Katana or better known as Ronin DEX is the new decentralized exchange built on top of Ronin. It is an Automated Market Maker (AMM) for DEX developed on the Ronin platform. The users of Axie world can now swap different ERC-20 assets. Read the detailed analysis to know more about this system and see if the offerings meet your investment criteria.

Katana overview

Katana Ronin Chain is easily used to swap between different assets present in the Axis Infinity. The exchangeable instruments are AXS, SLP, USDC, and WETH. The users would need a wallet to activate it from the Axie Marketplace.

Setting up the Ronin wallet

Traders can set up their wallets in the following steps:

- Download the Ronin wallet and click on “get started”

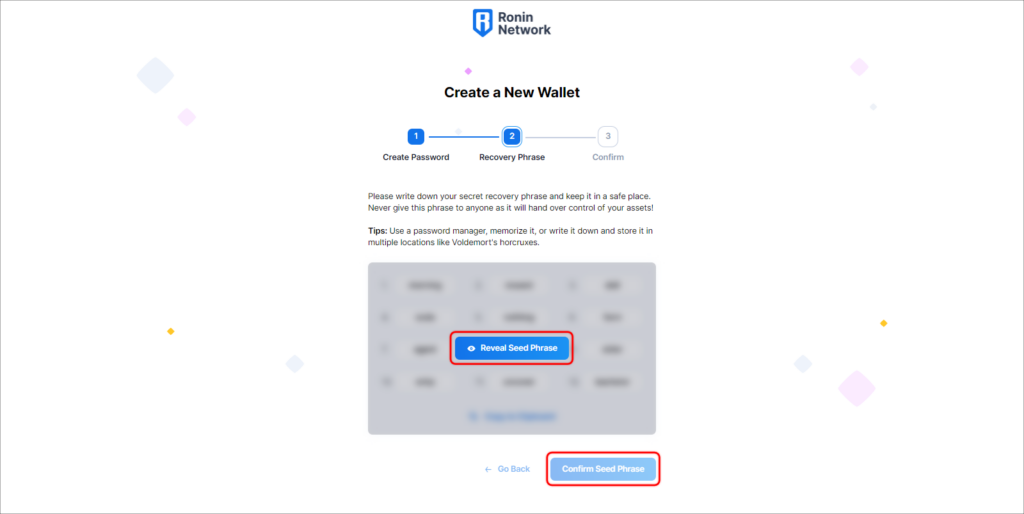

- Set up a strong password and press on create a wallet

- Click “reveal seed phrase”, and a 12 English word combination will pop up. Note down each word and make copies of it. Keep words in order. it is important

- Write down the phrases into their correct position, and you’re online

- You can use your ronin wallet on your browser

How does Katana work?

Katana allows swapping between various ERC-20 assets. The DEX also offers traders to invest in the liquidity pool through which the users can make money from the swap fees.

The customers can also farm Ronin coins (RON). To achieve the feet, you need LP tokens which can be obtained by providing liquidity. The token then can be used to start farming RON.

What can you buy on Katana?

With Katana, traders can access the following assets.

- USDC. The Katana Ronin Chain allows changing one USDS for one dollar.

- Wrapped Ethereum (WETH) is an ERC-20 type of Ether

- Axie Infinity (AXS) is part of Axis Infinity World, with over 270 million AXS available in the market.

- Smooth Love Potion (SLP) can be earned as a reward while playing the game. It can be further used to breed Axie with no fixed supply.

Is Katana safe?

Katana is moderately safe to use. It’s providing a bridge between Axie Infinity and Ronin Network to ease converting and buying the items in their ecosystem. On the poor side, there are no customer reviews on reputed third-party websites like Trustpilot, Forexpeacearmy, etc. As it is a decentralized platform, it is suspected of hacking.

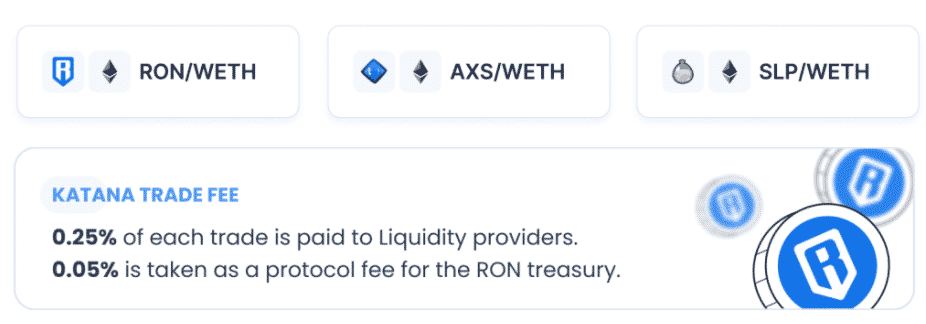

Katana fees, compatible wallets, and transactions

Katana is a decentralized exchange that can be used to trade between any two assets without the involvement of any third party or any banks. The DEX will deduct 0.25%, which is deposited to Liquidity providers, and 0.05% is taken as a protocol fee. It’s compatible with the Ronin Wallet.

What are the ways to trade on Katana?

The platform can be used to swap between multiple instruments. Liquidity pools are also available for investment and then taking profits from the swap fees.

Customer support

There is no information on the official page of DEX about the names of developers and their whereabouts. The company behind the decentralized exchange is Sky Mavis. No email address or any live chat option is available.

Should you trade with Katana?

Katana summary

Katana summaryPros

- It provides ease in swapping the assets without involving any third-party application or government institutions.

- Generation of LP from the liquidity which can be used to farm RON

Cons

- No customer service is provided

- The platform does not come under the regulation of any authority