Pegasys is a decentralized exchange that allows us to swap tokens quickly with low commissions. The documentation includes some information about this system which we are going to analyze on the following review.

Pegasys overview

It’s time to talk about available features and other useful features in using decentralized exchange details.

- The platform acts like a decentralized system exchange.

- It works on Syscoin NEVM.

- The system uses the same swapping mode as Uniswap.

- There’s a PSYS governance token released.

- The platform has three extra benefits like quick and affordable trades, high-quality development, and fair tokens distribution.

- We can work with impossible low fees.

- Token owners can participate in the company developing and invest tokens in liquidity pools to make even more rewards.

- The company can join various partnerships to push the service ahead.

- Developing products we can get access to features of Layer 2 of Syscoin.

- We can trade ERC20 tokens on Pegasys.

- If the token isn’t listed we can add liquidity of this token for others to trade.

- This allows us to earn fees every time someone trades.

- The developers claimed that their tokenomics is unique and fair.

- They are focusing on community growth over making profits here and now.

- There’s a Discord channel to manage the community.

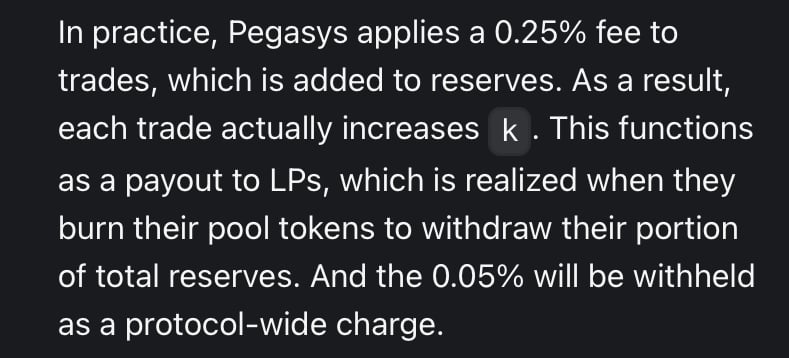

- The liquidity providers earn a 0,25% on all trades proportional to their share of the pool.

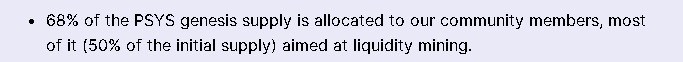

- Community members have 68% of all tokens.

- Over 50% of them keep being the liquidity mining.

- The liquidity mining program lasts 28 years.

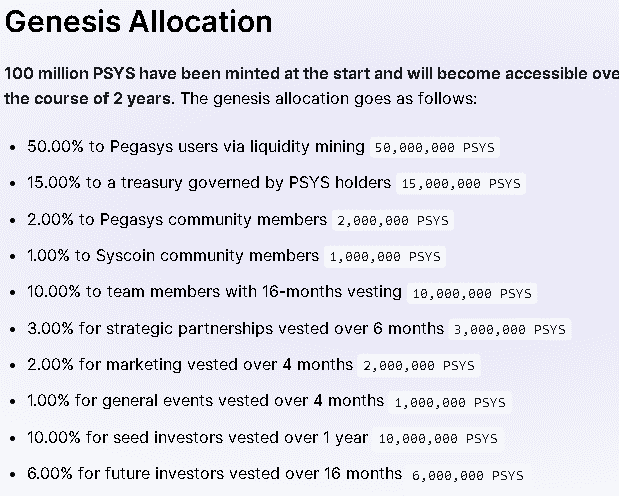

- We have a token supply limit at 100,000,000.

- Only owners can mint them.

- 50% tokens are delivered via liquidity mining.

- The treasure of 15% belongs to holders.

- Investors can have approximately 16% of tokens.

- They have three stakeholder categories: team, investors, and community.

- Tokens have a fixed inflation rate of 3%.

- There are no deflation mechanisms, but people will be able to vote for them.

How does Pegasys work?

The Pegasys protocol allows:

- We can swap ERC20 tokens.

- Investors can purchase PSYS tokens to invest in the platform and its functionality.

- It’s possible to stack or deposit coins into liquidity pools to get profits from swapping.

What can you buy on Pegasys?

We can purchase PSYS governance tokens to stake them or deposit in liquidity pools.

Is Pegasys safe?

The platform looks like a safe place to work directly from our wallet.

Pegasys fees, compatible wallets, and transactions

- The developers charge standard 3% fees.

- 0.25% of them go to the liquidity providers.

- We can work with MetaMask and WalletConnect.

- The system executes transactions quickly.

What are the ways to trade on Pegasys?

We can swap, deposit or stake tokens within the platform functionality.

Customer support

The developers provide support within Twitter, Discord, Telegram.

Should you buy a Pegasys token?

Pegasys summary

Pegasys summary

0

100

0

1

Pegasys is a decentralized exchange that provides us with possibilities to swap our tokens quickly and with affordable commissions. If we want to provide our liquidity, the developers suggest we buy their governance token and join liquidity pools.

Pegasys is a decentralized exchange that provides us with possibilities to swap our tokens quickly and with affordable commissions. If we want to provide our liquidity, the developers suggest we buy their governance token and join liquidity pools.

Pros

- The developers share significant amount of commissions with liquidity providers

- They have native token - PSYS

- We can participate in DAO

Cons

- No team revealed

- No risk of using this service revealed

- No people’s testimonials published