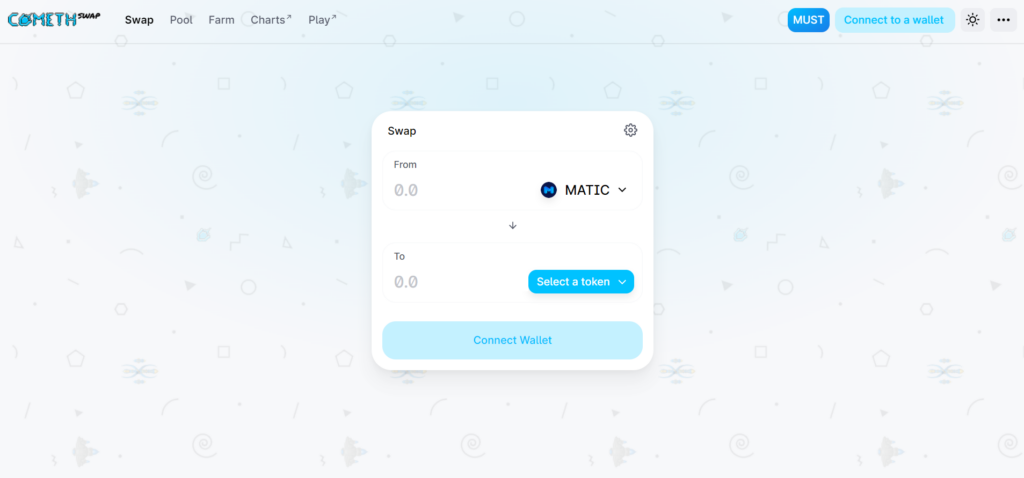

ComethSwap is a decentralized exchange that has a simple and not welcome start page. There’s a standard pack of services that usually DEX provides: swapping, staking, liquidity providing.

ComethSwap overview

The presentation and documentation were written poorly. So, there are almost no explanations provided.

- The platform provides rewards for all liquidity providers.

- It charges 0.5% fee from swapping.

- The providers receive 90% when the gov gets 10% only.

- Fees are added to the pool, accrue in real time and can be claimed when liquidity providers withdraw their liquidity.

- We can receive a gov token – MUST.

- It’s a ComethDAO coin.

- Reward pools can be reloaded every Monday

- There are various pools for providing liquidity mentioned: PSP – MUST, PSP – MATIC, LUCHA – MUST, USDC – MUST, LUCHA – MATIC, mWBTC – MUST, mWETH – MUST, MATIC – wPTG, LADZ – MUST, MATIC – WETH, WETH – MORK, WETH – MUST, LADZ – WETH, APW – WETH, BPT – MUST, BPT – WETH, WETH – SDT, WETH – USDC, WETH – WBTC, PICKLE – MUST, and MM – MUST.

- There’s a page with swap analytics: ETH Price: $2,990, Transactions (24H): 2,797, Pairs: 471, Fees (24H): $1,569

- The list of top tokens includes: Wrapped Ether, Must, Wrapped Matic, Stake DAO, BlackPool Token, beefy.finance, Staked SDT (PoS), AGA Carbon, and DokiDoki.

How does ComethSwap work?

- We can mint/redeem USDm stable coins

- The platform allows us to purchase XMS native tokens.

- There’s staking possibilities for XMS.

- We can swap coins.

- We are allowed to deposit coins.

What can you buy on ComethSwap?

We can swap tokens within the exchange functionality. Also, we can purchase any number of MUST tokens.

Is ComethSwap safe?

The platform looks like a safe place in general. Anyway, we have to read some customer reviews to get more details about this DEX.

ComethSwap trading interface

The developers have designed a common trading interface that has two parts: swapping and trading with analytics. ComethSwap Analytics provide intel about ETH Price: $3,115

Transactions (24H): 3,080, Pairs: 472, Fees (24H): $1,341. We can read information about top tokens and their parameters: Wrapped Ether, WETH, liquidity $1,607,892, volume $154,600, price $3,115, change 24H. We have the same parameters for other tokens. MUST, $1,381,635, $110,354, $64.01, and -2.79%. Wrapped Matic, WMATIC, $834,952, $63,071, $1.87, and -7.12%.Stake DAO Token, SDT, $355,809, $8,108, $1.67, and -8.62%. BlackPool Token, BPT, $338,173, $19,328, $4.52, and +2.30%. beefy.finance, BIFI, $311,153, $73,436, $2,474, and +16.71%. AGA Carbon Rewards, AGAcr, $292,759, $163.19, $7.68, and -2.58%. AGA Carbon Credit, AGAc, $290,078, $158.03, $0.0075, and -3.85%. Staked SDT (PoS), xSDT, $231,324, $73.62, $2.03, and -9.62%. DokiDoki.Chainbinders, BND, $226,435, $180.40, $7.21, and -4.17%.

ComethSwap fees, compatible wallets, and transactions

- The transaction fee is 0.5%

- 0.45% goes to the liquidity providers

- 0.05% goes to the government

- We can connect our coins through wallets: METAMASK, WalletConnect, StakeDAO

- We are allowed to use the service only if we have our wallet connected

What are the ways to trade on ComethSwap?

The MUST native token can be traded on Kraken and Binance. So, we can purchase or sell tokens against other coins. There should be pairs like MUST/USDT, MUST/ETH, or MUST/BTC.

Customer support

The devs provide support via Telegram and emails. Unfortunately, there are no customer reviews to find out how good it is.

Should you buy a ComethSwap token?

ComethSwap summary

ComethSwap summaryPros

- A native token provided

Cons

- No team revealed

- No risk or pool advice provided

- The platform doesn’t look finished and doesn’t have enough explanations