Ubeswap is a decentralized exchange that increases liquidity on Celo. Launched in February 2021, the platform aims to provide clearing free executing orders that raises trading speed significantly. They seek the best liquidity providers to increase the service quality. We can work with the platform directly from our wallet without providing any intel. There’s functional like swapping coins, stacking, farming, and so on. We can provide liquidity to Ubeswap via coin pools. So, we can earn trading fees based on the price variety between two tokens.

Ubeswap overview

Let’s talk about platform functionality and features.

- Ubeswap is based on Celo. Celo is a layer 1 protocol and blockchain platform.

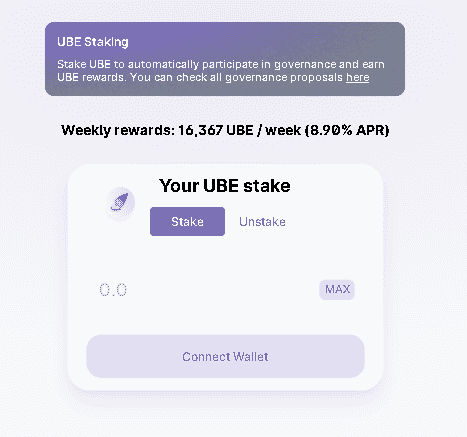

- We can stake UBE.

- We have to create an account on the blockchain.

- Then, we should go to our wallet and click Deposit.

- The platform includes analytics about listed tokens with liquidity, volumes, top tokens chart, and so on.

- We can see the price of top tokens and price changes within 24 hours.

- We can work with four wallets: Valora, Ledger, MetaMask, and Celo Extension Wallet.

How does Ubeswap work?

- We can trade or swap our tokens.

- The platform allows us to buy a native token – UBE.

- Staking possibilities are provided.

- We can participate in farming, providing our liquidity.

- We can take UBE to automatically participate in governance and earn UBE rewards. Weekly rewards are 16,367 UBE/week (8,90% APR).

- All liquidity providers a 0.25% fee on all trades proportional to their share of the pool. Fees are added to the pool. They can be claimed after withdrawing provided liquidity.

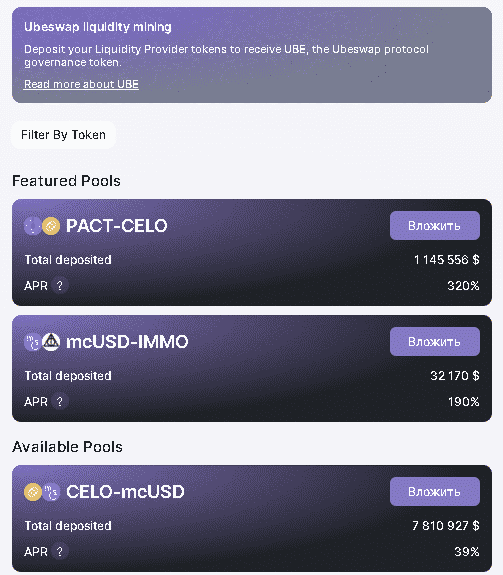

- We have to deposit our Liquidity Provider tokens to receive UBE, the Ubeswap protocol governance token.

There are following pools:

- PACT-CELO, Total deposited $1 145 556, APY 320%.

- mcUSD-IMMO, Total deposited $32 170, APY 190%.

- CELO-mcUSD, Total deposited $7 810 927, APY 39%.

- mcUSD-mcEUR, Total deposited $6 753 732, APY 14%.

- WETH-mcUSD, Total deposited $,7 099 739, APY 42%.

- mcUSD-WBTC, Total deposited $3 904 059, APY 45%.

- CELO-mcEUR, Total deposited $2 917 120, APY 31%.

- UBE-CELO, Total deposited $2 479 997, APY 64%.

- CELO-MOBI, Total deposited $906 967, APY 122%.

- ARI-CELO, Total deposited $710 751, APY 638%.

- MOO-mCELO, Total deposited $566 350, APY 50%.

- SOURCE-mcUSD, Total deposited $362 698, APY 387%.

- UBE-TFBX, Total deposited $144 325, APY 73%.

- SOL-CELO, Total deposited $143 130, APY 22%.

- POOF-UBE, Total deposited $135 570, APY 17%.

- CELO-KNX, Total deposited $120 330, APY 55%.

- mcUSD-BNB, Total deposited $90 519, APY 42%.

- AVAX-mcUSD, Total deposited $89 470, APY 32%.

- UBE-PREMIO, Total deposited $84 372, APY 60%.

- ABR-mcUSD, Total deposited $73 578, APY 90%.

- FTM-mcUSD, Total deposited $59 295, APY 47%.

- cMCO2-mcUSD, Total deposited $41 811, APY 42%.

- WMATIC-mcUSD, Total deposited $32 099, APY 57%.

- stabilUSD-CELO, Total deposited $31 989, APY 55%.

- UBE-SBR, Total deposited $30 475, APY 63%.

- POOF-pCELO, Total deposited $27 074, APY 173%.

We may note that APY varies in a big way.

What can you buy on Ubeswap?

We can swap any token via the service functionality. There are transaction options like: slippage tolerance from 0.1% to 1%, transaction deadline in minutes, expert mode, disable multi hops, use minimum approval, disable smart routing, and allow Mool withdrawal.

Is Ubeswap safe?

Yes. The platform looks pretty safe especially because they don’t require us to register on it. All we need is to connect our wallet.

Ubeswap fees, compatible wallets, and transactions

- The developers didn’t provide fees details in the documentation.

- We can work with the wallets: Valora, Ledger (recommended for storing amounts greater than $1,000 USD), MetaMask, and Celo Extension Wallet.

What are the ways to trade on Ubeswap?

We can swap and trade tokens within the platform functionality. UBE can be traded on Binance, Coingecko.

Customer support

The devs provide support only within Discord functionality within 5-8 hours.

Should you buy a Ubeswap token?

Ubeswap summary

Ubeswap summaryPros

- The platform has a standard functionality

- Native token available

Cons

- No team revealed

- Lack of liquidity pools

- No clients’ testimonials provided