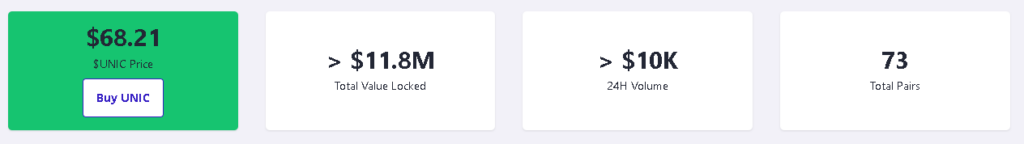

Unicly is a protocol to combine, fractionalize, and trade NFTs. We can transform our NFT collection into a tradable asset with guaranteed liquidity. Currently, the UNIC price is $68,21, the total value locked is $11.8M, and $10K is an average 24h volume. The system is built on the Ethereum blockchain. We can tokenize everything and make it tradeable.

Unicly overview

Let’s talk about features and possibilities.

- We can buy our stake of multiple NFTs at once through the uTokens functionality.

- There can be mixed ERC-721 and ERC-1155 NFTs.

- We are allowed to farm UNIC to get profits.

- Unicly service unites AMMs, NFT auctions, farming, and decentralized governance.

- Collectors, Casual Investors, Artists, Designers, Creators, Traders, Yield Farmers, and others are welcome on the platform.

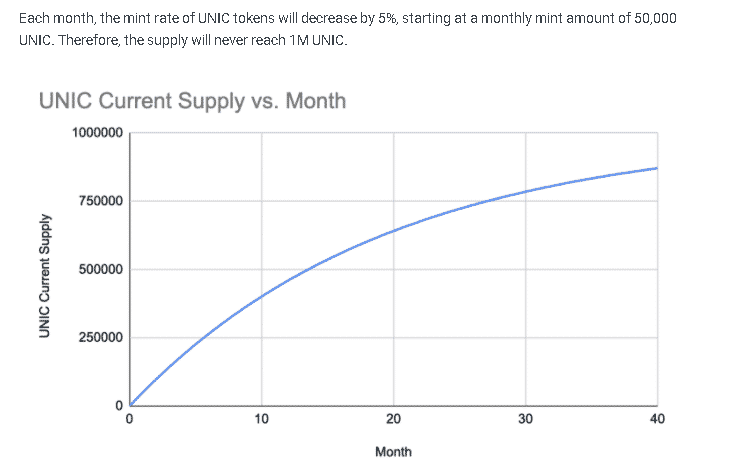

- UNIC has 1,000,000 supply coins.

- The inflation rate will decrease every month.

- We can farm more UNIC staking LP tokens.

- There’s a developer named Leia behind the service.

- The first month will have the highest UNIC mint rate ever. In this way a developer wants us to join the project asap.

- We can bid for a NFTs.

- As a uToken holder, we can govern the collection.

- If we trust the total value of the bids on the collection is high enough for the collection, you should stake your uTokens to unlock the NFTs.

- When people stake, we can redeem our uTokens for some of the NFT auction proceeds.

- We are also able to stake more UNIC to get xUNIC.

- xUNIC can be converted to more UNIC over time.

- UNIC holders can vote to whitelist our collections if the community likes it..

- Fees are added to the pool in real time.

- The fractionalization feature allows more people to trade NFTs at lower price points.

- The market cap for a single NFT has a ceiling. However, by fractionalizing any collection of NFTs across multiple smart contracts, we can create fractionalized tokens based on NFT pools that hold significantly more value.

- We can bid for specific NFTs rather than entire collections.

- Anyone with NFTs can create their own uToken.

- We should deposit and lock any number of ERC-721 and/or ERC-1155 NFTs into the smart contract.

- A mint rate of UNIC tokens will decrease by 5% every month, starting at a monthly min amount of 50,000 UNIC.

How does Unicly work?

- The platform allows us to purchase UNIC tokens.

- We can stake them for getting more UNIC tokens as rewards.

- We can add our own NFT tokens to the platform to trade.

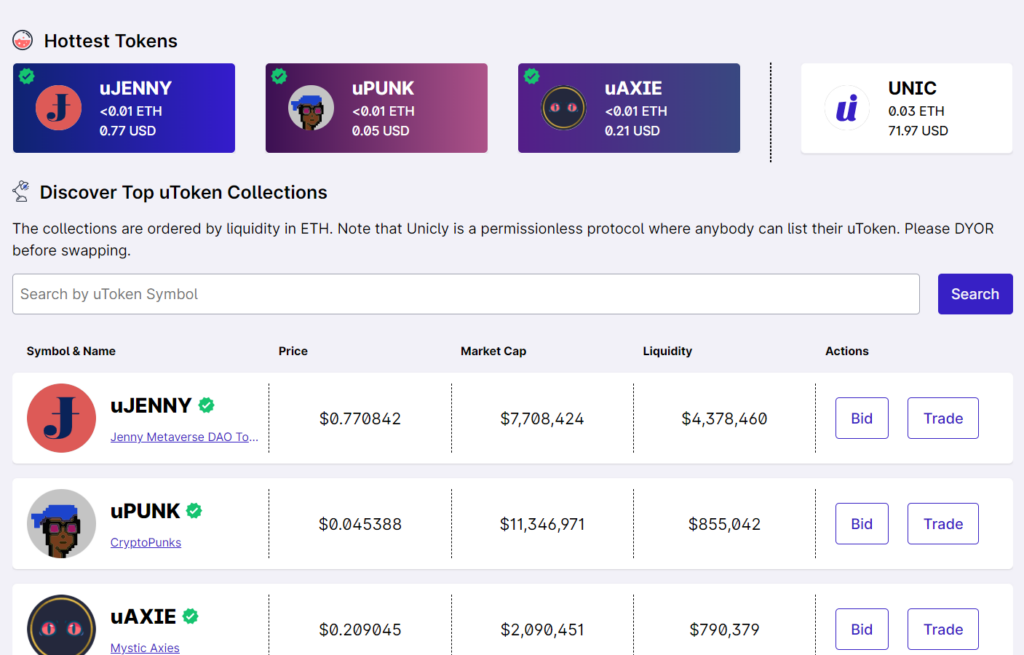

As an example, we can bid for uJENNY for $0.770842. Its market cap is $7,708,424. The liquidity is $4,378,460.

What can you buy on Unicly?

We can swap tokens within the AMM functionality any time after connecting a wallet. We have to choose swapping parameters.

Is Unicly safe?

Unfortunately, there are no users’ testimonials on third-party websites. So, we don’t know for sure if a platform is safe to work with.

Unicly fees, compatible wallets, and transactions

- We earn 0.25% in fees as a liquidity provider.

- There are wallets allowed: MetaMask, WalletConnect, Coinbase Wallet, Fortmatic, Portis.

- The transactions are processed quickly.

What are the ways to trade on Unicly?

We can swap tokens, trade native tokens, or bid for a part of the NFT collection.

Customer support

The developers provide support via discord. So, there we can ask our questions.

Should you buy a Unicly token?

Unicly summary

Unicly summaryPros

- A bid platform created

- We can publish our collection after an approval

- We can buy a native token UNIC

Cons

- No details about the developer provided

- No risks of investing shown

- No people feedback published