FundedNext is a globally recognized proprietary trading firm that offers unparalleled opportunities for traders. With its unique profit-sharing model and advanced trading technology, the firm empowers traders at all experience levels to maximize their market potential. In this review, we will delve into the firm’s offerings, exploring the benefits and challenges associated with trading at FundedNext.

Features

FundedNext is an online prop trading firm that offers a range of features to traders. Here are some key features of FundedNext:

- Funding Program: FundedNext provides a funded trading program where traders can access capital to trade. Traders can start with a small account size and work their way up to larger accounts as they demonstrate consistent profit and risk management.

- Multiple Asset Classes: FundedNext allows traders to trade various asset classes, including stocks, options, futures, and forex. This enables traders to diversify their portfolios and take advantage of opportunities in different markets.

- Performance Evaluation: FundedNext evaluates traders’ performance based on predefined criteria such as profit targets, drawdown limits, and risk management rules. Traders who meet or exceed these criteria can progress to higher levels of funding and potentially earn a share of the profits.

- Risk Management Tools: FundedNext provides risk management tools and resources to help traders better manage their positions and control their risk exposure. These tools include position sizing calculators, stop loss orders, and risk management guidelines.

- Real-Time Trading Platform: Traders at FundedNext have access to a powerful and intuitive trading platform that offers real-time market data, advanced charting capabilities, and order execution tools. The platform is designed to enhance trading efficiency and provide traders with the necessary tools to make informed decisions.

- Education and Support: FundedNext offers educational resources and support to help traders improve their skills and knowledge. This includes trading courses, webinars, and mentorship programs conducted by experienced traders.

- Profit Sharing: Once traders meet the profit targets and risk management requirements, FundedNext offers profit sharing opportunities. Traders can earn a percentage of the profits generated from their trading activities, providing an additional incentive for success.

Background

FundedNext was established with the mission to democratize access to trading capital and opportunities. Recognizing the barriers that traditional financial institutions impose on individual traders, the founders set about creating a platform that could level the playing field. Today, FundedNext is hailed as a progressive trading firm that combines technology, education, and access to capital, allowing traders from diverse backgrounds and experience levels to compete in the global financial markets. With a focus on risk management and consistent profitability, the firm has cultivated a community of traders who are dedicated to their craft and driven by the pursuit of financial success.

