QuickSwap welcomed us with the suggestion of exchange without any extra explanations about why we have to choose this service. This is a service that works automatically and is based on the Polygon Network. The service functionality was copied from Uniswap. So, it works with the same amount of liquidity using the same liquidity pool model. So, the earning model is based on adding pairs of tokens in the liquidity pool to make profits based on transaction fees on those who use the pool for swapping tokens.

QuickSwap Exchange overview

Let’s talk about the service features:

- Sameep Singhania created QuickSwap that works as the central market square of the Polygon layer-two Ethereum scaling solution.

- We have already known that there’s Uniswap behind it and uses its architecture.

- It offers making profits using a liquidity pool. It’s a commission based earning model.

- The service was launched on October 9, 2020. So, it’s just over a year old.

- There’s a share of 96.75% tokens that spreads in the community.

- The devs keep 3.25% for the team members.

- Those tokens provide voting power and allow making profits from staking them.

- The protocol was designed to overtake Ethereum high fees and transaction time within the network.

- It was built based on the Polygon Layer-2 scaling solution.

- This provides high execution speed (65000 transactions/second) and almost nothing commissions.

- The platform has its Quick tokens that can be stacked in the Dragon Lair feature.

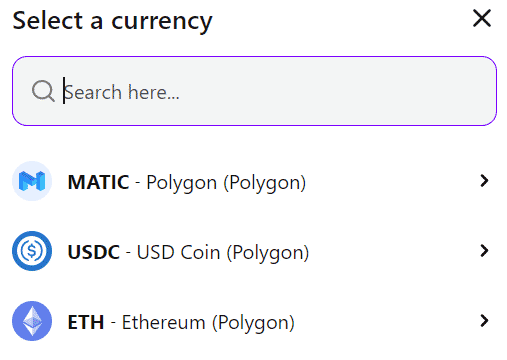

- We can deposit the following coins: MATIC, USDC, and ETH

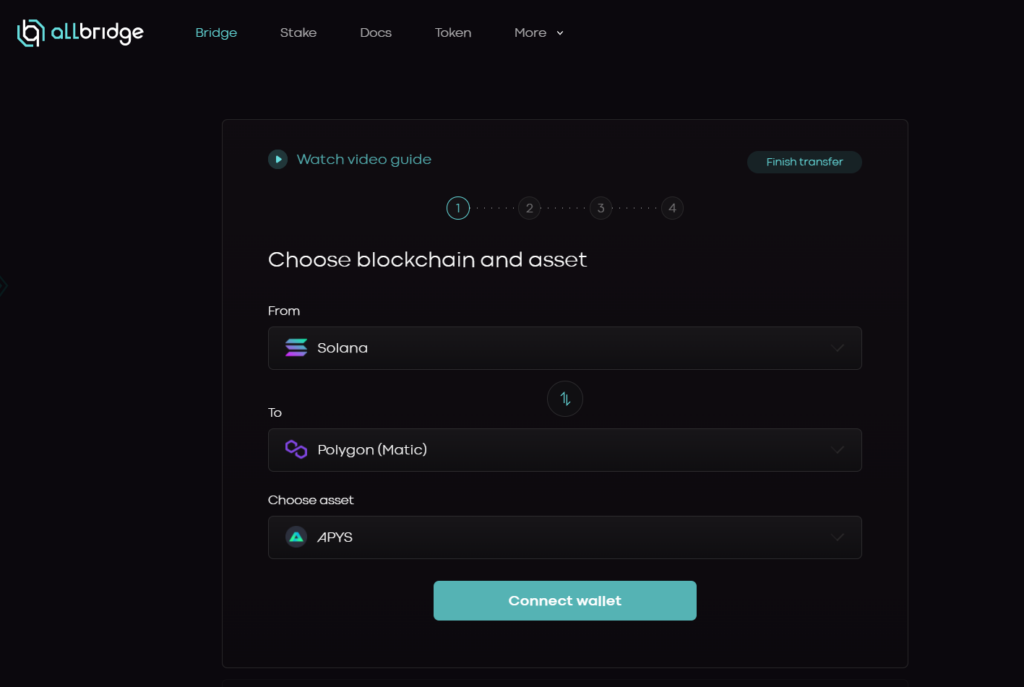

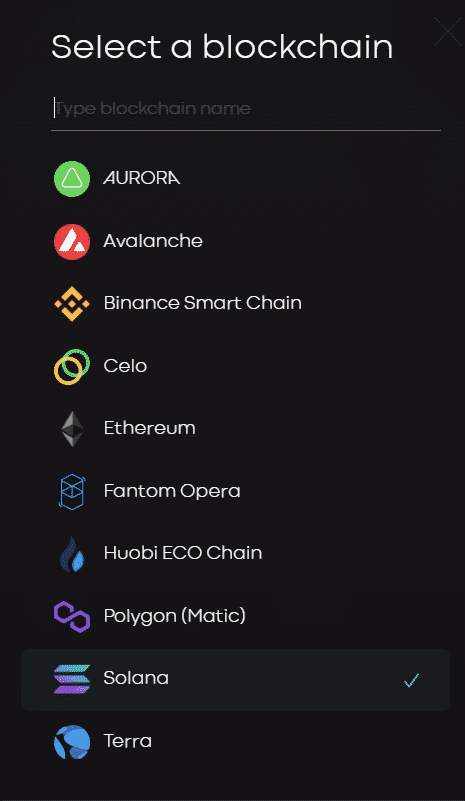

- Allbridge provides a connection between blockchains that allows us to deposit coins from any of them.

How does QuickSwap work?

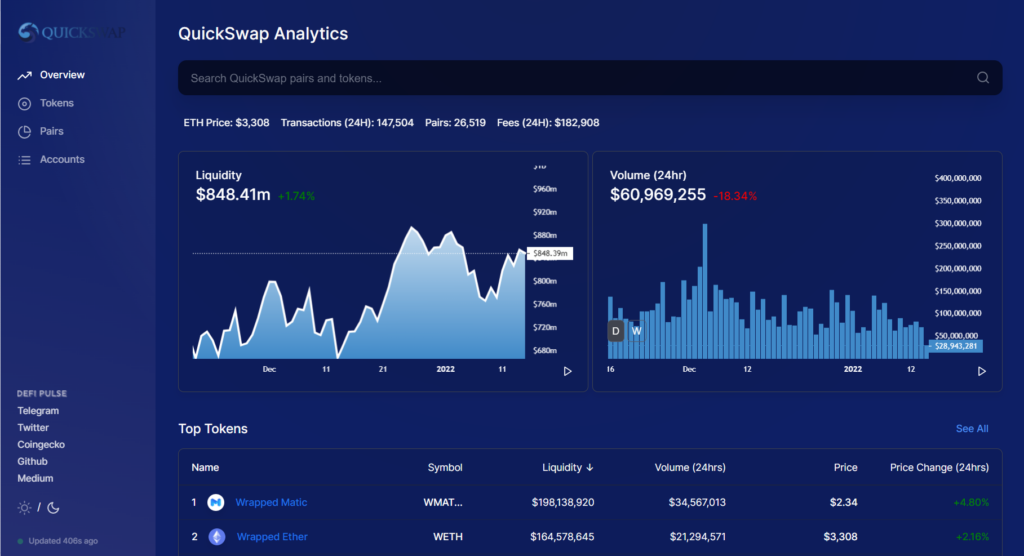

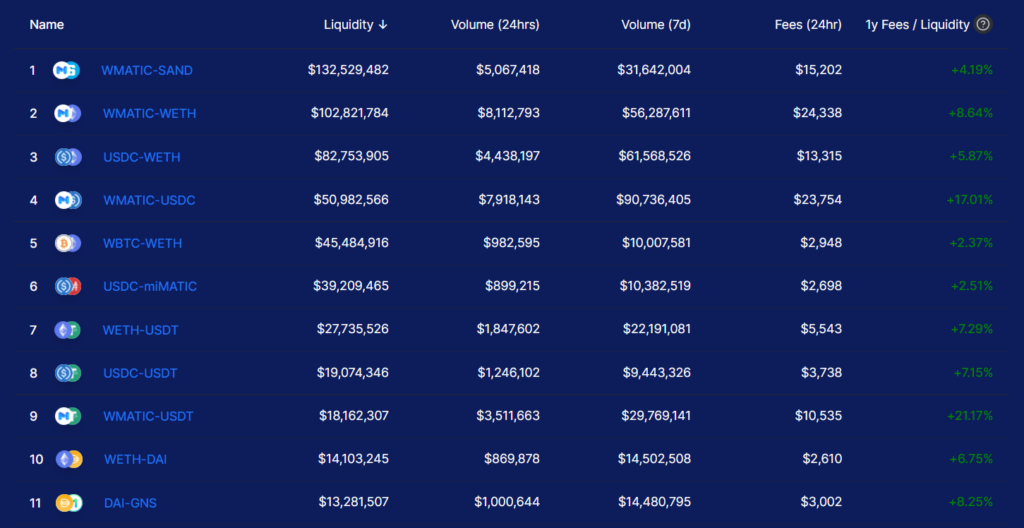

We can check common trading activities like market cap, volumes, prices.

