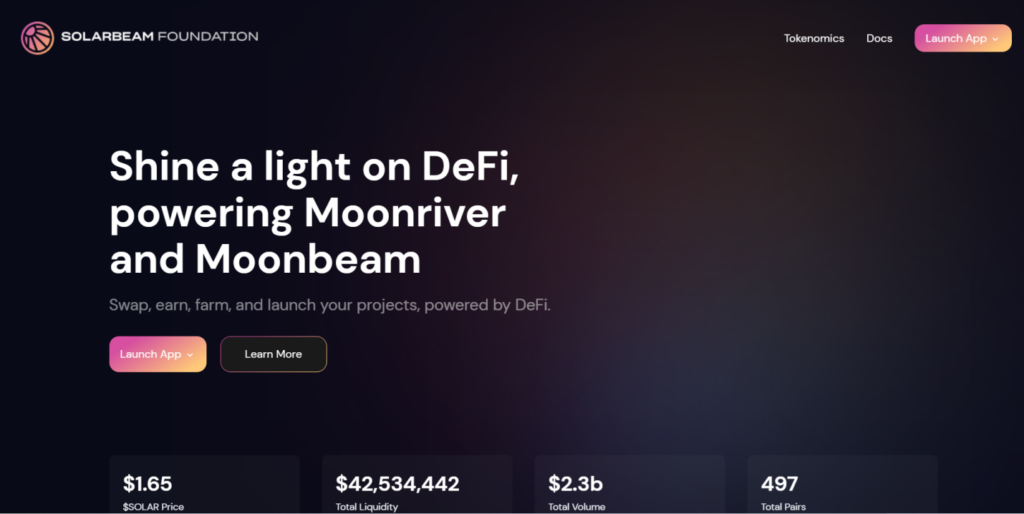

Solarbeam is a DEX that lets you swap coins, earn incentives, and farm, all in a decentralized environment. It was launched in September 2021, but we don’t know exactly where the company is based.

Solarbeam overview

The key features of the system are as follows:

- Supported cryptocurrencies and countries

This platform supports a large number of digital assets such as MOVR, 1SWAP, BNB, BUSD, DAI, ETH, MATIC, etc. The supported languages include English, Russian, and Chinese.

- Native token

The native token of this exchange is known as SOLAR. You can earn this token by staking your coins in single asset pools or as pairs in liquidity pools.

- Funding methods

To carry out transactions on this network, you need to possess MOVR tokens. You can buy it from supported exchanges or use the Solarbeam faucet functionality.

- Wallets supported

To conduct swaps on Solarbeam, you must configure your wallet first. At this moment, the platform supports only two wallets, namely Metamask and WalletConnect.

How does Solarbeam work?

You can do the following things on this exchange:

- Swap tokens

First, you need to click on the swap tab and select the tokens you want to trade in. Next, you ought to input the amount. You can also set the slippage tolerance and transaction deadline, disable multihops, and toggle expert mode. Then, you can conclude the transaction by clicking on Swap.

- Yield farming

This lets you stake and lend your coins to pool in return for additional tokens as incentives. Single asset pools have a low-risk, low-reward system, while liquidity pools with paired tokens offer higher rewards for higher risk. You can earn SOLAR tokens by staking MOVR, or pair them together and stake them in liquidity pools to earn more SOLAR coins.

- Lock tokens in vaults

You can win bigger incentives by locking your tokens for a certain time period in the Solar Vault. At this moment, there are 7-day and 30-days lockup periods available.

What can you buy on Solarbeam?

This DEX platform is based on the Moonriver blockchain network. It is compatible with Ethereum and follows a multi-chain approach. Some of the most popular coins on this platform include DAI, CWS, BUSD, BNB, ETH, FTM, MATIC, SOLAR, and USDT.

Is Solarbeam safe?

This platform has been audited by the renowned auditing firm Certik. Currently, it has a security score of 89 and 91% of users have voted that the exchange is secure. There were no critical issues with the system detected during the audit. A few major and minor issues were found, but they have since been resolved.

User reviews

We were unable to find any user reviews for this exchange on third-party websites. Since it was launched quite recently, not many people are currently registered on this platform.

Solarbeam fees, compatible wallets, and transactions

For each swap, there is a 0.25% fee. From this, 0.20% goes to the providers of the liquidity pool and the rest goes to the team. From the portion of the fees allocated to the team, 50% is used for burning coins and buybacks.

At this moment, the platform only supports the Metamask and WalletConnect wallets. Compared to other decentralized exchanges, the number of wallets supported is quite low. All trades are peer-to-peer. You have full control over your holdings, unlike a centralized platform where a brokerage or a third party takes custody of your tokens to facilitate a deal.

What are the ways to trade on Solarbeam?

You can choose to trade tokens on this DEX using the simple swap feature. Alternatively, you can use the Faucet. The swap function is quite simple and you just need to select the From and To coins after connecting your wallet. For the Faucet, you swap supported tokens for MOVR. This will deposit a small amount of MOVR in your wallet. You can use the tokens to pay for gas fees.

Customer support

Unfortunately, there is no dedicated support team for this platform. If you require help, you have no other option but to consult the technical support docs on the official website.

Should you trade with Solarbeam?

Solarbeam summary

Solarbeam summaryPros

- Large number of trading pairs

- Bridge tokens to and from the Moonriver network

- Full custody of assets

Cons

- No dedicated support team

- Only two wallets supported