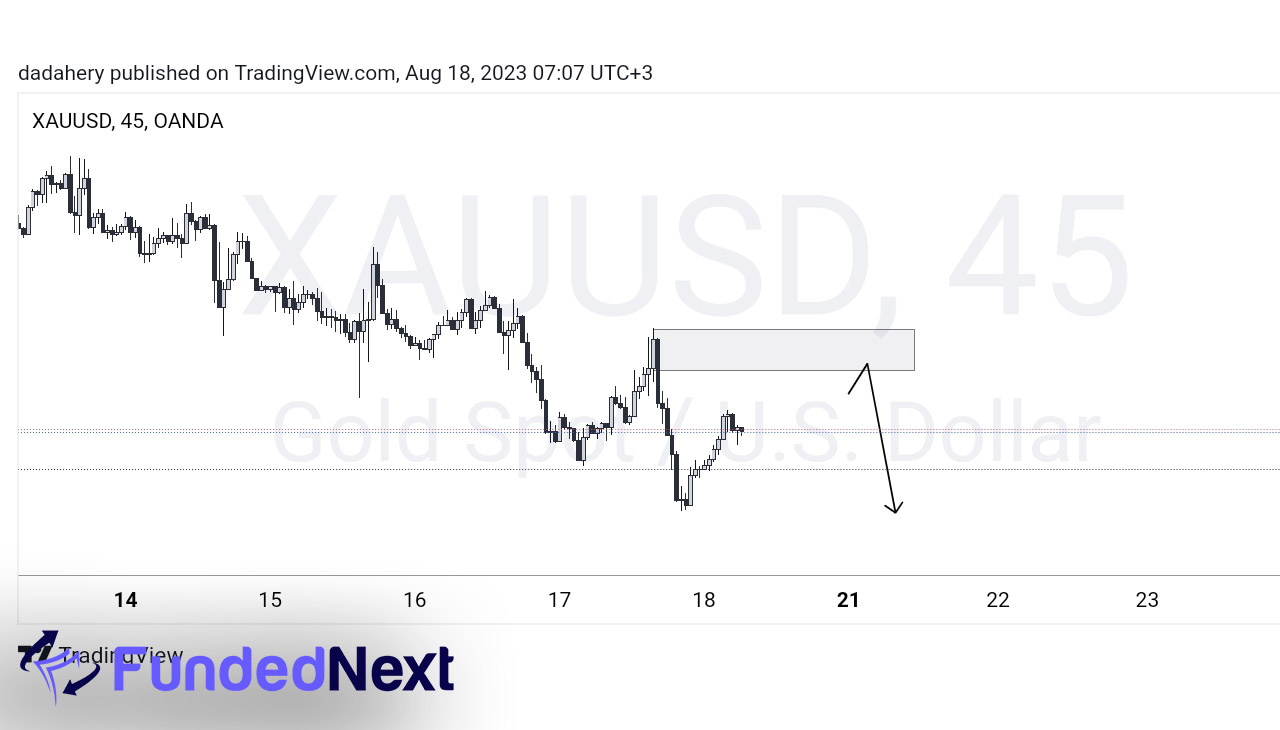

Trading Strategy

At FundedNext, the emphasis is on adopting a disciplined and strategic approach to trading. Traders are encouraged to follow their trading strategies while adhering to the firm’s guidelines on risk management and profit targets. Multiple strategies, including day trading, swing trading, scalping, and options trading, are welcomed, as long as they align with the firm’s risk parameters. The firm believes that the diversification of trading strategies within its trading community contributes to a robust and resilient trading environment. In line with this, FundedNext offers educational content and mentorship programs to assist traders in refining their strategies and improving their trading skills. This potent mix of autonomy, support, and strategic trading forms the backbone of FundedNext’s trading strategy approach.

Funding and Capital

FundedNext provides its traders with substantial trading capital, which is a distinctive aspect of its business model. The firm’s funding program is structured in a way that allows traders to start with smaller amounts and gradually increase their trading capital based on performance. This means that traders can access larger accounts as they demonstrate consistent profitability and sound risk management, effectively lowering the barriers to entry that come with personal capital requirements. Furthermore, FundedNext operates with a profit-sharing model, meaning that traders can earn a percentage of the profits they generate, thus adding an incentive to succeed. This unique approach to funding and capital allocation not only encourages consistency and discipline in trading but also allows traders to fully capitalize on their market success without the burden of individual financial constraints.