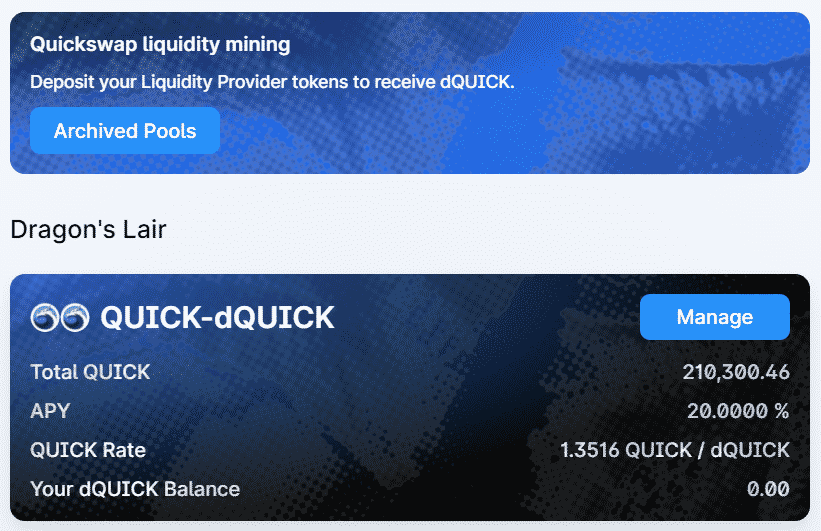

The Dragon’s Lair is the main pool for Quick tokens. We can expect to get 20% annually. There are 210,300 tokens stacked.

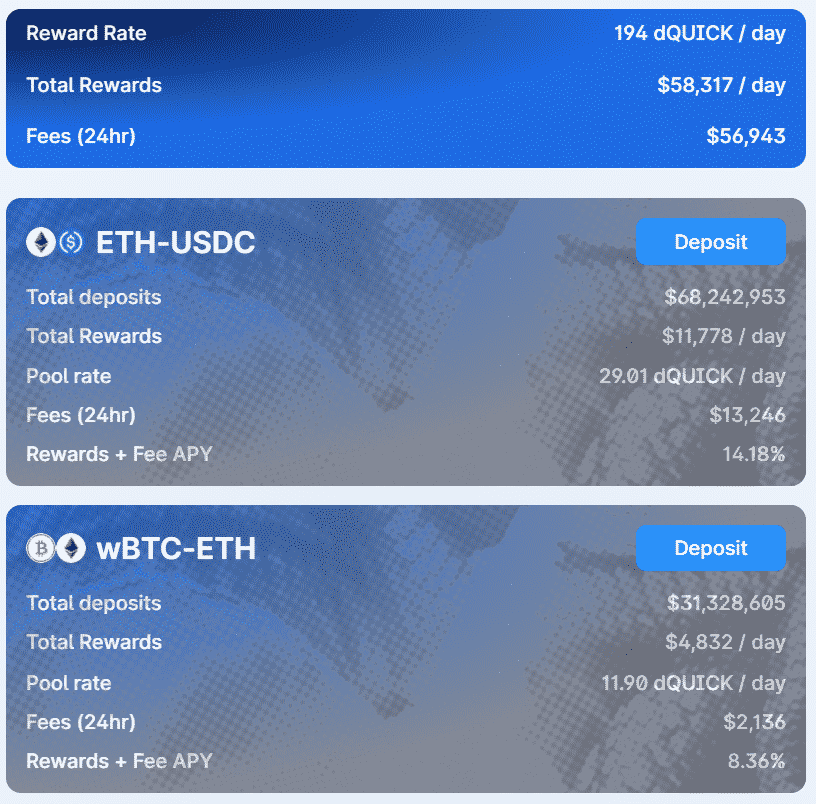

We have other pools for stacking. So, the ETH-USDC’s APY is 14.18%. For wBTC-ETH, it’s 8.36% only.

