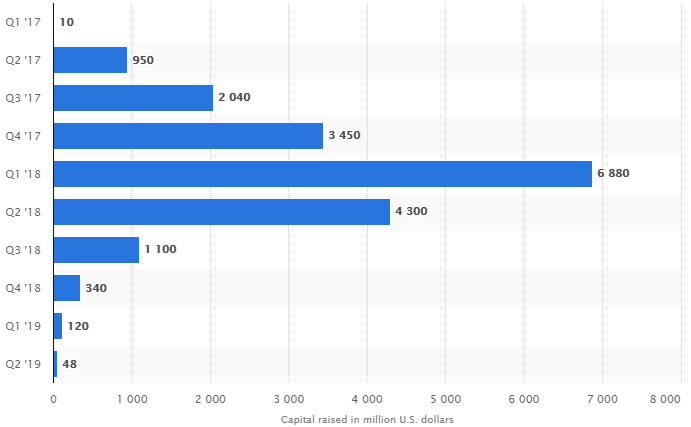

Initially, ICOs were seen as gamechanger. They would enable crypto-focused projects to raise sufficient capital to disrupt many industries. However, the honeymoon was short-lived after cases of fraud crowded the sector. In two short years, the promise of ICOs fueling growth in the crypto-sphere collapsed.

Figure 2: Blockchain ICO projects: funds raised worldwide 2017-2019, by quarter

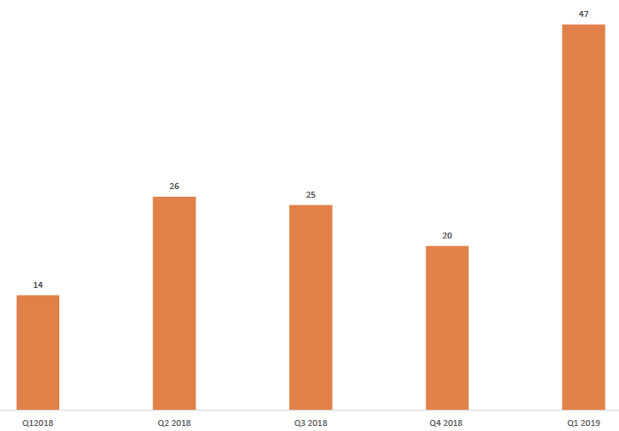

Meanwhile, STOs were slowly gaining ground. In Q1 2019, the number of STOs jumped 130% to 47 compared to Q4 2018. This was happening when the capital raised via ICO was in a veritable downward spiral.

Figure 3: STOs by quarter

Final thoughts

The world is transitioning into the age of full-blown technology. It will be an age where humans will be interacting with technology in almost all sectors of their lives. At the same time, blockchain technology is revolutionizing many industries, especially the financial space.

Because technology means simplicity and straightforwardness, STOs are likely to replace IPOs as the capital-raising avenue of the future. This is because STOs offer the same security as IPOs but with more simplicity and convenience.