Trader Support and Training

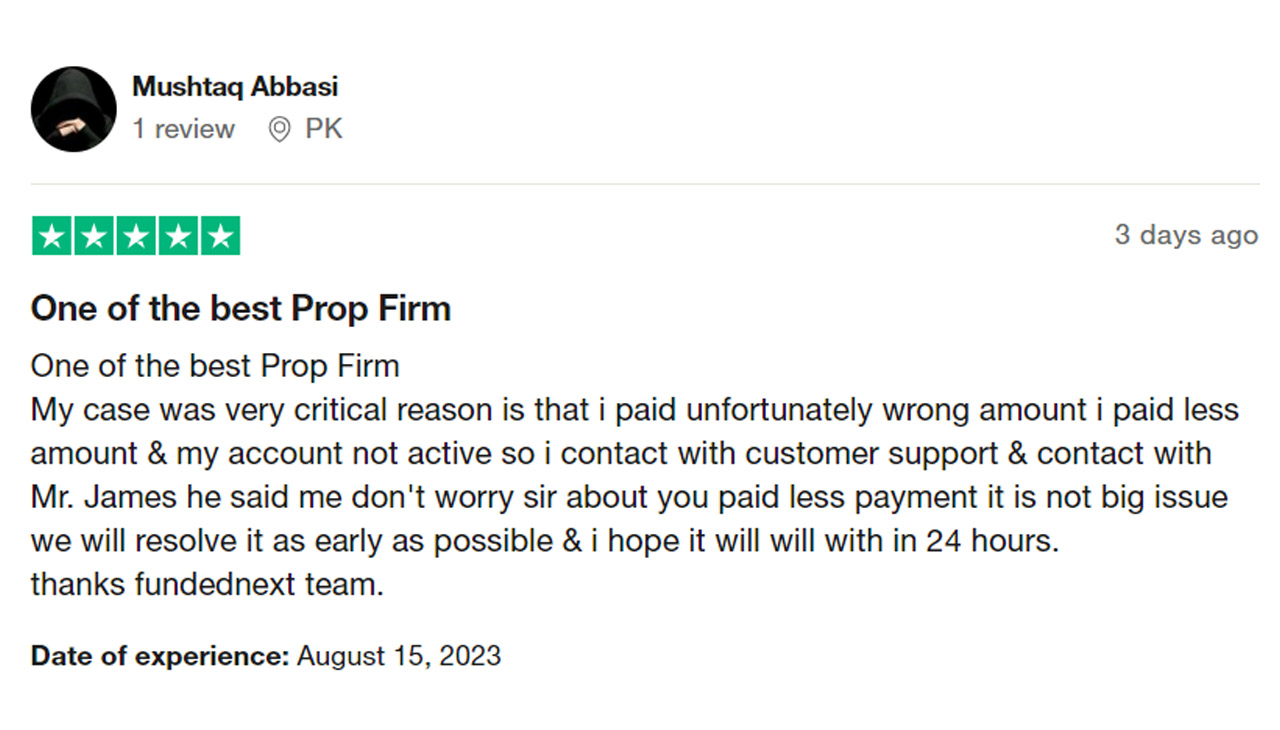

FundedNext places a strong emphasis on trader support and training, recognizing that educated and well-informed traders are the key to a successful trading environment. To this end, the firm offers a comprehensive suite of educational resources and support initiatives. This includes online trading courses that cover a wide range of topics, from the basics of trading to advanced strategy development. The courses are designed to be interactive and easy to understand, catering to traders of all experience levels.

In addition to its training courses, FundedNext also conducts regular webinars, offering traders the opportunity to learn from and interact with experienced market professionals. These webinars cover a diverse array of subjects, such as market analysis, risk management, and trading psychology.

For more personalized guidance, FundedNext offers a mentorship program where traders can work one-on-one with seasoned traders. This mentoring initiative provides individualized attention and support, helping traders refine their trading strategies, navigate challenges, and achieve their trading goals.

All these learning and support resources underscore FundedNext’s commitment to fostering a conducive trading environment where traders are empowered to maximize their market potential and achieve consistent profitability.

Track Record and Performance

FundedNext has consistently delivered strong performance since its inception, with traders at the firm earning profits month over month. This is testament to the firm’s unwavering commitment to risk management and capital allocation strategies based on solid market fundamentals. The track record of success is also a reflection of FundedNext’s trader-centric approach and its dedication to empowering its community of traders with the tools and resources they need to succeed.

The firm’s performance is further enhanced by its comprehensive trading platform, which provides traders with access to some of the most powerful market analysis and execution tools available. With features such as automated order routing, advanced charting capabilities, and real-time portfolio monitoring, FundedNext ensures that traders have all they need to stay ahead of the markets and generate consistent returns.

Summary

Summary-

Autonomy4/5 Good

-

Educational Resources/Support Initiatives3/5 Neutral

-

Funding Program/Capital Allocation3/5 Neutral

-

Profit share Model2/5 Bad

-

Trading Platform Features4/5 Good

-

Consistent Track Record of Profitability4/5 Good

The Good

- Autonomy, while adhering to risk management and profit targets

- A comprehensive suite of educational resources and support initiatives

- Funding program is structured in a way to accommodate traders of all experience levels

- Profit share model incentivizes traders to succeed

- Powerful trading platform with automated order routing, advanced charting capabilities, and real-time portfolio monitoring

- Consistent track record of profitability

The Bad

- Limited access to the firm's trading capital for inexperienced traders

- Short-term losses can quickly deplete trading funds if risk parameters are not adhered to properly