What can you buy on QuickSwap?

We can purchase MATIC, USDC, and ETH tokens on the platform.

Is QuickSwap safe?

Yes. The service is safe and it’s based on the Polygon blockchain.

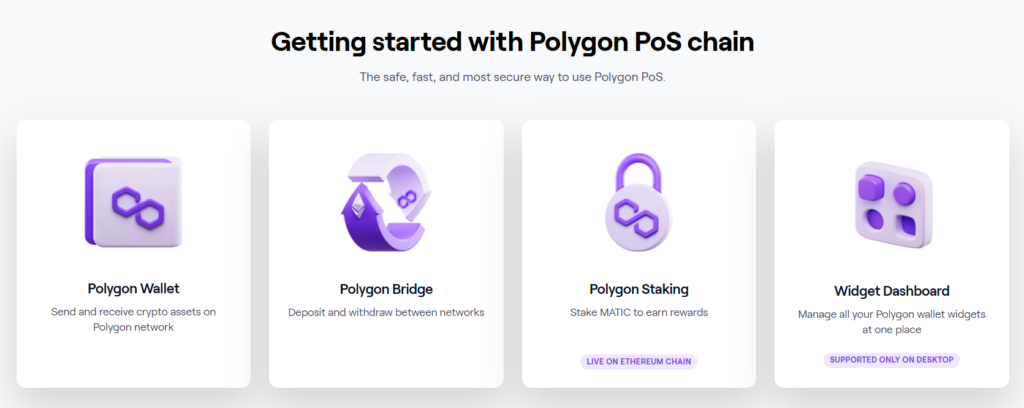

- We are allowed to dig into details: wallet, bridge, staking, and widget dashboard.

Security of QuickSwap

The devs provide a common Uniswap level of security.

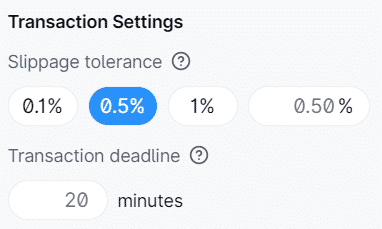

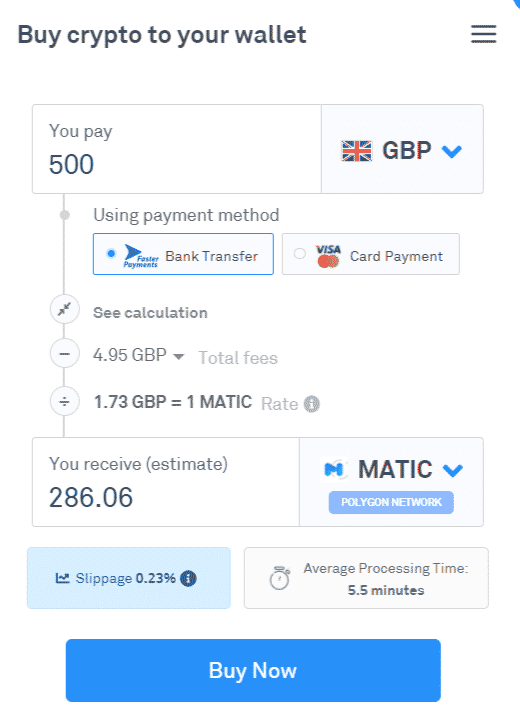

We can customize transaction settings like the level of slippage and transaction deadline.

What crypto exchanges does it support?

- The system works based on the Polygon PoS chain.

- We have no intel about what platforms excluding Uniswap support it.

QuickSwap fees, compatible wallets, and transactions

We have deposit fees if we use fiat. The system provides 0.3% of the transaction fee for each swap where 0.25% of it is paid for people who stack the tokens.

We can deposit using any blockchain using the allbridge functionality.

We can deposit via fiat money. There’s less than 1% commission.

What are the ways to trade on QuickSwap?

- Well-designed teal-farming option based on the Polygon blockchain.

- Pretty high annual profitability.

- We can deposit via fiat or any token.

- Simple and easy to understand functionality.

Customer support

The developers provide common support via email within a day.

Should you trade with QuickSwap?

QuickSwap summary

QuickSwap summaryPros

- Polygon blockchain

- UniSwap behind the service

- Various pools with various profitability

- The devs provide good support

Cons

- The service is young

- Profitability can be better

- Lack of testimonials

- Support should be delivered quicker