Trend Spider is an advanced charting software designed to help traders of all experience levels to accurately identify and act on market trends. This cloud-based platform is equipped with state-of-the-art algorithms and machine-learning capabilities that automate the process of technical analysis, enabling traders to make timely and informed decisions. In this review, we’ll delve into the key features, benefits, and potential drawbacks of Trend Spider, providing a comprehensive perspective for those considering this tool for their trading arsenal.

Key Features of Trend Spider

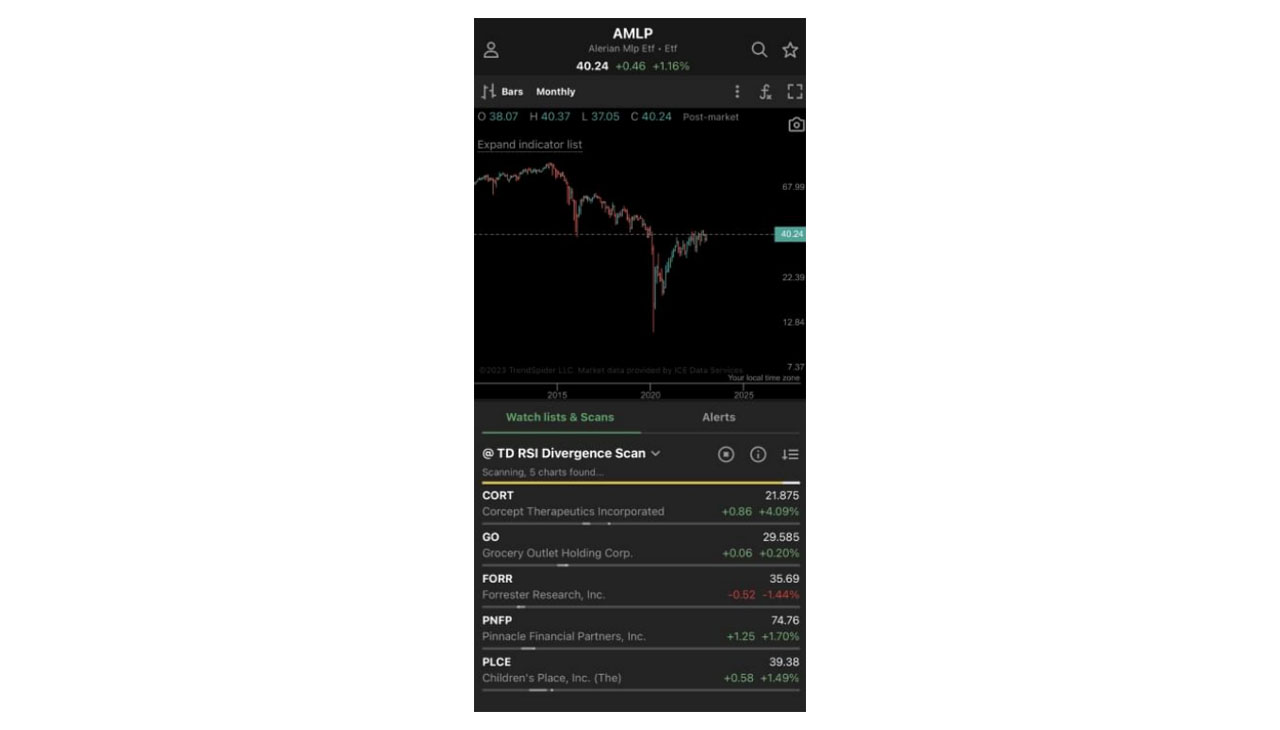

- Automated Technical Analysis: Trend Spider uses sophisticated algorithms to automate the process of technical analysis. This feature helps to eliminate human error and bias, providing reliable and accurate analysis.

- Multi-Timeframe Analysis: This feature allows traders to view multiple timeframes on a single chart, giving a comprehensive overview of market trends.

- Dynamic Price Alerts: Trend Spider informs traders of significant price movements and indicators that align with their trading strategy. This feature ensures traders never miss an opportunity.

