SakeSwap is a DEX platform whose objective is to offer an improved AMM to crypto traders. It claims to offer better incentives and price curves. It was launched in the year 2020, but we don’t know where the parent company is based.

SakeSwap overview

Here are the key features of this platform:

- Cryptocurrencies supported

On this exchange, you can seamlessly swap one token for another. Some of the coins supported by this DEX include ETH, BAND, BASED, BET, BOT, COMP, DAI, and DEGO.

- Native token

The native token of this platform is called SAKE. Holders are entitled to governance rights and a portion of the trading fees. Early adopters of this token are the majority stakeholders of the exchange.

- Funding methods

On this platform, you can swap tokens in a non-custodial and decentralized fashion. For this, you must fund your wallet with the coin you wish to swap.

- Wallets supported

You must connect your wallet before you can conduct swaps. Some of the supported wallets include Metamask, Coinbase Wallet, Portis, and Fortmatic.

How does SakeSwap work?

You can perform the following actions on this exchange:

- Swap tokens

After connecting your wallet, you can start swapping tokens on the exchange. The platform utilizes the liquidity pool to easily conduct swaps.

- Add liquidity

By adding liquidity to liquidity pools, you can earn a share of the trading fees. Swapping fees are deposited in the liquidity pool and this enhances the value of the LP tokens. These tokens act as payouts to liquidity providers proportional to their share of the pool.

- Yield farming

Liquidity providers can stake their LP tokens in farms. This way, they can earn rewards in terms of SAKE tokens. The daily APY of the farming pool is up to +600%.

- Add SAKE to SakeBar

A small percentage of the trading fees will be added to the SakeBar. When you deposit SAKE in the SakeBar, you get xSAKE tokens, the value of which grows over time. By converting xSAKE to SAKE later, you can grow your SAKE balance.

- Take part in governance

The community members can post proposals on the SakeSwap Snapshot voting platform. The voting power is calculated based on SAKE, xSAKE, as well as LP token balances.

What can you buy on SakeSwap?

This exchange is based on the Binance Smart Chain and the Ethereum blockchains. It is a fork of the Sushiswap and Uniswap exchanges. The top tokens on this exchange are Ether, ChainLink Token, SakeToken, Tether USD, Wrapped BTC, Linear Token, SushiToken, EtherCats.io, Compound, and USD Coin.

Is SakeSwap safe?

This exchange was audited by KnownSec Blockchain Lab. It passed the security audit with flying colors and no major issues were detected in the smart contracts.

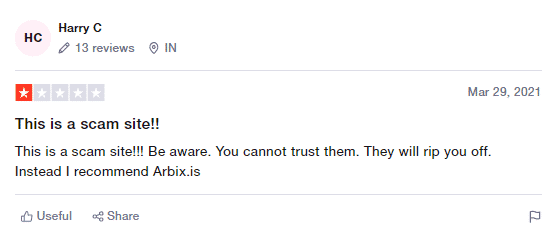

User reviews

On the Trustpilot website, there is only a single review for this DEX. This tells us that not many people are currently trading through this platform. In the review, the user has stated that the website is a scam and it rips off users.

SakeSwap fees, compatible wallets, and transactions

For each transaction, there is a 0.3% fee. From this 0.25% goes to the market makers, 0.045% is used for buyback and burning of SAKE, and the rest is distributed to the LockBar. Apart from Portis, Fortmatic, Coinbase Wallet, and Metamask, the platform supports wallets compatible with WalletConnect.

What are the ways to trade on SakeSwap?

To swap tokens on this DEX, you need to navigate to the Exchange tab on the official website. Then, you need to select the token you wish to swap and the one you wish to receive. You can select the slippage tolerance for the trades and the transaction deadline. By toggling the expert mode, you can conduct high slippage trades.

Customer support

There is no dedicated support team for this DEX platform. If you require assistance, you can check out the documentation. Alternatively, you can seek help from the Discord and Telegram communities.

Should you trade with SakeSwap?

SakeSwap summary

SakeSwap summaryPros

- Low trading fees

- Multiple staking options

- Large number of coins supported

Cons

- Lack of reputation

- No dedicated support team