FlatQube is powered by Broxus, providing its users with simple means of exchanging their cryptocurrency. The exchange is compatible with 78 token pairs and 15+ farming pools. It claims to have the fastest blockchain, many assets, and fewer gas fees. Our article will discuss more information on token pairs, security, and reliability of the DEX so that traders can get an idea on investment.

FlatQube overview

The FlatQube is available on Github as an open-source platform. It is lisenced under Apache 2.0 and allows potential traders to create their custom tokens. Multiple APIs such as FlatQube indexer and Farming indexer are used to support the user interface. Smart contracts are provided by the DEX to manage pools, liquidity, creating vaults etc.

Tokens and pairs

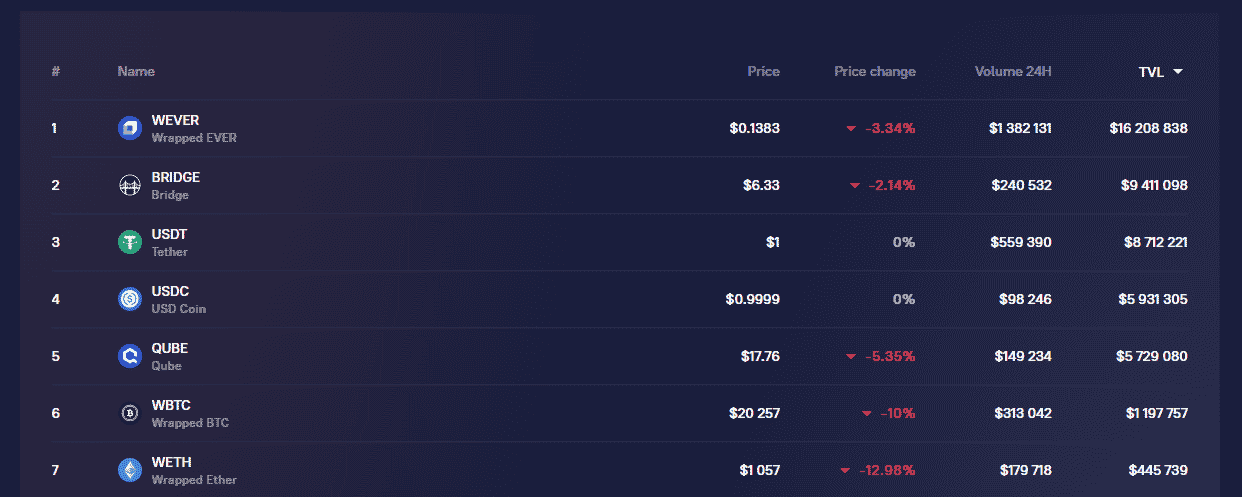

The exchange supports two main types of tokens: LP and native tokens. The former can be used for liquidity farming while the latter for transaction fees. Some of the most common pairs available on the DEX are USDT, WEVER, USDC, etc.

Privacy and reliability

There is no need for users to go through KYC protocols. The exchange does not use cookies on its service website and does not come under the check and balances of regulators.

Farming and stacking mechanisms

The platform offers average returns using the exchange’s farming and staking mechanisms. There are multiple pools available with varying APYs.

How does FlatQube work?

Traders must follow the following steps to get started with the system.

- Create an account on the website

- Install Ever Wallet and Select create new wallet option

- Link the wallet with the FlatQube

- Select all permissions and click connect

- Once the money has arrived in your account, provide liquidity or swap tokens

What can you buy on FlatQube?

FlatQube works on the Everscale blockchain, where the data is protected within local storage. Users can manage their seed phrases, accounts, and keys. The exchange is compatible with multiple tokens such as BRIDGE, QUBE, WBTC, etc., available for buying, selling, and exchanging.

Is FlatQube safe?

Als the exchange is decentralized, there is always a chance of being hacked by third parties. Investors must be cautious with their funds and should constantly double-check their investments.

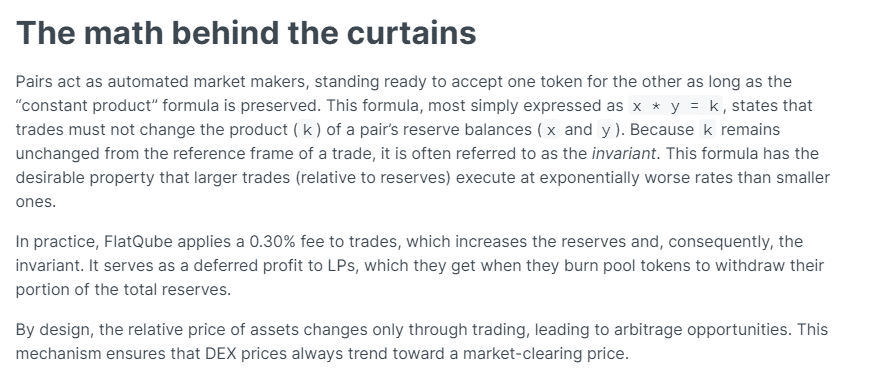

FlatQube fees, compatible wallets, and transactions

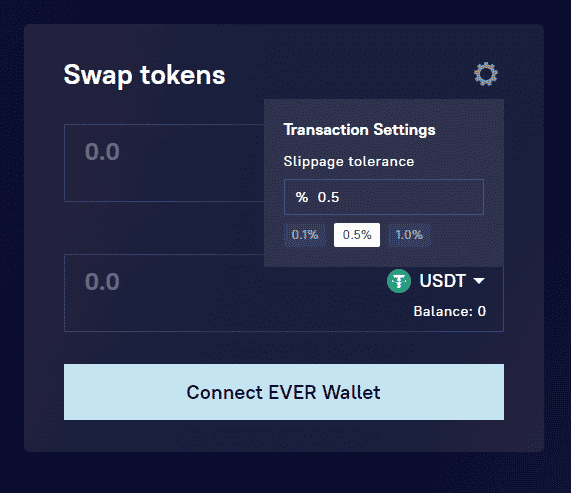

Traders must connect to Ever Wallet to fund their accounts on FlatQube. Transaction settings such as slippage tolerance are adjustable to 0.1%, 0.5%, and 1%. The system charges 0.30% on trades, which is directed at boosting the reserves.

What are the ways to trade on FlatQube?

As mentioned before, traders can swap tokens and invest in farming pools. It is also possible to build your custom tokens.

The FlatQube allows trading through an automated market maker AMM system to solve liquidity problems. These AMMs use blockchain oracles that supply information from exchanges and other platforms to fix the price of traded assets.

Customer support

The company provides support via telegram applications. Users can also get in touch with them by Email, Discord, or by filling out the form available on their website.

Should you trade with FlatQube?

Traders should consider the following pros and cons of FlatQube before trading on the platform.

FlatQube summary

FlatQube summaryPros

- No KYC required

Cons

- DEX is not user friendly

- Possibility of losing your funds

- Complex for beginners