Cardano vs. Ethereum is a debate that refuses to go away right from which cryptocurrency is the best investment option to the best platform for creating decentralized applications. The comparisons arise from the fact that both networks offer similar possibilities and target almost the same market.

Developers looking to come up with smart contracts or decentralized applications can always use both the Ethereum and Cardano blockchains, given the standard features on offer. However, these two also differ a great deal.

Understanding Cardano

Cardano came into being as a brainchild of Charles Hoskinson, a co-founder of the Ethereum project. While named after Italian polymath Gerolamo Cardano, the blockchain project was founded on peer-reviewed research and developed through evidence-based methods.

ADA is the native token that powers the network and is one of the biggest by market capitalization.

It differentiates itself from the pack and especially Ethereum in striving to deliver scalable, secure, and robust technology for running financial applications.

Understanding Ethereum

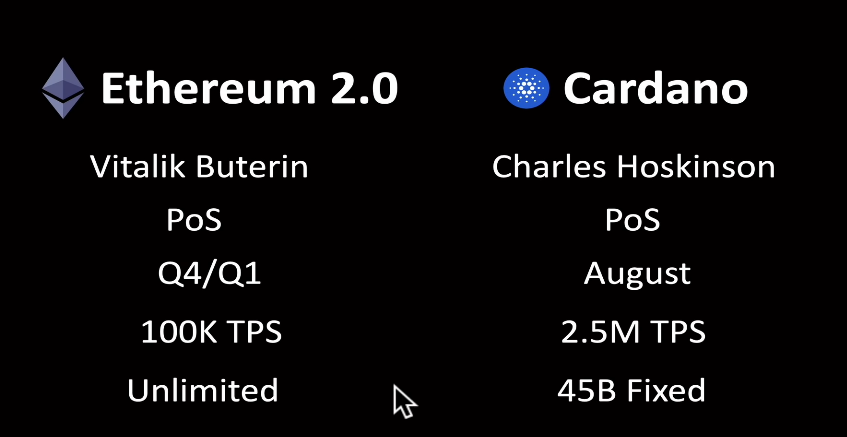

Ethereum, on the other hand, is an open-source blockchain conceived in 2014 by programmer Vitalik Buterin. The project’s sole aim is to provide a platform to create and deploy decentralized applications and smart contracts.

Ethereum network strives to be more than a medium of exchange or store of value. Instead, it seeks to provide a computing network built on the ledger technology.

Ether is the native token that powers the Ethereum network. It is the second most popular cryptocurrency after Bitcoin.

Cardano vs. Ethereum: the differences

Cardano’s primary goal is to enable transactions on the blockchain using its native coin ADA. It also seeks to provide developers a way of developing secure decentralized applications. Ethereum, on the other hand, strives to become a global open-source platform for custom assets and economic applications.

Cardano is governed by the proof of stake mechanism, which is used to verify transactions on the network. In addition, for anyone to participate in the development of the blockchain or vote on new updates, they must stake some of the network’s native currency.

Ethereum, on the other hand, relies on the energy-intensive proof of work mechanism. The consensus mechanism relies on minors or groups of people to compete against each other to complete transactions on the network.

The process of competing entails the use of powerful computers to solve complex mathematical puzzles from which a reward is given for a correct answer and a block added into the chain. Ethereum is in the process of migrating from the energy-intensive POW into the Proof of Stake mechanism.

ADA is the cryptocurrency that powers the Cardano network. The crypto is minted every time a new block is created and distributed to slot leaders. Its supply is limited, and there will only ever be 45 billion ADA tokens in circulation.

Ether, on the other hand, is the main currency powering the Ethereum blockchain. Just like Cardano, it is minted every time a new block is created and distributed to miners. There is no limit on the number of Ether that will ever be in circulation.

Cardano also differs from Ethereum in the fact that it emphasizes a research-driven approach to design. It is driven by research that continues to propel the adoption of its technology. Ethereum, on its part, is an ambitious blockchain project that seeks to use ledger technology to decentralize products and services in a wide range of use cases.