- Raindrop Charts: A unique feature of Trend Spider, Raindrop Charts provide a more detailed view of price movements, helping users to better understand market dynamics.

- Backtesting: Trend Spider offers robust backtesting capabilities, allowing traders to test their trading strategies against historical market data to measure their effectiveness.

Benefits of Using Trend Spider

When it comes to using Trend Spider, there are several benefits that traders can enjoy. Here are some key advantages highlighted by various sources:

- Advanced Technical Analysis: Trend Spider offers advanced technical analysis tools and features that allow traders to analyze market trends, identify key support and resistance levels, and make more informed trading decisions.

- Customizable Alerts: The platform provides customizable alerts that can be set based on specific criteria or patterns. This helps traders stay updated on market movements and potential trading opportunities.

- Efficient Trend Spotting: Trend Spider utilizes a combination of traditional and proprietary tools to help traders spot trends faster. Its powerful scanning feature assesses chart patterns and identifies potential trendlines.

- Automation and AI: The platform leverages machine learning algorithms to automate certain aspects of technical analysis. This can save time and effort for traders, allowing them to focus on other important tasks.

- Accurate Trendline Placement: Trend Spider uses data-driven algorithms to automatically place and calculate trendlines. This helps ensure accurate and reliable trend analysis.

- Compatibility with Multiple Markets: Trend Spider supports various markets, including stocks, Forex, and cryptocurrencies. This versatility makes it suitable for traders with diverse portfolios.

It’s important to note that these benefits are based on user reviews and opinions gathered from different sources. As with any trading tool, individual results may vary. Traders are encouraged to conduct their research and evaluation before making a decision.

Potential Drawbacks of Trend Spider

While Trend Spider has numerous advantages, it also has potential drawbacks that users should be aware of:

- Steep Learning Curve: Trend Spider’s advanced features may be overwhelming for inexperienced traders. To fully utilize the platform, users may need to invest significant time in learning its functionalities.

- Pricey Subscription: Compared to other charting software, Trend Spider is on the pricier side. Although it offers a range of advanced features, the cost may not be feasible for small-scale or beginner traders.

- Limited Customization: Some users have reported that the charting tools lack the level of customization found in other platforms. This could limit the ability to tailor charts specifically to a trader’s needs.

- Automated Trendlines Not Always Accurate: While the automated trendline drawing feature is useful, it may not always be accurate. Some users have reported discrepancies in trendline identification.

- Lack of Direct Broker Integration: Trend Spider does not currently offer direct broker integration. Users must execute trades through another platform, which can be inconvenient.

Keep in mind, these drawbacks are based on user experiences and may not apply to everyone. It’s recommended that prospective users leverage the free trial offered by Trend Spider to see if it’s right for their specific trading needs and style.

Who Should Consider Using Trend Spider?

Trend Spider is best suited for serious traders looking for advanced technical analysis tools to aid in their trading decisions. Particularly, those who value automation and the use of AI to minimize human error and bias will find this platform beneficial. The software is an excellent resource for individuals involved in diverse markets, including stocks, Forex, and cryptocurrencies due to its compatibility. Its unique features like Raindrop Charts and backtesting capabilities also make it an attractive tool for traders keen on exploring innovative approaches to market analysis. However, beginners or those on a limited budget might find the platform’s advanced functionality and pricing a challenge. As always, prospective users should take advantage of the free trial to ensure it’s a good fit for their trading strategy and style.

Summary

Summary-

Advanced technical analysis tools5/5 Amazing

-

Customizable alerts4/5 Good

-

Automated trendline placement and calculation4/5 Good

-

Raindrop Charts5/5 Amazing

-

Backtesting capabilities5/5 Amazing

The Good

- Advanced technical analysis tools

- Customizable alerts

- Automated trendline placement and calculation

- Raindrop Charts

- Backtesting capabilities

- Supports multiple markets

The Bad

- Steep learning curve

- Pricey subscription

- Limited customization options

- Automated trendlines may not always be accurate

- Lack of direct broker integration