Cardano does not promise groundbreaking features for users and developers. Instead, it offers appealing optimizations. In this case, its code is verified mathematically.

Ethereum has been the subject of distinct phases that have resulted in new capabilities for the network. The blockchain project was one of the biggest players in the Initial Coin Offering boom, during which the network was used for capital allocation and funding.

Currently, Ethereum is at the center of the decentralized finance spectacle. Its blockchain has been used to develop decentralized applications for automating financial services such as lending and borrowing.

Cardano ADA price action

Cardano native currency ADA is up by more than 700% for the year, making it one of the best performing burgeoning sectors. The impressive run has seen it emerge as the fourth-largest by market cap.

ADA has continued to outperform the likes of Ethereum and Bitcoin despite coming under pressure in recent days. The altcoin is down by about 20% from all-time highs of $3.1 a coin. Deep pullbacks in the recent past have acted as buy opportunities from which buyers have come into the fold and helped steer the coin higher in the market.

Increased valuation has come at the back of advanced use cases, especially in the financial sector, which has emerged as one of the busiest platforms. Japan has already given the green light for the listing of ADA in the country’s exchanges.

The implementation of smart contract functionality is also poised to strengthen Cardano’s case in the decentralized Finance space, a development that could see it become an even bigger competitor to Ethereum.

Ether price action analysis

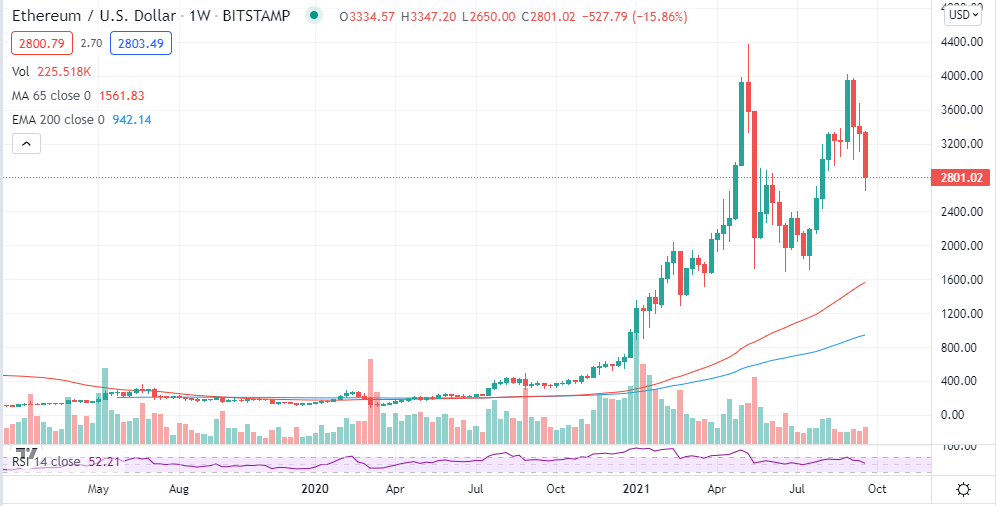

Ethereum has also been one fine run in the market, going by the 200% plus rally since the start of the year. However, it is no match for Cardano. Additionally, Ethereum has been extremely volatile, powering to record highs before plunging on huge volumes.

While ETHUSD is down by about 25% from all-time highs, it has found the going tough above the $3,100 level in recent days. Short sellers have come into the fold every time Ethereum has tried to rally past the $3,500 level.

Where to buy the dip?

Cardano is panning out to be a smart play for anyone looking to buy the dip. After a 700% plus rally, any deep pullback is expected to attract huge buying pressure, especially from investors and traders who missed out on the initial leg higher.

While Ethereum is also an attractive play on the dip, it’s shown some weakness in recent days, struggling to hold on to gains above the $3,000 level. Sell-offs below the $2,800 level have attracted huge buying pressure, which also makes the case why it could be an attractive play on the dip.